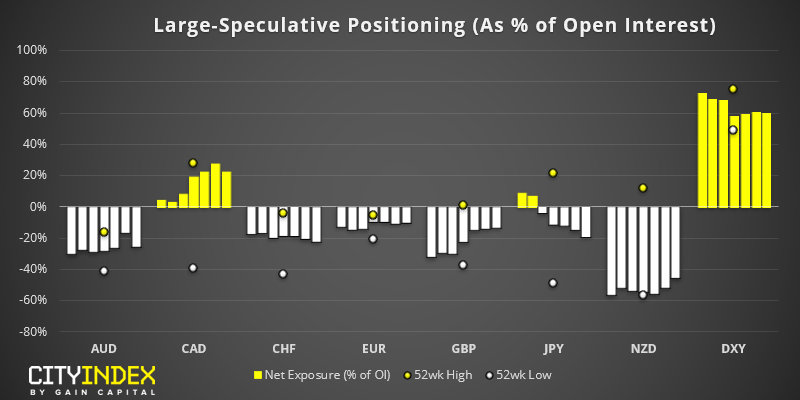

As of Tuesday 12th November:

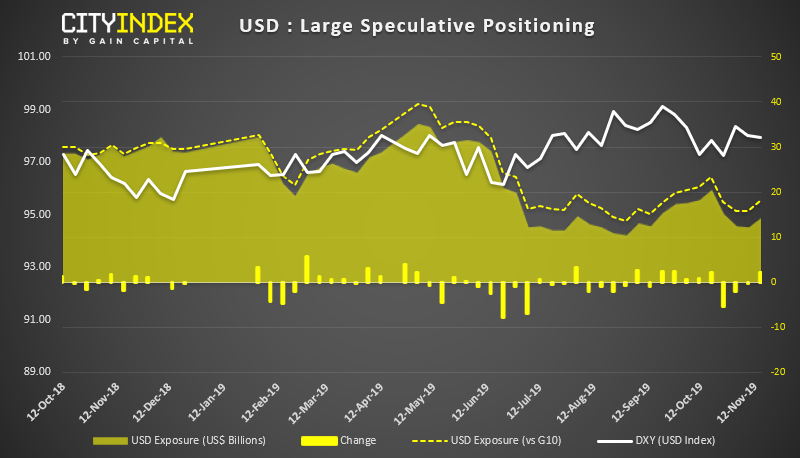

USD: Last week’s increase of net-long exposure snapped a 3-week streak of declines. However, the rebound on DXY has since stalled and now prices are retracing. Whilst there is potential for another leg higher, we’re also mindful of the fact that December tends to be a bearish month for the greenback, so any breakdown from here would send a warning that its seasonal tendency has shifted forward this year.

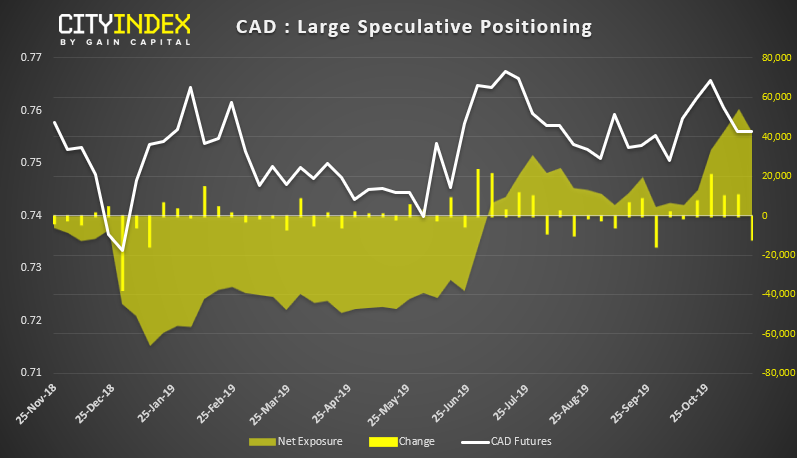

CAD: Net-long exposure on CAD shows the potential for fall further. Gross longs had reached their highest level in 12 months before net-long exposure saw its largest weekly drop in 7 weeks. With interest rates still at a relatively high level of 1.75% and signs of dovishness from BOC, weak data could easily weigh on CAD further. So keep a close eye on CPI data later this week.

