As of Tuesday 7th January:

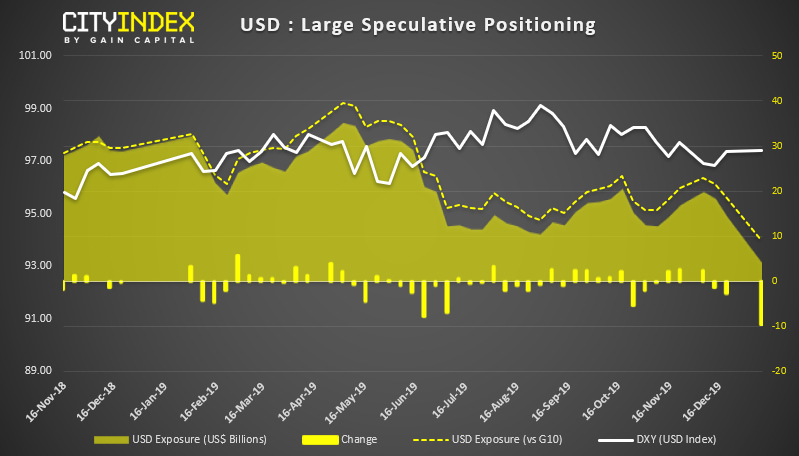

USD: With traders shedding -$10.2 billion in net-long exposure, it’s the largest weekly change since June 2018 and the largest negative decline since June 2015. It’s also the least bullish traders have been on the dollar in 19-months, since traders flipped to net-long. (Not) QE is certainly having an impact on the dollar, or at least traders' perception of it, so perhaps this theme will persist until the Fed fix the issues in the repo market.

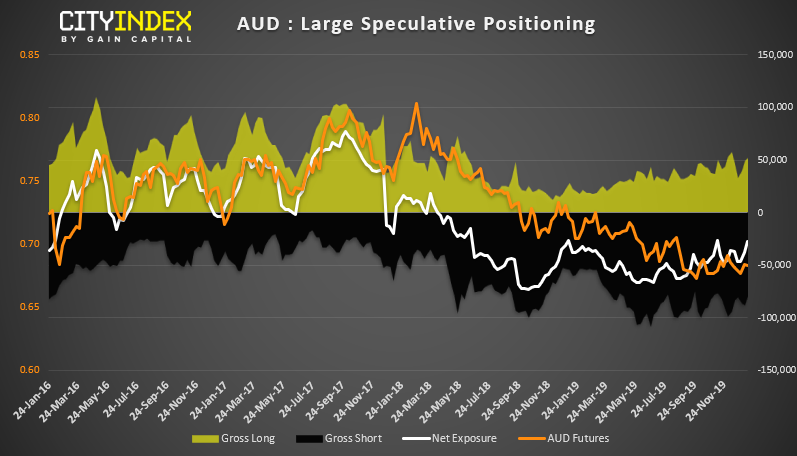

AUD: Net-short exposure has fallen to its lowest level in 2-months, and near similar levels seen in January 2019. And the timing is curious, given the RBA could very well cut rates early February. Still, perhaps this will provide bears with better price to consider short traders, particularly if inflation and / or employment data misses the mark ahead of RBA’s first meeting of the year.

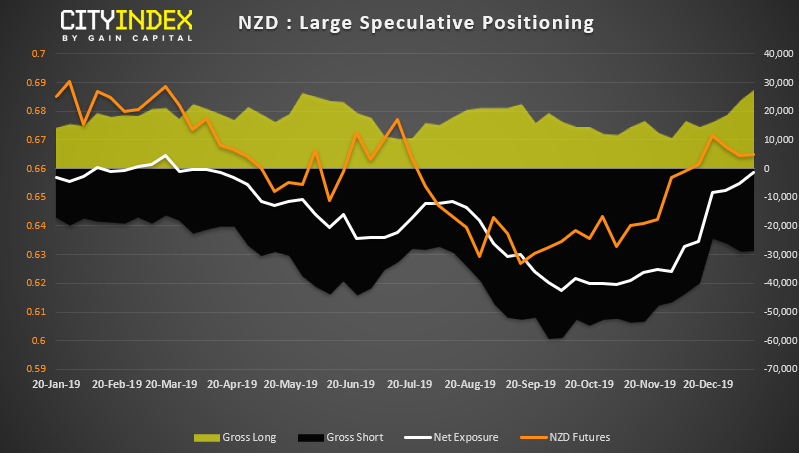

NZD: Traders are on the cusp of flipping to net-long exposure. Moreover, we’ve seen a healthy rise of gross long exposure after shorts were culled between September and December. We continue to expect RBNZ to hold rate through Q1 so core view on NZD remains bullish.

As of Tuesday 7th January:

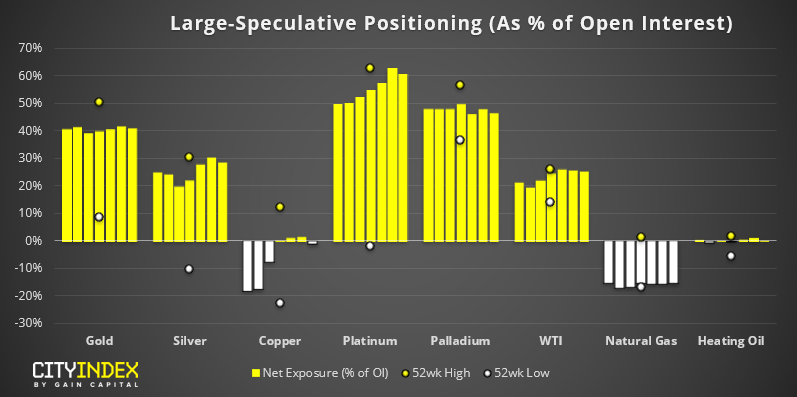

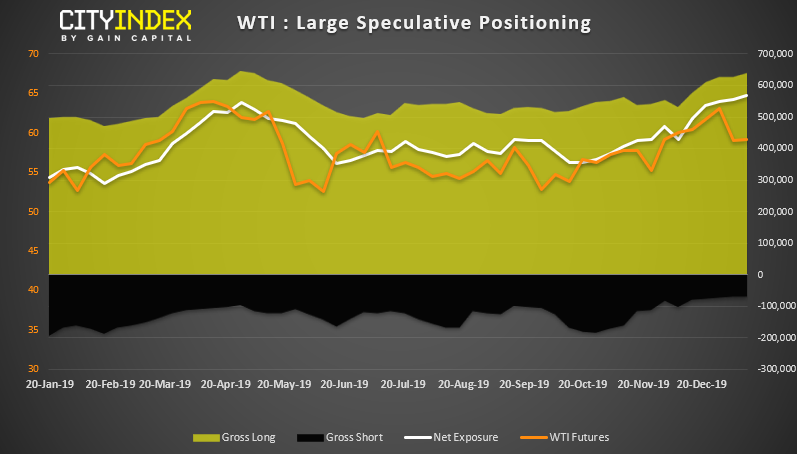

WTI: Whilst traders increased their bullish exposure to a 17-month high, it should be noted that tensions were high in the Middle East which supported oil prices. Yet with WTI’s failure to close above $64 and roll over, it trades back within range and we’d expect the positioning to reflect this in the next report. This means range-trading strategies are preferred whilst prices remain below $64 - $65.