Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

As of Tuesday 10th December:

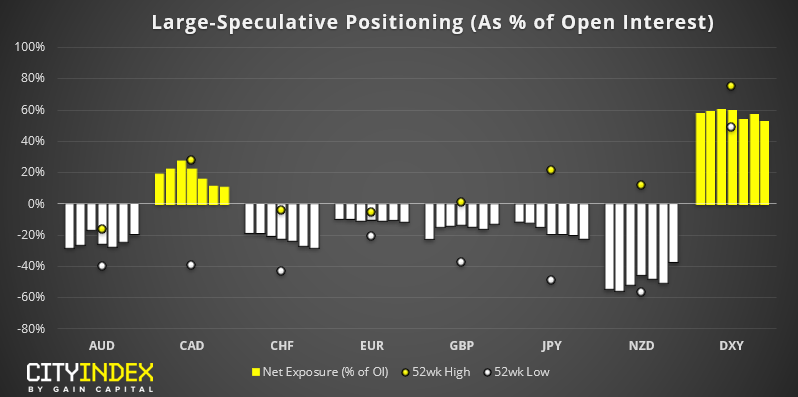

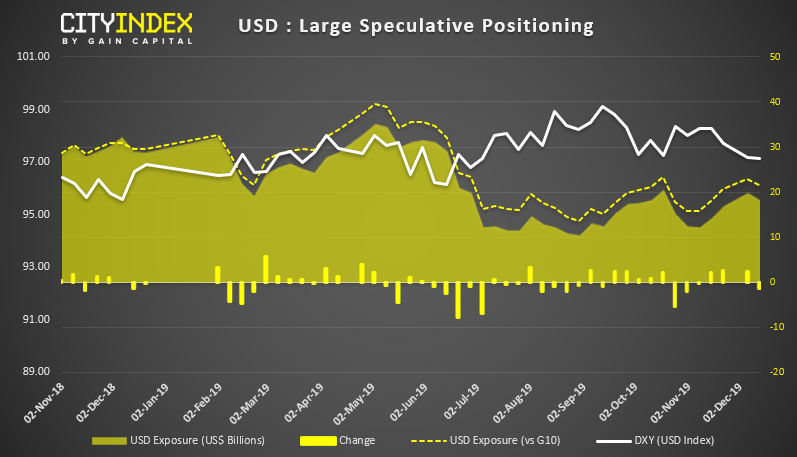

USD: Whilst still net-long, bullish exposure on the USD has remained subdued and effectively range-bound between +10 to +20 billion since July. This is neither a compelling bullish or bearish case, so perhaps we’ll continue to see DXY chop around in ranges until a more divergent theme appears next year between the US and ROW (rest of world).

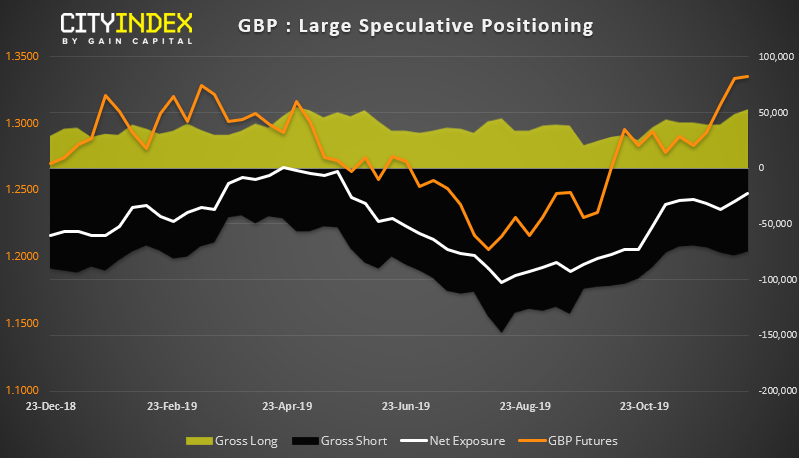

GBP: Gross longs reached their highest level since April, ahead of Friday’s UK election which saw net-short exposure at its least bearish level since May. Given the 2% rally at the exit polls, we wouldn’t be too surprised to see traders stitch to net-long in this week’s report (whilst data is released on Friday, the report is compiled on Tuesday)

As of Tuesday 10th December:

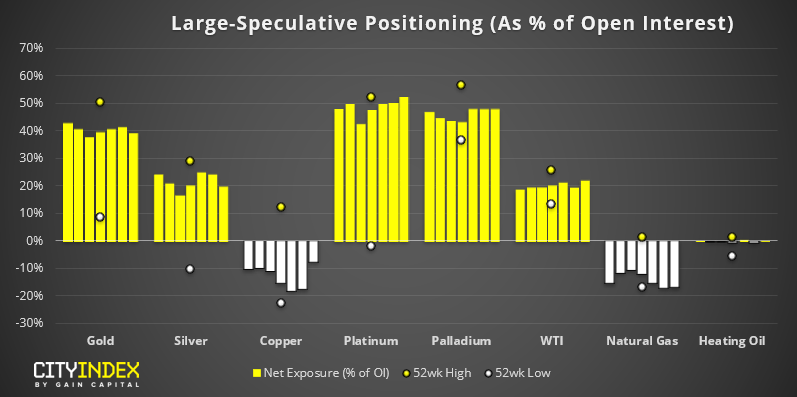

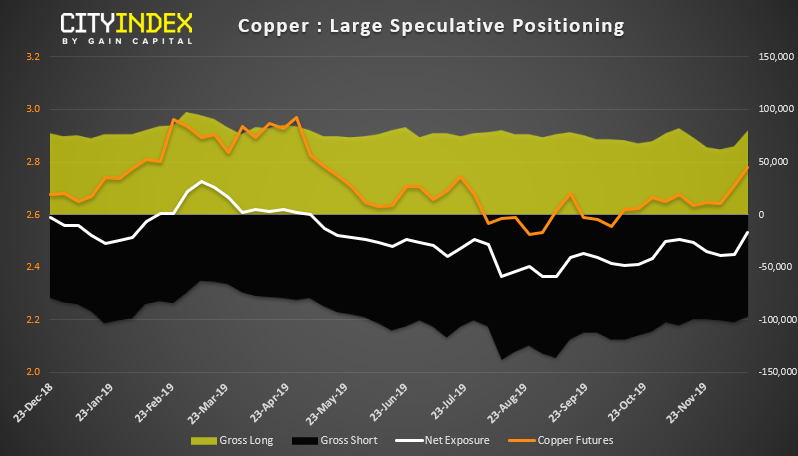

Copper: Gross shorts have been trending lower since August and, whilst early days, we saw a slight pickup with gross longs last week. Last week’s high saw copper futures trade at their highest level since May, although Friday’s bearish engulfing candle warns of near-term weakness and likely mean reversion. Sill, we’ll see if its upswing since September’s low can push higher over the coming weeks.