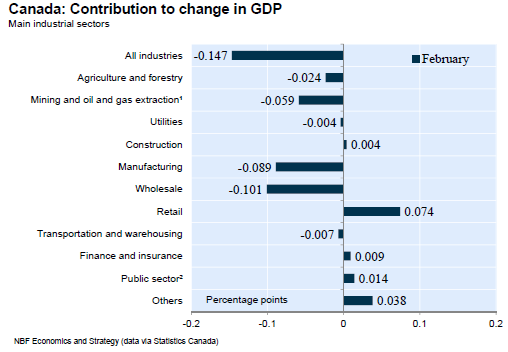

Canada – Real GDP contracted 0.1% in February, matching consensus expectations. The small decline came after an unrevised 0.6% increase the prior month. In February, goods producing industries saw output fall 0.6% (after a 0.9% advance the prior month) as small gains for construction were dwarfed by declines in all other categories including a 0.8% dive for manufacturing. Industrial production fell 0.7% as a result. The services sector's output was flat as gains in retailing, finance/insurance, real estate and accommodation/food services offset declines in wholesaling, transport/warehousing, professional services, health, education, and arts/recreation.

February’s soft GDP was in line with expectations. A moderation was always in the cards after January’s outsized gains. But the big picture is positive because it shows a much improved overall outlook. The cheap Canadian dollar’s benefits are clearly visible. Despite the decline in February, factory output remains close to multi-year highs, no doubt benefiting from strong exports (courtesy of the more competitive loonie). The surge in the accommodation/food services category in recent months (including February) is likely linked to tourism, a sector that’s also benefiting from the currency’s earlier slump. It’s also encouraging to see retailing remaining strong as that points to the resilience of Canada’s main engine of growth, i.e. consumers. All told, despite a soft February, there are positive signs for Canada’s economy. Real GDP should still manage to grow at a near 3% pace annualized in Q1 courtesy of a good handoff from last year and January’s output surge.

To read the entire report Please click on the pdf File Below