Canada – The Teranet–National Bank National Composite House Price IndexTM rose 2.0% in July, thanks to monthly gains in seven of the eleven regions covered. It was the second largest rise for a month of July since the index began in 1999. Gains exceeded that of the Composite index in Victoria (+3.8%), Toronto (+3.1%), Hamilton (+2.4%) and Vancouver (+2.3%). There were also significant gains in Ottawa-Gatineau (+1.7%), Winnipeg (+1.6%) and Montreal (+0.6%). Prices were flat in Edmonton, and declined in Calgary (-0.1%), Halifax (- 0.4%) and Quebec City (-1.6%). On a y/y basis, the national index was up 10.9%, the largest 12-month gain in six years.

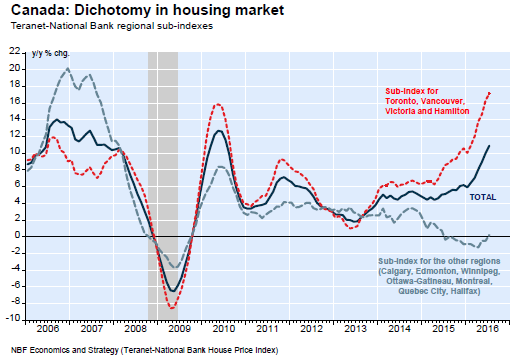

The annual increase was well above the national average in Vancouver (+24.3% - the largest increase on record), Victoria (+14.7%), Hamilton (+13.4%) and Toronto (+13.3%). Those massive gains contrast sharply with other regions, where prices rose in Winnipeg (+3.8%), Ottawa-Gatineau and Montreal (+0.8%) and declined in Halifax (-0.1%), Calgary (-0.6%), Edmonton (-1.2%) and Quebec City (-2.4%). In July, the dichotomy in the Canadian home resale market continued, with large monthly gains in the four metropolitan areas (Vancouver, Toronto, Victoria and Hamilton) that have been driving the national index recently.

Some observers believe that prices are going to cool in Vancouver based on last July’s 19% drop in home sales on a y/y basis and to the implementation of a 15% property transfer tax on foreigners purchases of residential real estate. However, despite the drop in existing home sales, the Vancouver resale market remains tight. Furthermore, the labour market in Vancouver is red hot, with employment having risen 7.4% on a y/y basis. These two factors provide support to house prices. The story is not solely about alleged foreign capital flows.

To read the entire report Please click on the pdf File Below