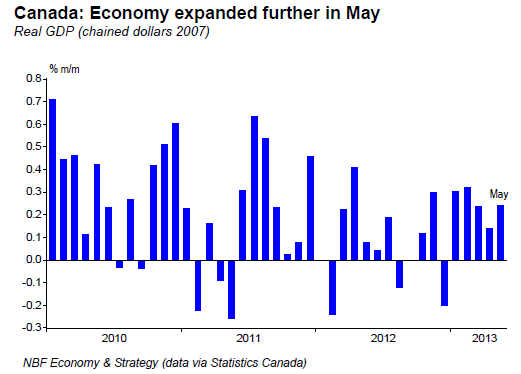

Canada – This week we got further clues about last quarter’s economic performance. GDP grew 0.2% in May, matching our forecast, but was one tick lower than consensus expectations. The goods sector saw a 0.3% contraction in output after a 0.4% drop in the prior month. The 1.7% slump in the resources sector, the 0.4% drop in utilities output and flat construction output, more than offset the 0.3% advance in manufacturing. The services sector’s output rose 0.5% with gains in most subsectors

including retail (+1.8%) and wholesale (+1.4%), which more than offset the decline in transportation/warehousing (-0.3%).

Industrial production fell 0.5% for the second month in a row, not surprising given the drop in the resources sector. The slump in the oil and gas sector hurt the economy in May. Despite the softer-than-expected GDP results, Q2 GDP growth is shaping up to be close to 2% annualized, and that, even assuming a contraction of 0.3% in June — not our forecast, but just a suggestion that even after taking into account the Calgary floods and the strike in Quebec’s construction industry, Q2 growth was probably much stronger than the Bank of Canada’s latest forecast of 1% for the quarter. But the growth in Q2 happened courtesy of the services industry, with the goods sector treading water — with two months of data, industrial production is tracking a small contraction (-0.3% annualized) in the quarter.

United States – A data heavy week featured information about both the current quarter and the last one. GDP growth in Q2 came in at 1.7% annualized according to the BEA's advance estimate. That was above consensus expectations for a 1.0% expansion. However, growth was revised downwards sharply in Q1 to just 1.1% (from 1.8%). In the second quarter, there were contributions to growth from consumption spending (+1.8%), business investment (+4.6%), and housing (+13.4%), which more than offset the usual drag from government, and helping to support domestic demand. There was some inventory accumulation in the quarter, which contributed 0.4% to growth. Trade, however, was a net drag on Q2 economic activity removing 0.8% from economic growth. Real disposable income increased 3.4% while the savings rate rose to 4.5% in the quarter (from 4.0%). Note that there were revisions to prior years to reflect a new methodology. And after revisions, the US economy seems to be doing a bit better than first thought.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Economic Watch - August 05, 2013

Published 08/06/2013, 04:09 AM

Updated 05/14/2017, 06:45 AM

Weekly Economic Watch - August 05, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.