Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

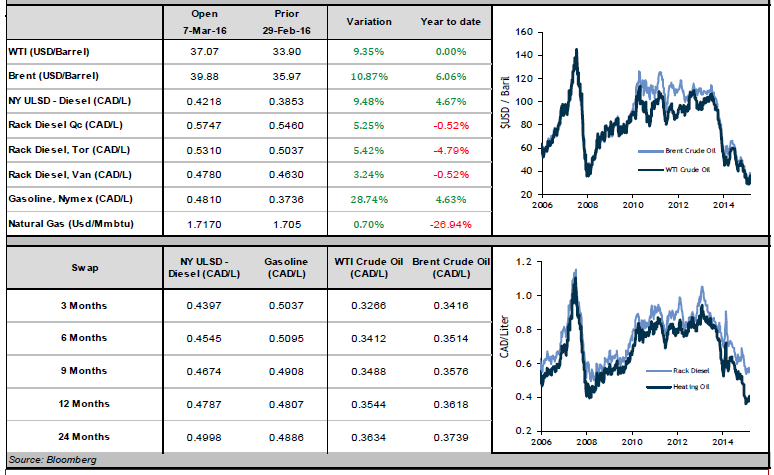

The crude rally that began three weeks ago showed no sign of slowing down last week. WTI and Brent gained roughly 8% during over the week, and are up about 35% from their yearly lows. Brent has almost returned to $40/bbl., and WTI is trading over $35/bbl. for the first time since January 6.

Oil bulls will be happy to see that producers around the world are reducing their output. On Wednesday, the Energy Information Administration revealed that American oil production was only slightly over 9 million barrels per day in February—the lowest level since November 2014. North American energy companies are struggling to cope with low crude prices, and many have to shut down their higher cost operations. The pain is not limited to our continent either: OPEC output also declined in February (by 79,000 barrels per day). While the market is still in oversupply, the gap between production and demand is shrinking.

The coalition of countries willing to freeze oil production keeps growing. Last week, Nigeria’s Minister of State for Petroleum Resources, Emmanuel Ibe Kachikwu, announced that his country will join the negotiation with Saudi Arabia, Russia, Venezuela and Qatar to cap crude production. He revealed that the countries will meet on March 20, and that should expect a “dramatic price movement.” There was no mention of whether Iran would attend (recall that Iranian officials initially supported the freeze, only to later reject it). Kachikwu added that all countries would like oil to return to $50/bbl.; whether they will be able to make this a reality remains to be seen.

Diesel in USD jumped nearly 10%, while gasoline ended about 5% up (note that we have switched to more expensive “summer gasoline,” so the price increase at your local gas station could be much higher). The loonie strengthened this week, so prices in Canada increased slightly less than they did in the U.S. However, diesel and gasoline are now both trading above 0.40 CAD/L. As energy prices gather steam, companies should strongly consider hedging their fuel consumption while strategies remain attractive.