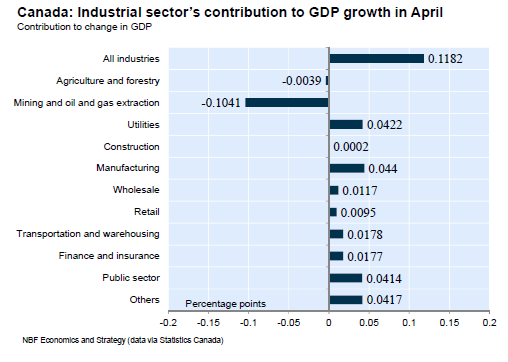

Canada – In April, real GDP swelled a consensusmatching 0.1% after contracting an unrevised 0.2% the prior month. Goods-producing industries saw output shrink 0.1% (after pulling back 0.9% the month before) as gains in the utilities and manufacturing sectors were dwarfed by losses elsewhere, including mining, quarrying, and oil and gas extraction, and agriculture and forestry. With the construction industry flat, industrial production edged down 0.1%. Service sector output rose 0.2% as gains in transportation and warehousing, real estate, public administration, and accommodation and food services, among others, offset declines in administrative and support services (-0.1%), arts and entertainment (-3.9%), and other services (-0.1%). The chart below shows how the main industrial sectors contributed to GDP growth in April.

April’s soft GDP growth was in line with expectations. We attribute the massive drop in the arts and entertainment industry to the fact that, for the first time since 1969-1970, no Canadian hockey team made the NHL playoffs. Elsewhere, we note that though resources remained a drag on growth, other sectors picked up the slack thanks in part to the relative weakness of the Canadian dollar. Manufacturing activity bounced back after declining for two consecutive months, and accommodation and food services rose at an annualized pace of 4.1% in the three months ended April. Over this period, consumers remained the main engine of growth with retail trade expanding at an impressive annualized rate of 3.2%. All in all, the economy continued to show remarkable resilience. However, after posting the strongest advance within the G7 in Q1, the Canadian economy is set to retreat in Q2 owing to a poor handoff and the impact of the Alberta wildfires. For 2016, we have notched our growth forecast down one-tenth of a percentage point to 1.2% in light of the uncertainty created by the Brexit.

According to the latest Survey of Employment, Payrolls and Hours (SEPH), year-on-year earnings growth fell to a measly 0.2% in April from 0.5% in March. April’s result was the second lowest ever since record keeping began in 2002. The smallest ever year-on-year increase had been registered only a few months earlier in January. These results are attributable in part to a drop in earnings in the oil-producing provinces.

To read the entire report Please click on the pdf File Below