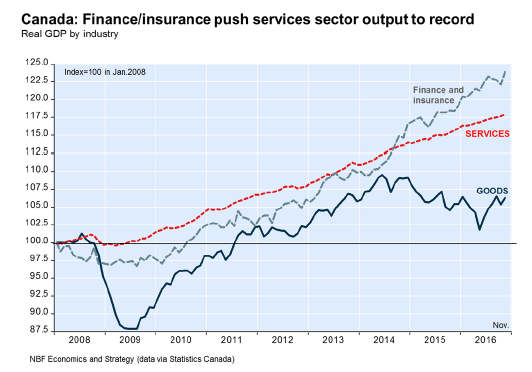

Canada – Real gross domestic product rose 0.4% in November, more than recouping the prior month’s losses (October’s slump was revised from -0.3% to -0.2%). November’s increase was the fifth in the past six months. Goods producing industries saw output jump 0.9% as gains in manufacturing, mining, oil and gas, and construction more than offset decreases for agriculture and utilities. Industrial production grew 0.9% as a result. Output in the services sector swelled 0.2% thanks to gains in retailing, transportation/warehousing, education, health and finance/insurance. (This last category reached an all-time peak.) After nine consecutive months of positive growth, the services sector’s output stood at a record high. November’s overall output gains put the economy in a good position to expand further in Q4 after a strong third quarter. Assuming no change in December, Q4 GDP growth could come in around 1.6% annualized, close to the Bank of Canada’s estimate of 1.5% for the quarter.

Bank of Canada Governor Stephen Poloz held a Q&A session at the University of Alberta in Edmonton in which he highlighted the divergence between the Canadian and the U.S. economies. He described the latter as operating at close to full capacity, unlike the former where, in his opinion, significant slack remained. Poloz deplored the fact that, despite this state of affairs, the Canadian dollar continued to appreciate against most non-USD currencies. He referred to the loonie’s ascent as a “headwind” for the economy. In an attempt to set things straight, he made it clear that Canada’s monetary policy was set to deviate from the United States’ in the foreseeable future. The governor also drew the crowd’s attention to rising mortgage rates, which were affecting an already weak housing sector in Canada. As for the possible implementation of protectionist trade measures by the new U.S. administration, he described it as a risk but also said that “[w]e can’t model them without knowing what they will be.”