Trading Themes: Weak US PMI data sets stalled the USD’s bullish advance midweek with the service sector reading falling back to 51.2 in May and manufacturing equally disappointing. Despite these soft reading, further Fed officials expressed support for the Fed’s proposed rate path of two hikes this year with market expectations now building ahead of the June FOMC meeting. GDP growth was revised higher for the 1q from 0.5% to 0.8% adding further support for the dollar. Finally, on Friday bulls were given the green light with Fed chair Yellen noting that a rate hike in the coming months is appropriate if economic data picks up.

EUR: ECB rate decision on Thursday the key focus this week.

GBP: Sterling bolstered by growing support for the “VoteStay” Brexit campaign.

JPY: Japanese yen weakens on expectations of delayed sales tax increase.

CHF: A lack of EUR downside keeps the pressure off the SNB for now.

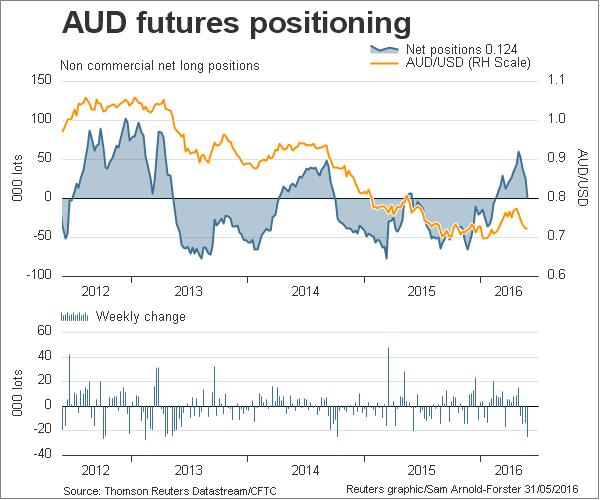

AUD: AUD supported by small data beats overnight. GDP key focus this week.

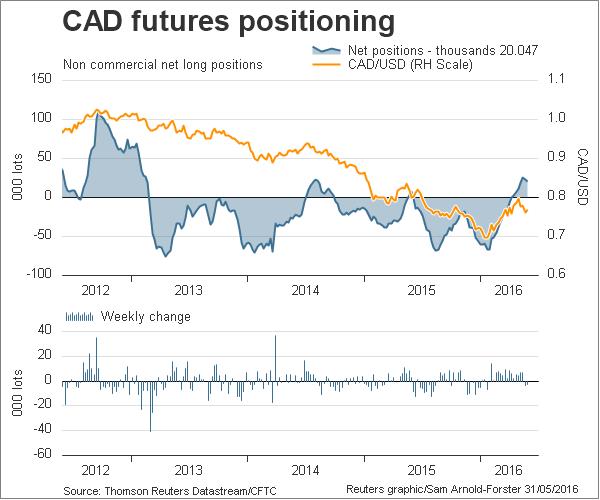

CAD: BOC surprised markets with less-dovish statement at recent meeting.

Let’s take a look at what the latest COT report data is showing us from a trend and net change week over a week perspective…

