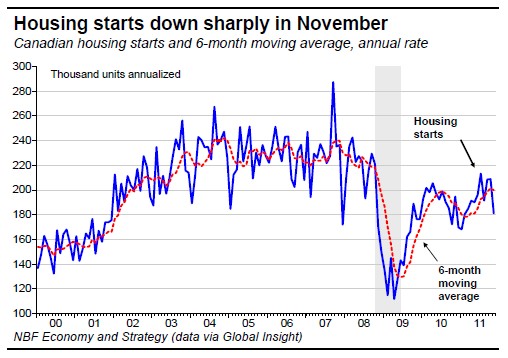

– In November, housing starts in Canada decreased sharply to 181.1K units from an upwardly revised 208.8K in October. Urban starts fell to 158.9K from 185.7K the previous month. Rural starts sank to 22.2K from 23.1K. Single-family starts increased 3.6% to 63.6K while multiple starts plunged 23.3% to 95.3K. On a regional basis, urban starts pulled back hardest in Ontario (-30.6% or -22.0K) and Saskatchewan (-26.8% or -1.9K) while pressing forward most in P.E.I. (+57.1% or +0.4K) and Newfoundland and Labrador (+20.0% or +0.4K).

Though we do expect activity in new home construction to cool in the coming months and November's showing could be seen as a harbinger, the fact remains that the decline was concentrated in Ontario, which accounted for 80% of slump, and in the highly volatile multiples segment to boot. We have to wait for another month’s data to confirm whether the moderation is actually occurring. Meanwhile, 7 of 10 provinces registered a decrease on the month while mortgage interest rates reached an all-time low in Canada. This suggests that, despite a highly stimulative environment, housing starts in the months ahead will be in line with or below our household formation estimate of 190K, especially with the labour market struggling of late.

To no one’s surprise, the Bank of Canada left its overnight rate put at 1%. The BoC remains apprehensive about the European situation’s potential spill-over effects on the rest of the world, especially the United States and emerging Asia. In the light of this global risk factor, Governor Carney seems comfortable with the BoC's present stance, which he deems considerably stimulative. However, the BoC can still react to changes in financial conditions if matters in Europe deteriorate. Indeed, it could resort to instruments other than interest rates, such as last week's coordinated action by central banks to provide US$ liquidity. Developments in Europe over the next few weeks will be critical to interest rate expectations in Canada.

In October, Canada’s merchandise trade balance dipped back into the red, recording a deficit of C$0.89 billion versus consensus expectations for a C$0.7-billion surplus. September’s surplus was revised down slightly from C$1.25 billion to C$1 billion. Exports sagged 3% as declines in energy, forestry, machinery and equipment and agricultural products and industrial goods and materials outweighed gains in autos. In real terms, exports slid 3.2% while imports rose 1.2%. With this decrease in volumes, exports are now tracking at -8.6% annualized in Q4 after climbing 18% in Q3. The increase in real imports of machinery and equipment suggests business investment will stabilize in Q4 after contracting the quarter before. By the looks of it at this point, trade will be a drag on GDP in Q4. That said, some export sectors could still do well. For example, with demand for autos buoyant in the United States (if October and November sales are any indication), we can expect Canadian auto exports to rebound in the final quarter of the year. The trade outlook for next year is less upbeat as Canadian exporters will need to navigate a course against strong headwinds in the form of a slower global economy and a strong Canadian dollar.

Canada’s labour productivity surprised on the upside by rising a non-annualized 0.4% q/q in Q3 as output grew at a faster pace than hours worked. As a result, unit labour costs fell 0.5%.

In November, the Ivey Purchasing Managers Index rose to 59.9 on a seasonally adjusted basis, breezing past consensus expectations. This was its highest reading since June. The inventory sub-index soared to 61.3, its highest mark in over five years. The employment sub-index slipped to 49.4, bringing the average for Q4 to just 50.4. This is its lowest level this year but consistent with the deceleration witnessed in the labour market. We like to take the Ivey

PMI with a grain of salt as it tends to be rather volatile and does not necessarily correlate with monthly Canadian GDP. Still, the pick-up in the inventory sub-index suggests some stock rebuilding in Q4. This is not all that surprising given the drag from inventories in Q3.

United States – In October, factory orders in the United fell 0.4%, which was a little worse than expected by consensus (-0.3%). September orders were revised down to -0.1% from +0.3%. October durable goods, which the advance report had dropping 0.7%, in fact declined just 0.5%. Non-defence capital goods orders excluding aircraft, a proxy for future investment spending, dropped 0.8% (a bit better than the 1.8% decline initially reported). Total factory shipments swelled 0.6% after growing 0.3% a month earlier.

In November, the ISM non-manufacturing index eked down to 52 when consensus was looking for it to crawl up to 53.9. The drop was due primarily to the employment index, which sank to 48.9. The new-orders component, however, jumped to 53. Overall, the composite ISM (taking into account this week’s release and last Thursday’s strong manufacturing ISM) retreated to 52.1 from 52.7. The fact that the ISM remains above the 50 mark, combined with the strong shipments data, supports our view that the U.S. economy posted its best quarter this year in Q4. Growth is currently tracking at well above 2% annualized. The deceleration in orders for non-defence capital goods excluding aircraft needs to be put into perspective, however, as it came on the heels of a relatively hot spell of business investment. Moreover, the new-orders component of the ISM manufacturing index (seen last week) suggests factory orders improved in November.

In October, the trade deficit shrank 1.6% to $43.5 billion, thus surprising most forecasters, who had been looking for the balance to deteriorate. Imports decreased $2.2 billion to $222.6 billion from the previous month. Exports fell 2.2% to $179.2 billion on the back of lower gold shipments. In real terms, the trade deficit in September narrowed to $44.2 billion from $45.9 billion.

Euro area – The European Central Bank lowered its policy rate 25 basis points to 1.0%. It also announced that it would relax its collateral eligibility criteria and conduct two longer-term refinancing activities with a maturity of 36 months. Moreover, the ECB revised its forecasts downward. The mid-point GDP growth forecast for 2012 is now 0.3%, compared with 1.3% before. In his press conference, ECB President Mario Draghi reiterated that the central bank had

no intention of circumventing rules that prohibit it from financing governments. Financial markets reacted negatively to the statement. Commenting on the interest rate cut, Draghi pointed out that discussion on the issue had been lively and that the timing of the move had not met with unanimity.

To read the entire report please click on the pdf file below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Economic Letter

Published 12/13/2011, 02:56 AM

Updated 05/14/2017, 06:45 AM

Weekly Economic Letter

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.