Commentaries

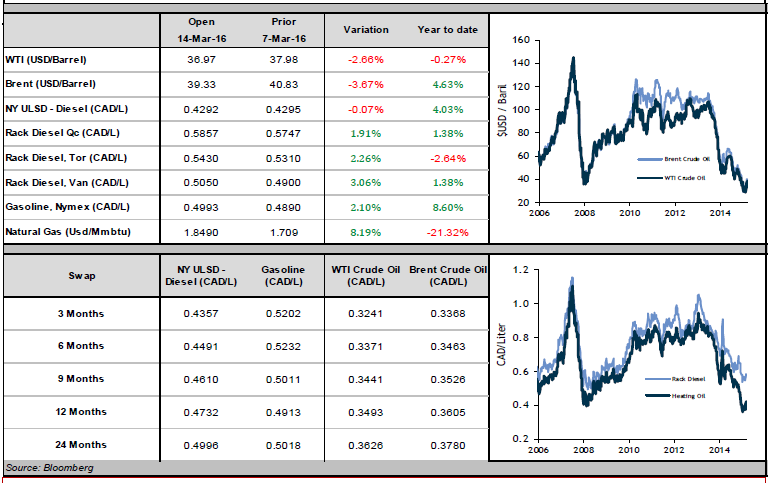

Oil is back to 40 USD/bbl.—at least for Brent. Brent oil broke the $40 barrier for the first time this year, and WTI closed the week just under that level. WTI ended almost 8% in the green, and Brent finished up 4%. Crude has been surging since mid-February, with Brent and WTI up roughly 45% since their yearly lows. A milestone to note: both benchmarks are finally positive on the year.

The International Energy Agency (IEA) released its monthly Oil Market Report on Friday, and the group’s prediction that oil has bottomed out made headlines across the globe. The IEA expects demand for oil to increase this year, while low energy prices should push a lot of production out of the market. We noted last week that the current price environment is forcing American production to decline. The IEA believes that other countries will soon face a similar fate, causing the global crude oversupply to shrink. Even though the market may not return to equilibrium in 2016, as long as the supply-demand gap is closing, prices should not fall significantly.

Even before the IEA’s announcement on Friday, the market was already signaling that the oil’s recent strength may not be just a temporary spike. One stat sums up this idea nicely: the total amount of bets against oil is falling at its fastest pace in 10 months. The number of “shorts” against WTI dropped by 25% in February, with a 15% decrease in the last week of the month alone. Investors are increasingly unwilling to bet against oil, indicating that market sentiment has shifted from bearish to bullish. Whether this feeling will match reality remains to be seen, but the past few weeks will have certainly left oil bulls feeling vindicated.

Diesel and gasoline had strong weeks, closing Friday up 5% and 8%, respectively, in USD. Canadian consumers got a little help from a strengthening loonie, so that increases at home were 4% for diesel and 7% for gasoline. Diesel is currently trading around 0.40 CAD/L, and gasoline is now at 0.50 CAD/L.