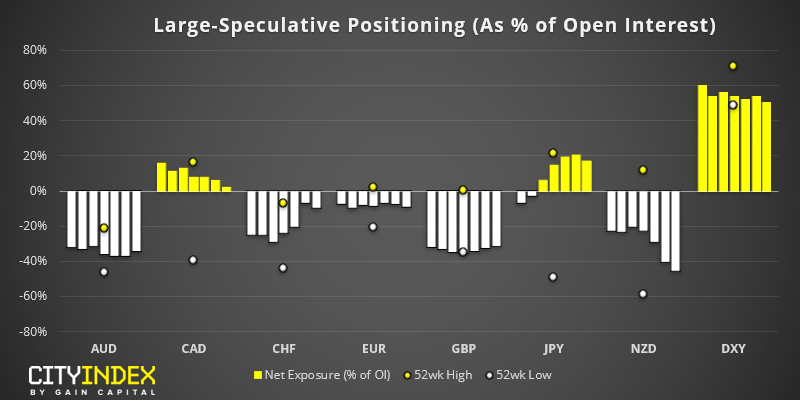

As of Tuesday 3rd September:

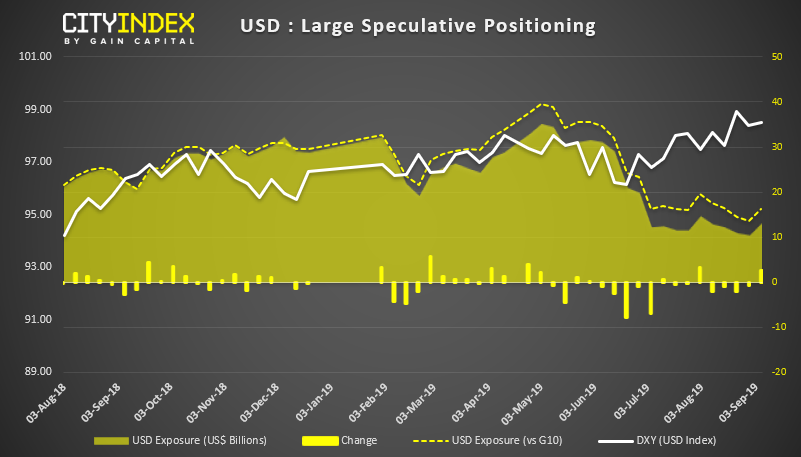

- Traders increased net-long exposure to USD by +$2.6 billion, which make them the most bullish on USD in 5 weeks at $13.1 billion (or $16.2 billion against G10 currencies)

- Traders of the US dollar index (DXY) were their most bullish in 6-months

- The euro saw the largest weekly change among FX majors, with large speculators increasing net-short exposure by -10.3k contracts

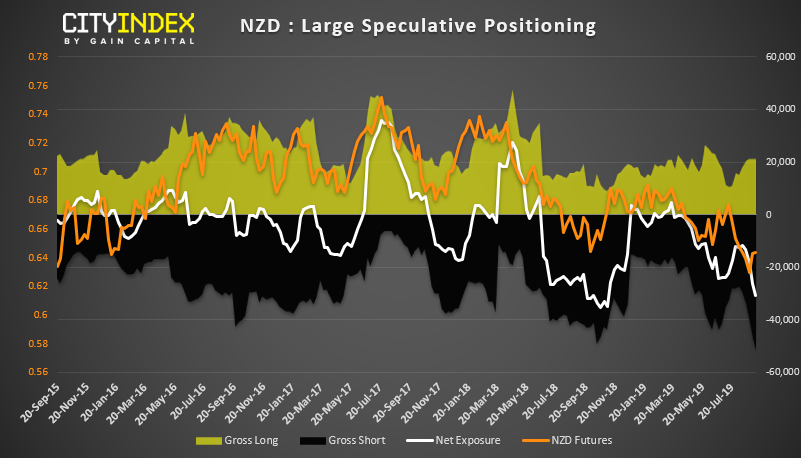

- Traders are their most bearish on NZD in 10-months

USD: We’ve been following the divergence between broader USD positioning (using IMM data) and price action on DXY (the US dollar index). Last week’s bullish increased snapped a 4-week streak of bullish reduction, and it’s possible we may have seen a low for USD bullish net-exposure.

DXY: Whilst IMM data provides a broader view of the USD, it is not a tradable product, whereas DXY is. Whilst net-long exposure hit a 6-month high, gross long exposure is at an 18-month high. However, as we’re also seeing gross-short exposure increase, we don’t suspect this to be a sentiment extreme just yet and could lay the groundwork for a sustainable bullish move. Of course, a stronger USD would create a headache for the Fed (and no doubt catch Trump’s attention).

NZD: Traders are their most bearish on the Kiwi dollar in 6 months. However, net-short positioning is approaching a historical extreme and gross-short exposure is at a record high. It’s possible we’re approaching or have reached a sentiment extreme, and worth noting that prices have rallied over 2.6% since the low on the 3rd of September to suggest short covering is already underway, in light of improved trade sentiment.

