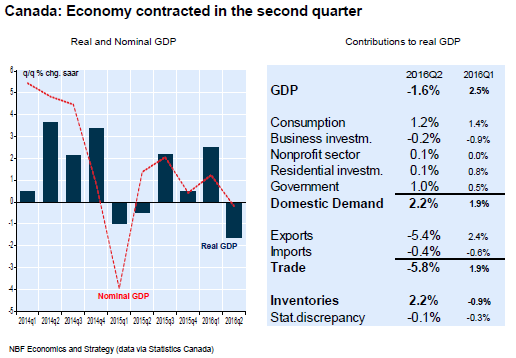

Canada – Real GDP shrank an annualized 1.6% in the second quarter of 2016 after expanding an upwardly revised 2.5% the prior quarter. Trade was a major drag on the economy on account of slumping exports (-20% annualized, their worst retreat since the 2009 recession) and rising imports. Domestic demand was restrained by a further decline in business investment, moderation in consumption growth, and weak residential investment growth, all of which offset higher government spending. Poor sales resulted in inventory build-up, which made a significant contribution to growth. In nominal terms, GDP contracted an annualized 0.2%. Monthly GDP data by industry showed output sprang 0.6% (non-annualized) in June, thereby erasing the prior month’s drop. There were gains in both the goods sector (+1.6%) and the services sector (+0.2%) in the month.

Exporters were affected by two temporary factors in Q2: Alberta’s wildfires interrupted southbound oil shipments and an inventory cull in the United States translated into softer demand for Canadian goods. However, these forces are now dissipating. Oil production is reportedly rising again and there are signs American manufacturers are rebuilding stocks. Consumption, too, is expected to bounce back in Q3. The reasons are twofold: a mounting savings rate and higher household income courtesy of the federal government’s enhanced child benefit program, which went into effect in July. We are encouraged also by the increase in government outlays last quarter, which suggests the announced federal fiscal stimulus is already in gear. Consequently, while inventory accumulation could cramp future production, we still expect Canada’s real GDP growth to rebound sharply in the third quarter.

To read the entire report Please click on the pdf File Below