As of Tuesday 13th August:

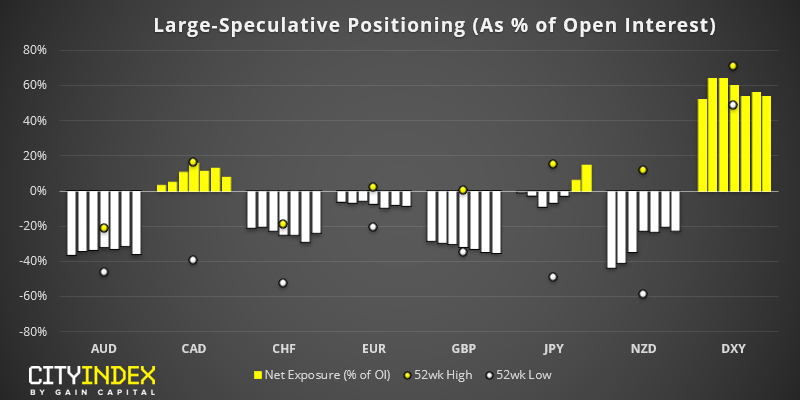

USD: Despite relatively low demand for the greenback, the US Dollar Index (DXY) saw its highest weekly close since March 2017. Still, the stat is better than the reality of the situation. DXY is heavily weighed to the Euro (57%) which is the weakest major this past month, so the dollar is more attractive on a relative basis which is helping to prop up DXY. The main takeaway from the chart above is that investors remains wary of the dollar, yet remain net long overall, albeit at their lowest levels in around a year.

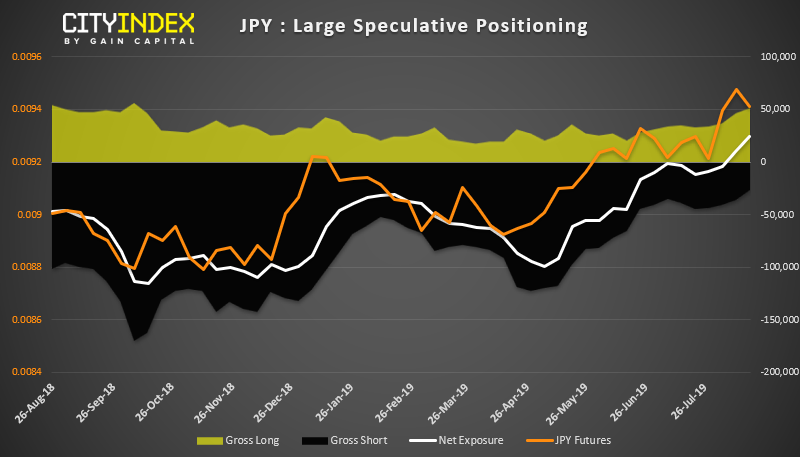

JPY: The surge of yen strength doesn’t come as too much of a surprise, given the intensified fears of a global recession, dovish central banks and ongoing trade wars. Moreover, it’s been seen with a rise of freshly initiated longs and covered shorts. The long/short ratio has spiked to 1.92 and is reminiscent of the spike seen from February 2016 when investors were also fretting about a potential global recession. The 1-year Z-score is above +2 standard deviations (SD) which warns of over-extension, although given the shift in sentiment we’re inclined to use the 3-year Z-score which sits at just +0.98 SD. So, until a lift in global sentiment is seen, we’d prefer to stick with Yen strength in terms of trade setups.