JPY: We suspect the net-long positioning on the Japanese yen may have reached a peak. Traders reduced net-long exposure by -5.9k contracts, its first weekly decline in 6 weeks, although bears also reduced exposure by -2.6k contracts to show lighter volumes among large speculators. Whilst this is not an all-out bearish case, it does show a hesitancy for bulls to push higher. Moreover, improved relations between US and China since the report as compiled makes it likely we’ve seen further longs closed and shorts initiated. We wouldn’t be too surprised to see JPY revert to net-short exposure over the coming week/s.

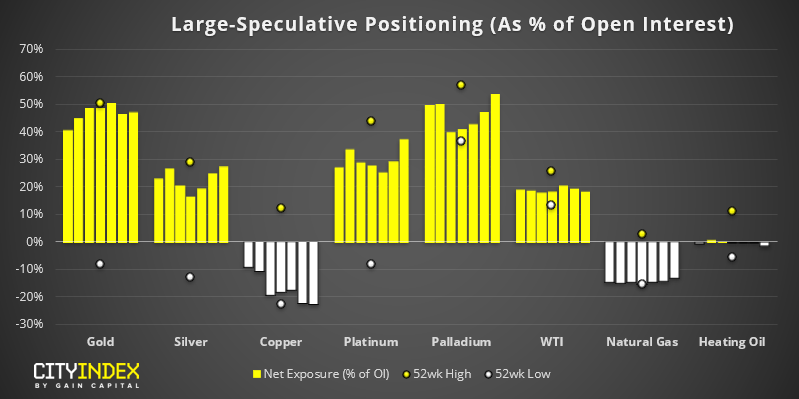

As of Tuesday 3rd September:

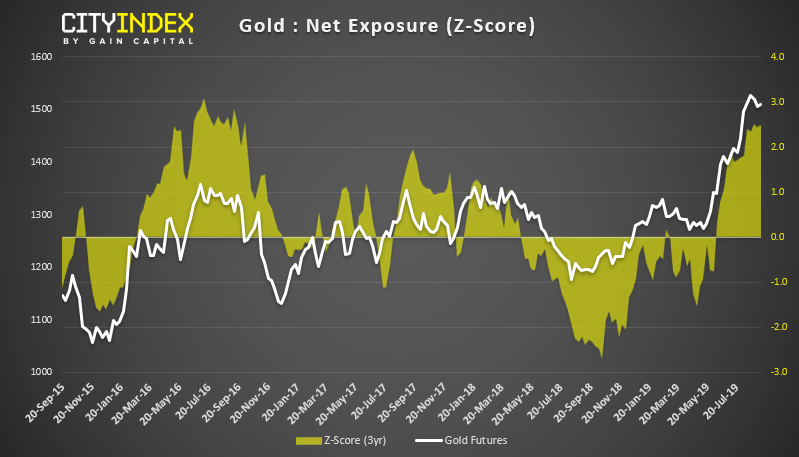

- Gold bugs pushed net-long exposure to a 3-year high

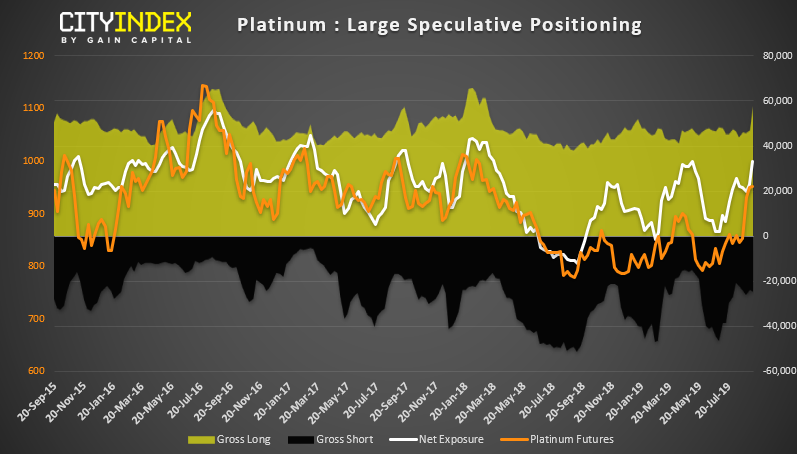

- Platinum traders are their most bullish on the metal since Feb 2018

- Net-long exposure for palladium hit a 5-week high

Gold: The scene may finally be set for gold to correct. It’s been sending warning signs for several weeks of possible over-extension, with exposure at multi-year highs and Z-scores remaining above +2 standard deviations. However, markets now rallying on reports of new US China trade-talks set for October, demand for gold has fallen to send it -3.4% lower from its highs. Even before this development, we note that the long/short ratio has fallen from to 5.6 from 6.7 just two weeks ago, and the 1-year Z-score is now back below +2 SD for the first time in 3 months.

Platinum: Gross long exposure shot up to an 18-month high last week, taking net-log exposure to its most bullish level since May. Prices are also at their highest level since March 2018, although resistance has been found at a long-term bearish trendline, which began in August 2011. Like gold, it could be due a correction but, given the bullish breakout of long exposure, we suspect Platinum could be trading at new highs again over the coming month/s.

Related Analysis: Week Ahead: Draghi’s last ECB meeting and US inflation