Commentaries

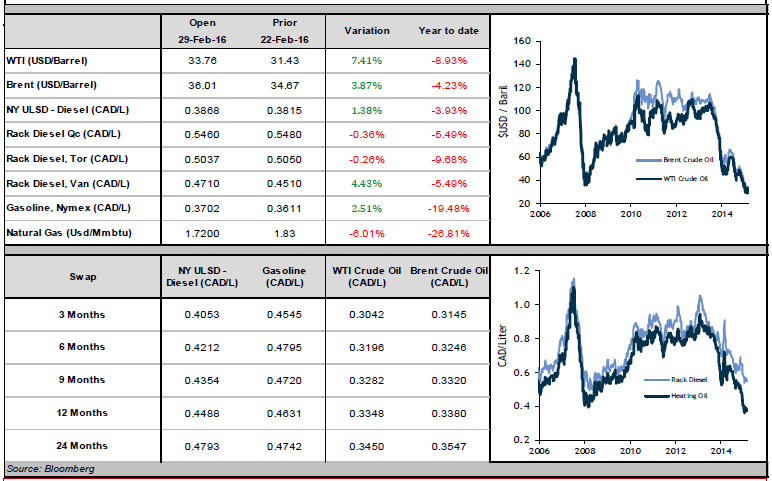

After a difficult start to 2016, oil finally found some strength: Brent and WTI both finished the week up just under 10%. Both benchmarks (in USD) are now trading in the mid-$30s. Black gold is slowly but surely erasing its year-to-date losses, and is now within 5 USD/bbl. of its price on New Year’s Eve.

One word dominated oil headlines this week: “ridiculous.” That is how Iranian Oil Minister Bijan Zanganeh described the production freeze proposed two weeks ago by Saudi Arabia, Russia, Venezuela and Qatar. Although Zanganeh initially seemed to support the plan, on Tuesday he stated that the output cap makes “unrealistic demands” of his country. Iran, as we have reported, will soon be free of economic sanctions that reduced its oil production by 20%. And here is where the problem arises: Saudi Arabia wants Iran to freeze production at January levels—20% below its capacity. While Iran’s rejection of the Saudi plan is bearish, the news hardly dented crude’s upward momentum this week. Pay attention when the market downplays bad news; this could be a sign of growing bullish sentiment.

In North America, low energy prices are taking their toll: last week, two large American energy companies (Energy XXI Ltd and SandRidge Energy Inc) missed interest payments on their debt. They now have a month to fix this problem, or they go bankrupt, and take 7.6 billion USD with them. The U.S. energy sector is $237 billion in debt, and Goldman Sachs (N:GS) reports that 40% of its energy lending is to firms rated “junk.” Banks feel pressure from these risky loans, and hesitate to give new credit to energy companies. Many producers rely on credit to operate, so if lenders disappear, American oil output could decline.

Prices for refined products also increased this week, though not as strongly as black gold. In USD, gasoline climbed about 5%, while diesel edged up roughly 3%. Thanks to a slight strengthening of the loonie, gasoline and diesel in CAD increased even less (4% and 1%, respectively). Prices for both are still under 0.40 CAD/L.