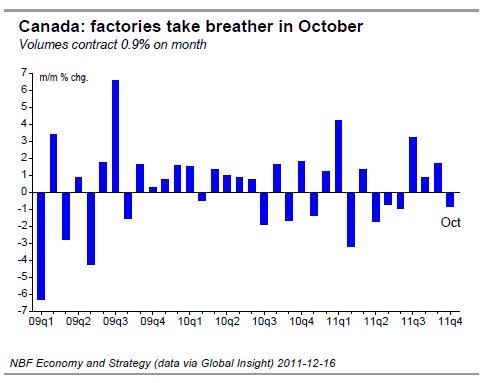

– In October, manufacturing shipments fell 0.8% with 13 of the 21 manufacturing industries slumping. A 4.3% decrease in petroleum and coal products was the main driver of the decline, but several other sectors slipped as well, including transportation equipment (-0.6%) led by autos and the volatile aerospace category (-9.7%). In volume terms, shipments were down 0.9%. The inventory-to-sales ratio rose to 1.33, its first increase in four months. The contraction in shipment volumes does not bode well for GDP, which is on track to posting its worst monthly showing since May. So, after a strong Q3, the expected softening of the Canadian economy in the final quarter of the year seems to be materializing.

Still in October, foreigners continued purchasing Canadian securities, albeit at a slower pace, adding C$2bn of Canadian assets to their portfolios. More than half of that ($1.2bn) was in bonds. Purchases of federal government bonds topped $4.2bn, the largest amount since May. So, as we had expected, the drop in Q3 investment in federal government bonds was just temporary. Canada's AAA status suggests there will be demand for our government debt, particularly compared with that of other countries in difficult fiscal positions. The increase in government bond buying by foreigners more than offset the $3bn net selling of corporate bonds in October, which was in fact the largest monthly cut on record going back to 1988. The sharp drop in corporates might have had something to do with flight to safety in a month when risk aversion was fed by bad news out of Europe. However, as monthly data can be quite volatile in any event, we do not believe the October selloff of corporates signals the beginning of an exodus.

United States – Last week was a busy one in terms of data releases with key indicators generally confirming the acceleration of the U.S. economy in the final quarter of the year.

Weekly initial jobless claims fell to 366K, beating consensus expectations of 390K. This was the lowest level of initial claims since May 2008, providing further evidence of a labour market on a clear uptrend.

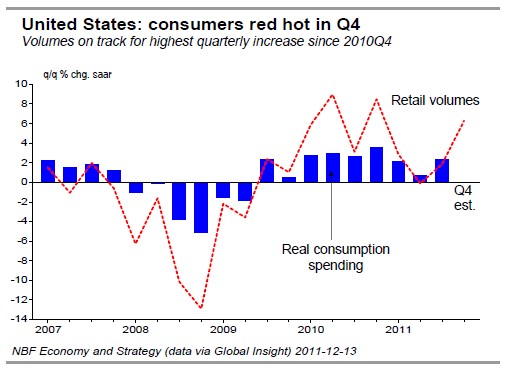

In November, U.S. retail sales grew 0.2% for both the total and ex-autos. The ex-auto sales increase was driven by strong gains in clothing, electronics, and furniture, which more than offset declines in food, building materials and gasoline. Discretionary spending (i.e., excluding gasoline, groceries, health/personal care) was up 0.4% after climbing 0.8% the month before. October and September retail numbers were revised upward. Two months into Q4, real retail spending is tracking at +6.3% annualized, its highest level since 2010Q4. In addition to the improving labour market and less of a negative wealth effect from housing, a slowdown in the pace of deleveraging seems to be boosting U.S. consumption spending.

The Philadelphia Fed and the New York Fed both released their indices of manufacturing activity for December and both were quite strong. The Philly index sprang to 10.3 with the new orders component jumping to 9.7, which were both the highest readings since April. The New York (Empire) index shot up to 9.53, its highest mark since May.

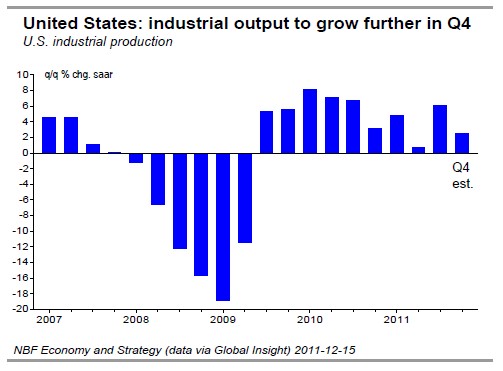

Again in November, U.S. industrial production slid 0.2% on drag from manufacturing and more moderate growth in mining. However, the month’s weak results must be put into perspective, coming as they did on the heels of a strong 0.7% advance in October. As the drag came primarily from autos, we expect production to rebound soon in light of just how strong retail auto sales have been recently. Dealerships will need to rebuild their inventories eventually. Despite the weak November reading, IP growth is tracking at a healthy 2.6% annualized in the final quarter of the year.

Still in November, the U.S. National Federation of Independent Business (NFIB) index rose for a third straight month, reaching 92, it highest reading since February. The "expect higher sales" index turned positive (i.e., positive respondents outnumbered negative respondents) for the first time since May. Respondents also found it less difficult to get credit and expected credit conditions to ease further in future. In addition, they planned to increase capital expenditures, with this index rising to its highest level since March. Business optimism is clearly on the rise in the United States thanks to better credit and improved sales.

Consumer prices (CPI) were unchanged in November as lower energy prices offset increases elsewhere. Food prices rose only 0.1% for the second month in a row, continuing to moderate after a string of hot months. The flat monthly headline CPI pulled the annual inflation rate down one tick to 3.4%. Excluding food and energy, prices edged up 0.2%, pushing the year-on-year core CPI higher a notch to 2.2%. Apparel prices rose 0.6%, computers 0.7% and medical care 0.4%. However, on a 3-month annualized basis, core CPI came in at a subdued 1.5%, its lowest mark since January. Vehicle prices sank for a third consecutive month, indicating that shortages are clearly resolving following production disruptions.

Still in November, the Producer Price Index (PPI) rose 0.3%, pulling the year-on-year rate down two ticks to 5.7%. Excluding food and energy, prices eked up 0.1% on

the month, pushing the year-on-year core PPI one tick higher to 2.9%.

Both the CPI and PPI reports confirm that price pressures are moderating in the United States.

To no surprise, the Fed left interest rates unchanged at zero. The FOMC acknowledged the improvement in the labour market but remained concerned about “strains in global financial markets", which continued to pose a significant risk to the economic outlook. The Fed will go on: extending the average maturity of its holdings of securities; reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities; and rolling over maturing Treasury securities at auction. The only note of dissent against the no-change decision came again from Charles Evans, who argued instead in favour of rendering monetary policy even more accommodative. While the accelerating U.S. economy means that QE3 will not be dispatched for now, the softening of prices affords the Fed some leeway to act, if needed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weekly Economic Indicators

Published 12/20/2011, 07:50 AM

Updated 05/14/2017, 06:45 AM

Weekly Economic Indicators

Canada

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.