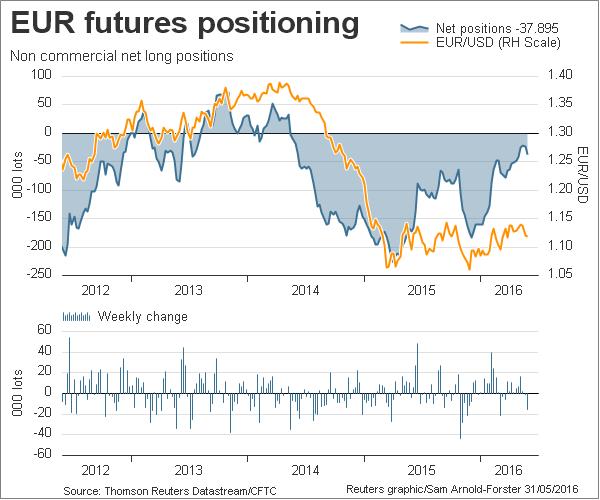

- EUR bearish, increased on the week

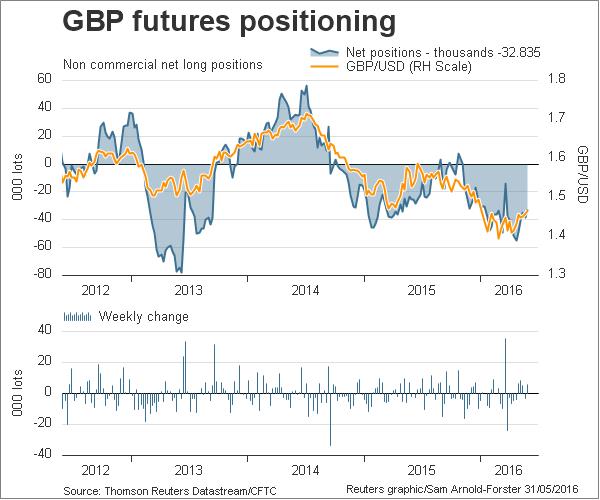

- GBP bearish, decreased on the week

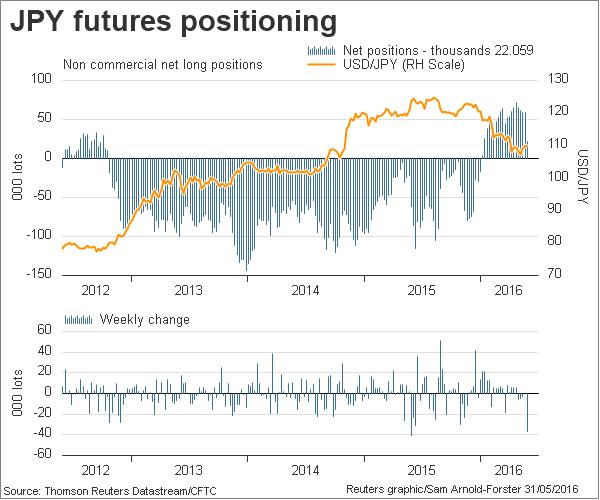

- JPY bullish, decreased on the week

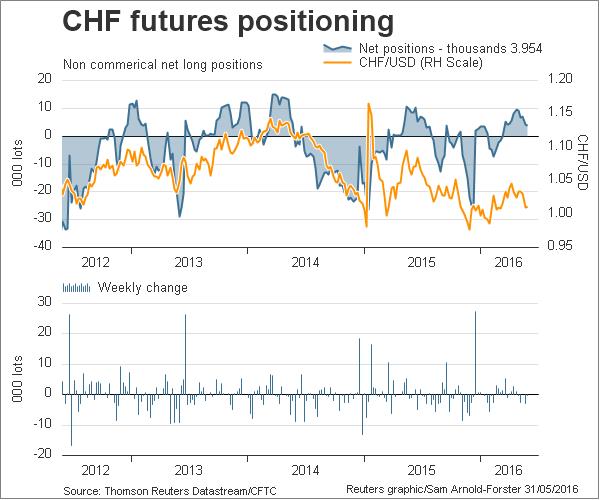

- CHF bullish, increased on the week

- AUD bullish, decreased on the week

- CAD bullish, flat on the week

EUR/USD Outlook – Bearish

ECB policymakers are echoing for governments to coordinate their economic strategies to shore up the region’s recovery prospects. French central bank chief Francois Villeroy commented that “monetary policy cannot be a substitute for economic policy coordination or the lack of reforms. One point of discussion that was previously raised whether a lack of economic reform by government is seen as disinflationary. Villeroy also added that there is a need for stronger governance of the euro area, as he opines that the Eurozone cannot afford another missed opportunity and will need to act swiftly without losing the long term view. ECB rate decision will be key focus this week.

COT Indicators

- Index active buy signal ticks down

- Strength active sell signal ticks down

- Momentum buy ticks down

LFOrder Flow Trader Bullish

GBP/USD Outlook – Bearish

Sterling remained supported this week as the latest polling data continues to show growing support for the Vote Stay campaign. Optimism regarding the likelihood of the UK staying the EU has seen markets disregarding weak data sets with Q1 GDP printing below expectations. S&P warns that the GBP may potentially lose its reserve currency status should Brexit becomes an eventuality. A vote to leave the European Union on June 23 may dethrone the GBP and may even threaten the nation’s AAA credit rating, warns S&P.

COT Indicators

- Index sell signal strengthens

- Strength sell signal strengthens

- Momentum buy signal given

LFOrder Flow Trader Bullish

USD/JPY Outlook – Bullish

Japanese Finance Minister Taro Aso said on Wednesday he told his G7 counterparts at a finance leaders’ meeting last week that his country will proceed with a scheduled sales tax hike next year as raising the sales tax is a very important factor in maintaining trust in Japan’s finances. Aso also noted that Japan is not intending to devalue their exchange rate, despite having recently warned that they would take steps to counter any further JPY strength. Weak domestic data continues to delay the implementation of the 2017 tax increase.

COT Indicators

- Strength active sell signal, ticks up

- Index active sell signal ticks up

- Momentum buy signal ticks up

LFOrder Flow Trader Bullish

USD/CHF Outlook – Bullish

With EUR having moved counter-intuitively higher in response to the latest ECB measures, it seems some pressure has likely been alleviated from the SNB who refrained from moving on rates at their recent meeting. Worth noting however that recently SNB’s Jordan has warned of a “nuclear” option in the event of continued CHF appreciation stating that the SNB can cut the exemption from negative deposit rates that it extended to most domestic banks’ reserves. The latest CPI data for Switzerland showed that inflation grew 0.3% MoM as expected, adding support for the Swiss franc.

COT Indicators

- Strength buy signal ticks up

- Index active sell signal ticks up

- Momentum active buy signal ticks up

LFOrder Flow Trader Bearish

AUD/USD – Outlook Bullish

AUD hovered near three-month lows on falling iron ore prices and speculation that the Reserve Bank of Australia (RBA) will ease policy further. RBA Governor Glenn Stevens commented on Tuesday on uncertainties over the economic transition in China, Australia’s biggest export market, which weighed on the Aussie. Growing US rate hike expectations are also putting the antipodean currency under pressure much to the delight of the RBA.

COT Indicators

- Strength signal turns flat, await new signal

- Index active buy signal ticks down

- Momentum sell signal ticks down

LFOrder Flow Trader Bullish

USD/CAD Outlook – Bullish

CAD strengthened against the USD after the Bank of Canada’s statement was less dovish than some investors had expected. The Bank of Canada kept interest rates on hold at 0.50 percent, saying the economy would shrink in the second quarter because of the recent wildfires in Alberta.

COT Indicators

- Strength sell signal ticks lower

- Index active sell signal remains at lows

- Momentum buy signal given

LFOrder Flow Trader Bearish