Canada – Wholesale sales rose 0.2% on a month-onmonth basis in November to $56.9 billion. Motor vehicles and parts recorded a 5.8% retreat while the miscellaneous sector, which includes paper and plastic products as well as agricultural supplies and chemicals, nudged up by 7.2%. Total sales, excluding motor vehicles and parts, advanced by 1.6%.

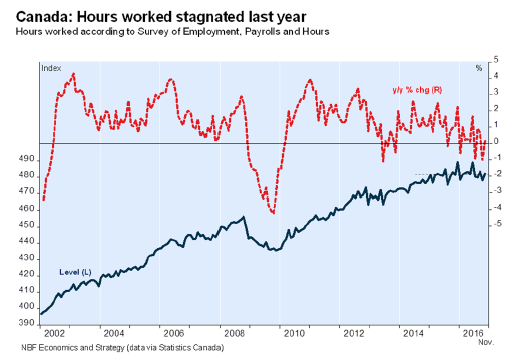

Expressed in volumes, sales slid by 0.1% The Survey of Employment, Payrolls and Hours (SEPH) showed Canada adding 25K net new jobs in November. That took the tally for the first 11 months of 2016 to 141K, or an average of 13K net new jobs/month which is much lower than the Labour Force Survey’s tally of 20K jobs/month for paid employment over the same period. The SEPH’s year-on-year earnings growth was just 0.8% in November. The lack of wage growth and stagnating hours worked are not encouraging but they are in line with the slow moving economy last year.

United States – Q4 GDP growth came in at 1.9% annualized, disappointing consensus which was looking for a print of 2.2%. Trade was a major drag on growth as exports fell and imports rose. But domestic demand more than compensated for that thanks to gains for consumption, government spending (mostly at the state level), residential investment and even business investment. Inventories added 1% to growth, meaning that final sales, i.e. GDP excluding inventories, grew slower than GDP, i.e. just 0.9% (albeit after two strong quarters). Nominal GDP grew at an annualized pace of 4%, on top of the prior quarter’s 5% increase. The personal savings rate fell two ticks to 5.6%.