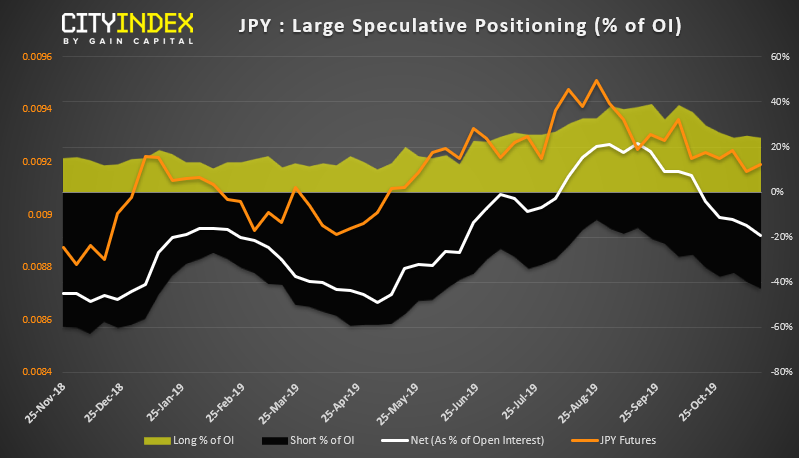

JPY: Traders are their most bearish on JPY since June 2019, which is hardly a sign of risk-off. Still, it leaves plenty of room for a reversal should sentiment turn, especially if the phase one trade deal gets bumped to next year. Other than that, there’s no signs of a sentiment extreme yet.

As of Tuesday 12th November:

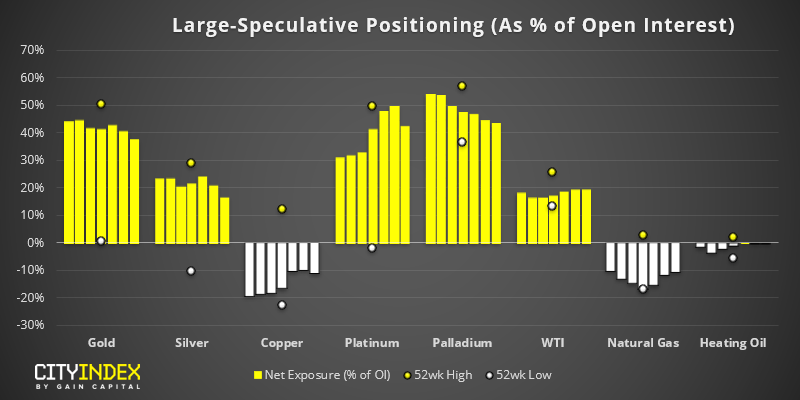

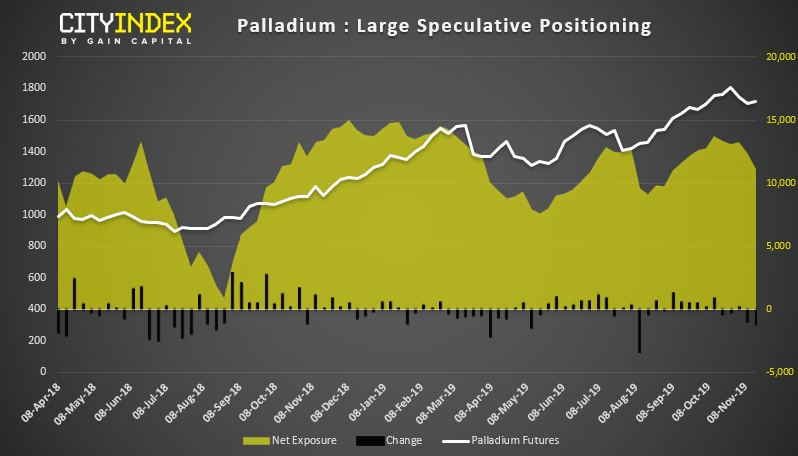

Palladium: Large speculators were shying away from Palladium ahead of its October top and their net-bullish exposure now sits at a 2-month low. Price action has lifted from its lows but provided a 2-bar reversal on Friday, so we see potential for further downside before reverting to its longer-term bull trend.