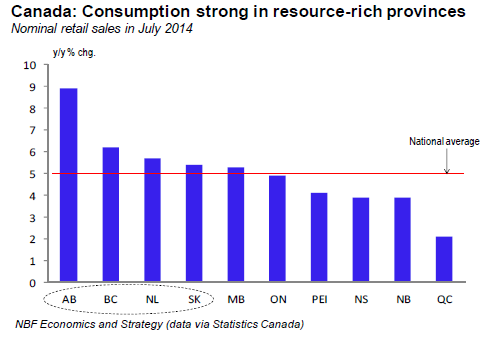

Canada – Retail sales fell for the first time this year, dropping 0.1% in July after an upwardly revised 1.2% gain in the prior month. In July, there was the expected jump in auto sales (+1.6%), but that was offset by declining sales in 5 of the 11 subsectors. Ex-auto sales actually fell 0.6% restrained by declines in food/beverage, gasoline, clothing/accessories, general merchandise and miscellaneous stores, which dwarfed gains for furniture, building materials, health/personal care products, sporting goods, and electronics. In real terms overall retail sales were flat. Four of the 10 provinces experienced a decline in nominal sales, including a 1.3% drop in Quebec. On a year-on-year basis, Alberta continues to lead the nation with sales up 8.9%, followed by BC at 6.2%, while Quebec is last at just 2.1%.

The Survey of Employment, Payrolls and Hours (SEPH), a survey of establishments (unlike the Labour Force Survey which surveys households), showed that Canada gained 42K jobs in July. The SEPH’s year-on-year earnings growth jumped to 3.3%, the highest since September 2012. Annual wage growth topped the national average in sectors like mining/oil/gas, utilities, construction, finance/insurance, real estate, management, transportation/warehousing, wholesaling, and forestry. Sectors including arts/entertainment, accommodation/food services, public admin and education had annual wage growth below the national average in July. Overall, the SEPH (+17K paid jobs/month on average in the first seven months of 2014) shows a stronger Canadian labour market than what is depicted by the LFS (+14K paid jobs/month over the same period). It’s unclear if the SEPH took a dive in August similar to that of the LFS (-98K paid jobs). But for now, the SEPH is showing a decent performance by the Canadian labour market this year, more importantly with support from the private sector.

To Read the Entire Report Please Click on the pdf File Below