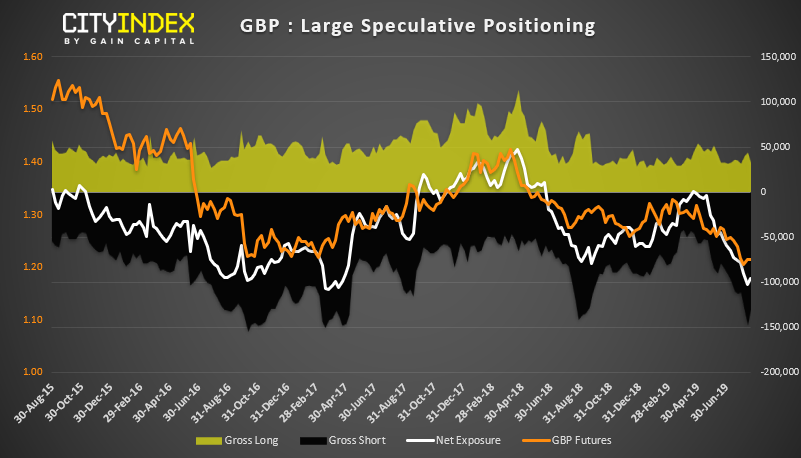

GBP: Traders reduced short exposure for the first time in 9 weeks, and several indications have been pointing towards a sentiment extreme. Gross short exposure had reached levels not seen since February 2017 and August 2018, the 1 and 3-year Z-scores were less than -2 SD last week and long/short ratio is its lowest in 16 months. Still, whilst positioning continues to look stretched, it remains difficult to be bullish on GBP with so much headline risk weighing it down, barring a reversal of Brexit fortunes. So perhaps the indications warn against being short, as opposed to bucking the trend at present, even if GBP enjoyed its most bullish session in a month on Friday.

As of Tuesday 13th August:

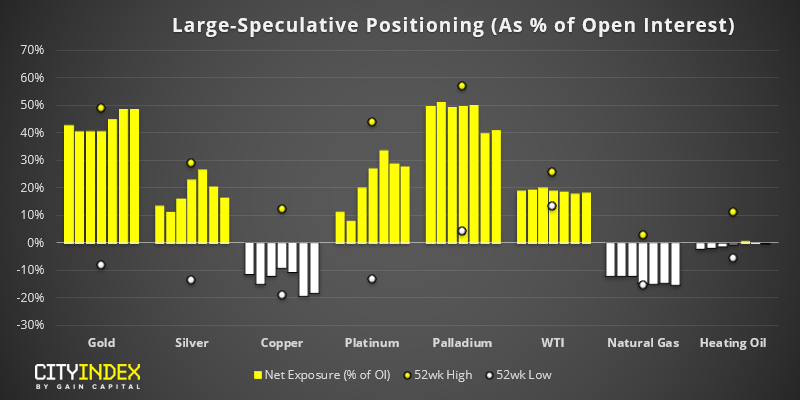

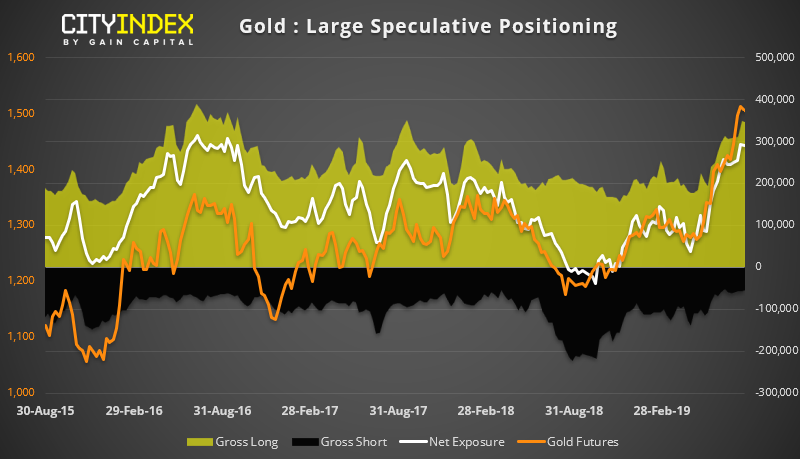

Gold: Ultimately, we remain firmly bullish on gold but at some point its likely due some mean reversion. Both 1 and 3-year Z-scores are over +2 SD (1-year has been above it for 10 weeks) and the long/short ratio is 6.2, its highest level since December 2012. Both longs and shorts reduced exposure last week (-4.3k and -1.9k respectively) which saw net-long exposure fall by -2.5k contracts. Yet whilst gold screams a sentiment extreme, investors appear reluctant to let go of their bullish exposure, so perhaps mean reversion could result in sideways trading before the trend resumes.