As of Tuesday 5th November:

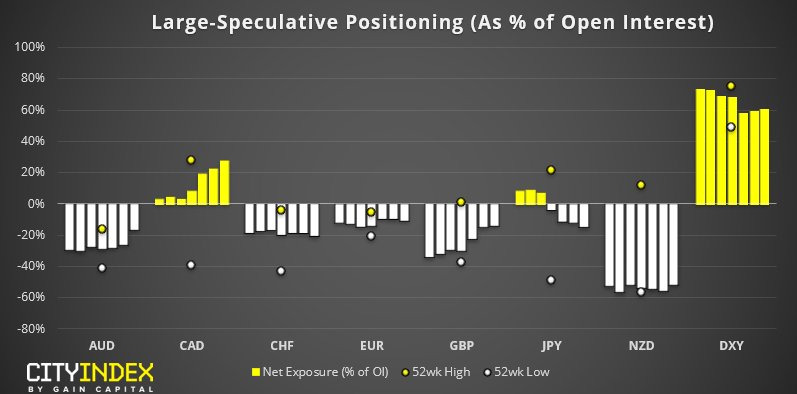

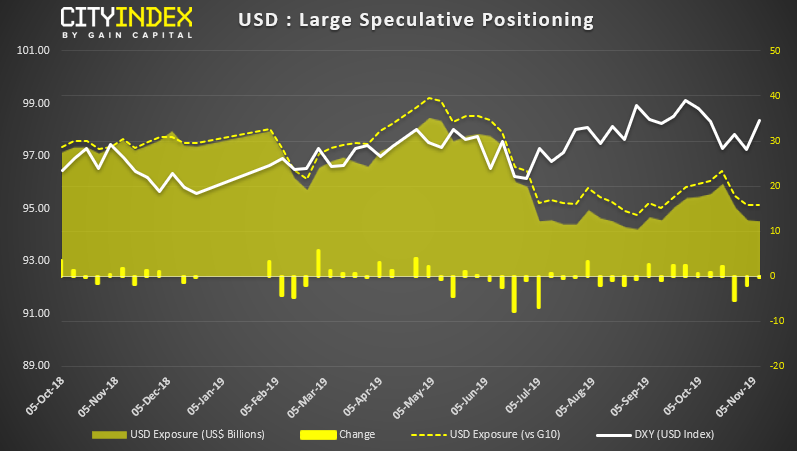

USD: DXY has rebounded from key support (which is heavily weighted to Euro), yet the broader measure of USD positioning is not confirming the move. This could suggest the rebound is simply corrective, so perhaps USD will break to new lows. Yet over the near-term, bullish momentum prevails and there are no clear signs of a top forming, so the bias for USD remains bullish.

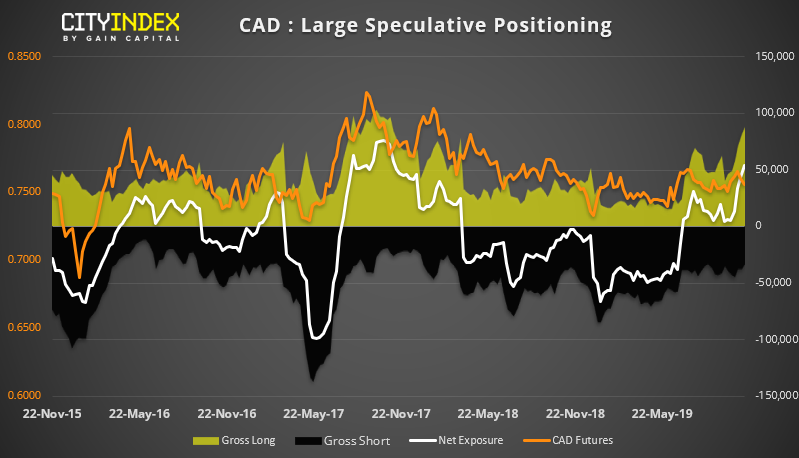

CAD: It seems that trade deal optimism has overcome the dovish BOC meeting, with net-long exposure at its highest level in 2 years. Moreover, the move is fuelled by an increase in bullish bets and reduction of shorts, which is the backbone of a healthy move. Still, seeing as demand for USD remains, it could cap volatility for USD/CAD and make directional moves harder to come by.

