CANADA: Retail sales rose 0.7% in March (6.9% y/y) following an upwardly-revised -0.4% print the prior month. Sales rose in 6 of the 11 major subsectors, including a 3.2% increase for autos. Excluding autos, sales were down 0.2%, as increases for sellers of electronics, furniture/home furnishings, building materials, sporting goods, and general merchandise were more than offset by lower sales of gasoline, food/beverages, health products, clothing and miscellaneous items.

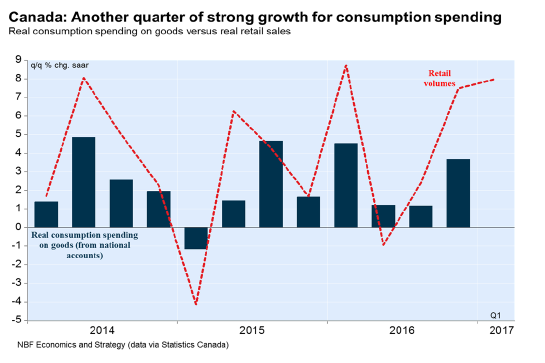

Discretionary sales, i.e. sales excluding gasoline, groceries and health products, rose 1.5% during the month. In real terms retail spending was up 1.2%, which translated into a buoyant 8.0% annualised gain in Q1. That result came on the back of another strong showing in Q4 2016 (+7.5% annualised q/q). Solid retail volumes mean consumers contributed significantly to first quarter real GDP growth, the latter expected to come in close to 4% annualized. Clearly, Canadian consumption is in a more than decent shape. Income gains from a solid labour market, the housing wealth effect, low interest rates, and a high savings rate are all supporting consumers.

The consumer price index rose 0.5% in April in seasonally adjusted terms but, due to the base effect, the year-on-year inflation rate remained unchanged at 1.6%. The monthly advance was driven by food, transportation, and household operations which more than offset a decline in clothing. CPI excluding food and energy rose 0.1% in seasonally adjusted terms allowing the year-on-year core inflation rate to drop two ticks to 1.5%. On an annual basis, the CPI-trim stands at 1.3% (down from 1.4%), CPI-median at 1.6% (down from 1.7%) and CPI-common at 1.3% (unchanged).

As a result, the average of the three measures is now at its lowest level in 4 years at 1.4%. While the economy is showing strong momentum, inflation remains disappointing. Still, we continue to expect core CPI to speed up in 2017 in line with the recent economic impetus. Keep in mind that underlying inflation usually responds to the economic situation with a 3 to 5 quarter lag.

To read the entire report Please click on the pdf File Below..