Headlines

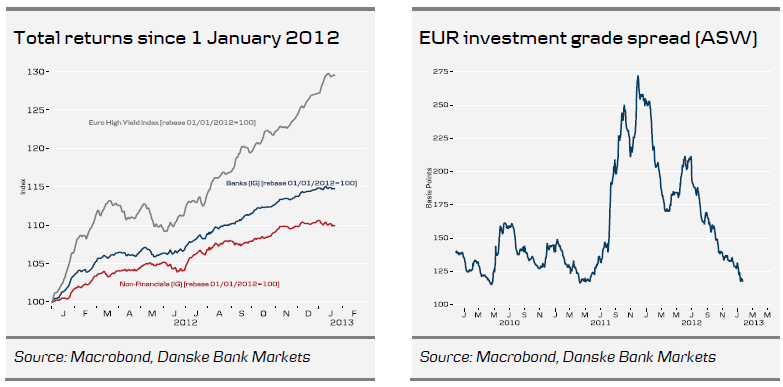

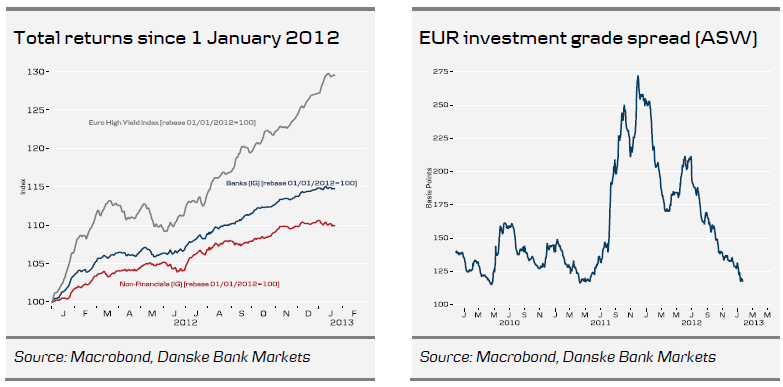

Credit spreads have been largely stable in recent weeks and the newsflow is currently limited. Towards the end of last year we saw an aggressive spread tightening and, consequently, the risk-reward has moved further to the downside and there is no chance that 2013 will prove as yielding for credit investors as 2012 was. Indeed, the spread widening we saw at the end of January was a timely reminder of this. In 2012, credit investors benefited from both lower base rates and a significant spread tightening, resulting in double-digit yields for both investment grade and high yield.

We believe ample liquidity and depressed sovereign yields will continue to be beneficial to credit but we do expect some reallocation from credit into equities as relative valuations seem to support the latter. Should we see a significant uptick in longer dated yields, it is likely to come on the back of an improvement in macroeconomic conditions and the effect on credit on that front would be ambiguous (less attractive to govies in a relative context but a more robust economy would support credit metrics).

We expect spreads to be range bound around current levels, which is likely to result in lower – but positive – returns for the rest of 2013. Search for yield will be a prevailing theme in 2013 and we think the spread tightening potential is largest in the lower rated segments, where the credit risk is more than compensated for by the spread. For senior financials, we are still reasonably optimistic despite the strong rally we have seen. The strong and potentially unlimited backing by the ECB has removed much of the tail risk from the banking sector and the SNS nationalisation once again confirmed the reluctance to impose losses on senior unsecured. Furthermore, European banks are likely to remain in deleveraging mode for some time to come.

In the Nordic primary market Atlas Copco came to the market with a EUR500m bond prices at 70bp over swap.

To Read the Entire Report Please Click on the pdf File Below.

- Stable credit spreads and modest primary market activity

Credit spreads have been largely stable in recent weeks and the newsflow is currently limited. Towards the end of last year we saw an aggressive spread tightening and, consequently, the risk-reward has moved further to the downside and there is no chance that 2013 will prove as yielding for credit investors as 2012 was. Indeed, the spread widening we saw at the end of January was a timely reminder of this. In 2012, credit investors benefited from both lower base rates and a significant spread tightening, resulting in double-digit yields for both investment grade and high yield.

We believe ample liquidity and depressed sovereign yields will continue to be beneficial to credit but we do expect some reallocation from credit into equities as relative valuations seem to support the latter. Should we see a significant uptick in longer dated yields, it is likely to come on the back of an improvement in macroeconomic conditions and the effect on credit on that front would be ambiguous (less attractive to govies in a relative context but a more robust economy would support credit metrics).

We expect spreads to be range bound around current levels, which is likely to result in lower – but positive – returns for the rest of 2013. Search for yield will be a prevailing theme in 2013 and we think the spread tightening potential is largest in the lower rated segments, where the credit risk is more than compensated for by the spread. For senior financials, we are still reasonably optimistic despite the strong rally we have seen. The strong and potentially unlimited backing by the ECB has removed much of the tail risk from the banking sector and the SNS nationalisation once again confirmed the reluctance to impose losses on senior unsecured. Furthermore, European banks are likely to remain in deleveraging mode for some time to come.

In the Nordic primary market Atlas Copco came to the market with a EUR500m bond prices at 70bp over swap.

To Read the Entire Report Please Click on the pdf File Below.