Investing.com’s stocks of the week

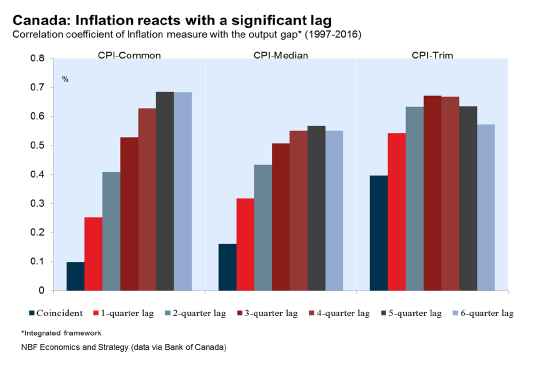

CANADA: The consumer price index rose 0.2% in March, allowing the year-on-year inflation rate to decrease 4 ticks to 1.6%. In seasonally adjusted terms, CPI was down 0.2% as higher prices for food, shelter, health care, recreation and alcohol/tobacco were more than offset by the declines in transportation, household ops and clothing. CPI excluding food and energy rose 0.3% but, due to the base effect, the year-on-year core inflation rate dropped three ticks to 1.7%. In seasonally-adjusted terms, it declined 0.1%. On an annual basis, the CPI-trim stands at 1.4% (down from 1.5%), CPIMedian at 1.7% (down from 1.8%) and CPI-Common at 1.3% (unchanged). This means that the average of the three measures followed by the BoC to gauge underlying inflation stands at its lowest level in almost 2 years. How can this be happening while the Canadian economy is one of the most surprising worldwide since the second half of 2016? Keep in mind that underlying inflation usually responds to the economic situation with a 3 to 5 quarter lag. For this reason, we expect the Bank of Canada preferred measures of inflation to speed up on a month-to-month basis in light of the recent economic momentum. That being said, the closely watched annual rate for the underlying inflation (average of the three measures) could remain weak up to June due to the base effect.

International securities transactions data showed foreign investors increased their holdings of Canadian securities by a record-high C$38.8 billion in February. The month’s result were pulled upward by net buying of equities worth an unprecedented C$35.9 billion. This impressive showing must be interpreted with caution, however, as it was driven by a $42-billion M&A deal that saw a Canadian company (Enbridge) acquire a U.S. company (Spectra) in an all-stock buyout. In other words, flows were not propelled by renewed foreign interest in Canadian equities. Meanwhile, foreign acquisition of Canadian bonds added up to C$7.1 billion. Inflows into ex-federal government bonds and government business enterprise bonds totaled C$5.1 and C$4.3 billion, respectively. Alternatively, foreign investors divested from both federal bonds (-C$2.1 billion) and private corporate bonds (-C$0.3 billion, a first net outflow since June 2015). Canadian money market instruments, also, were shunned by non-resident investors: Net outflows of C$4.1 billion were due essentially to declines in provincial and federal government paper (–C$2.9 billion and -C$1.1 billion, respectively).

To read the entire report Please click on the pdf File Below