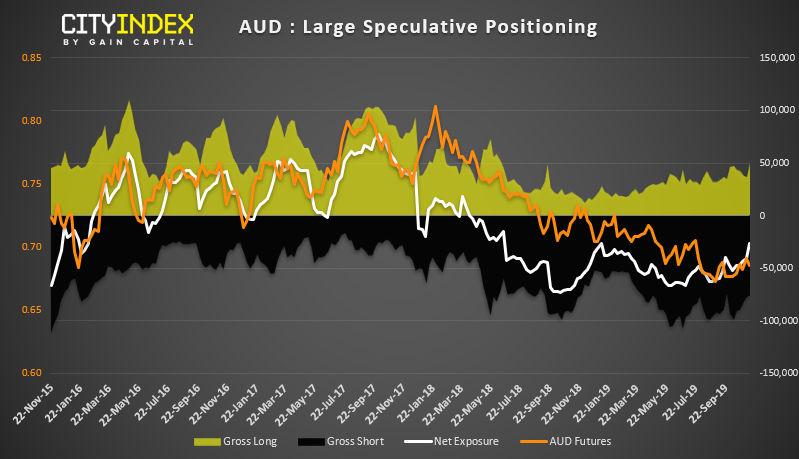

AUD: Bears continue to flee whilst long interest perks up. Gross-long exposure is its highest level since June 2018 and gross shorts are at their lowest level since September. Like CAD, the Aussie is reaping the rewards of better US-China trade relations, which leaves it open to further upside should the phase one trade deal get signed.

As of Tuesday 5th November:

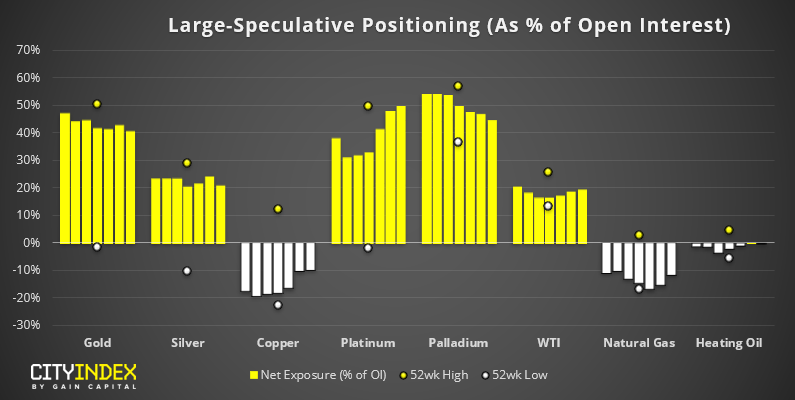

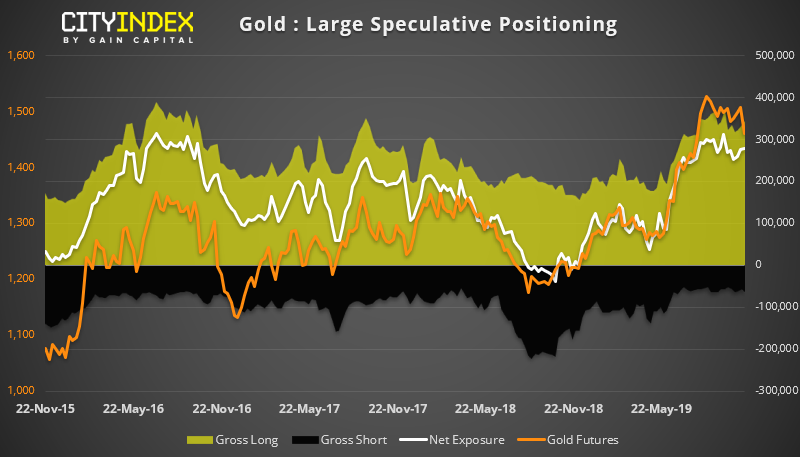

Gold: Bullish exposure nudged it way to a 6-week high. Yet we’ve seen a notable drop in gold prices since the gold report was compiled, some longs may have been squeezed along the way. Spot prices are teasing a break of 1459 and, given the bearish momentum, a breakdown appears likely. Yet the core view remains that this is still part of a much-needed correction from its highs, so the bias is bearish over a near-term horizon only. After this, we’ll look for evidence that the corrective low is in.