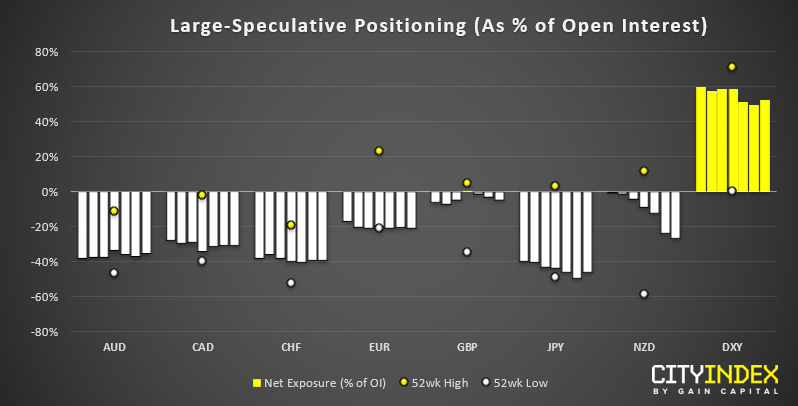

A summary of the weekly Commitment of Traders Report (COT) from CFTC to show market positioning among large speculators.

As of Tuesday, May 7th:

- Large speculators trimmed USD exposure by -$0.72 billion against G10 currencies and remain long by $38.9 billion.

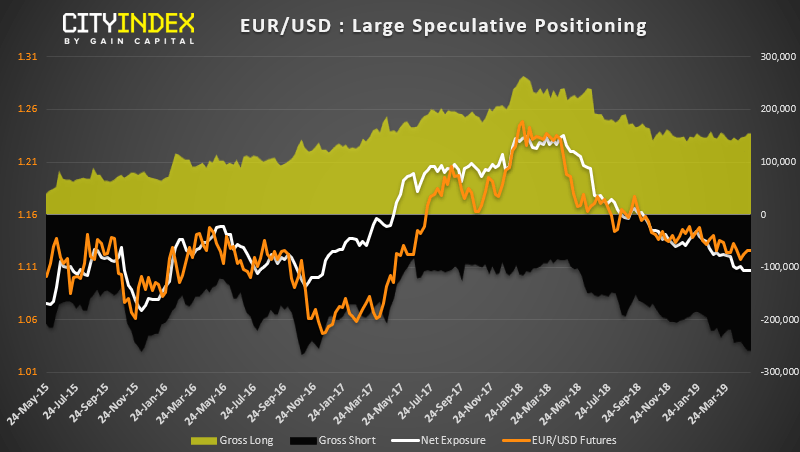

- Traders were the most bearish on Euro Futures since December 2016.

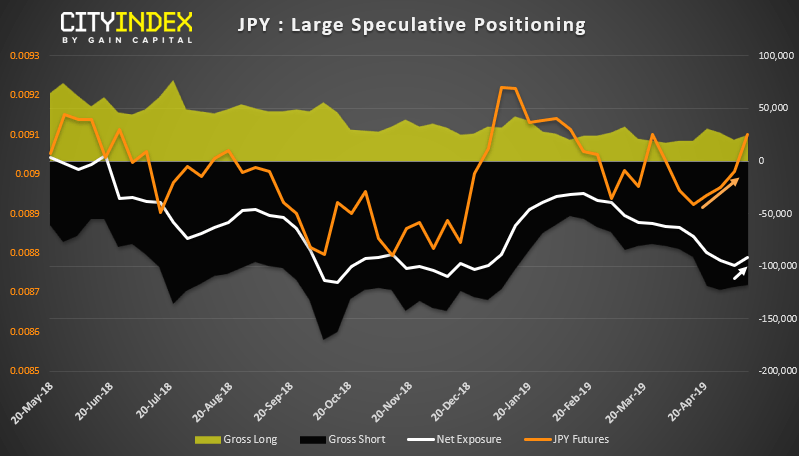

- Net-short exposure on JPY futures were trimmed by -7.8k contracts, which was the largest weekly change among FX majors.

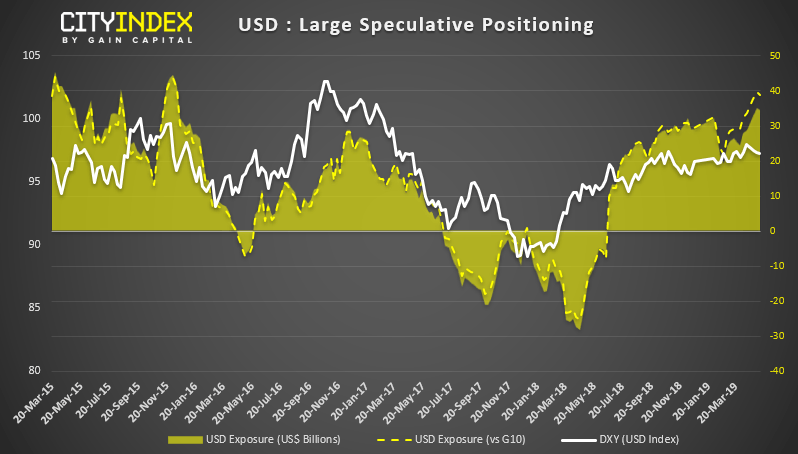

USD: Overall, large speculators have been net-long on the dollar since mid-June 2018. Although longs were reduced by -$0.72 billion last week, exposure is near its most bullish since December 2015 continue to favour the USD against G10 currencies. While the 3-year Z-score is only +1.6, we should consider the potential of a sentiment extreme as bullish positioning is approaching historically high levels.

EUR: Net short exposure nudged to the most bearish positioning since mid-December 2016. Extending its bearish exposure by a mere 561 contracts, bulls closed out 1.2k long bets and shorts adding 672 new short contracts. Still, prices have continued to trace higher since finding support at 1.1100 two weeks ago, so price action has not confirmed the increasingly bearish view. Like above, we should consider the potential for a sentiment extreme if prices fail to break lower, as the weeks progress.

JPY: As noted in last week’s report, the increasingly net-short exposure had been seen on lower volume whilst prices refused to break lower, bringing into question the true ‘bearishness’ of net-exposure. With trade talks dominating sentiment last week, we saw increased demand for the yen, where 2.6k shorts were closed and +7.9k longs added. By Tuesday the net-long exposure had moved to its least bearish level in 4-week and shows sign of a potential trough.

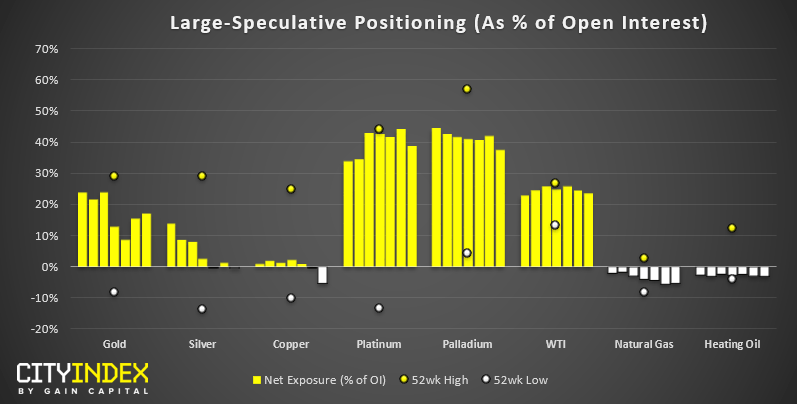

As of Tuesday, May 7th:

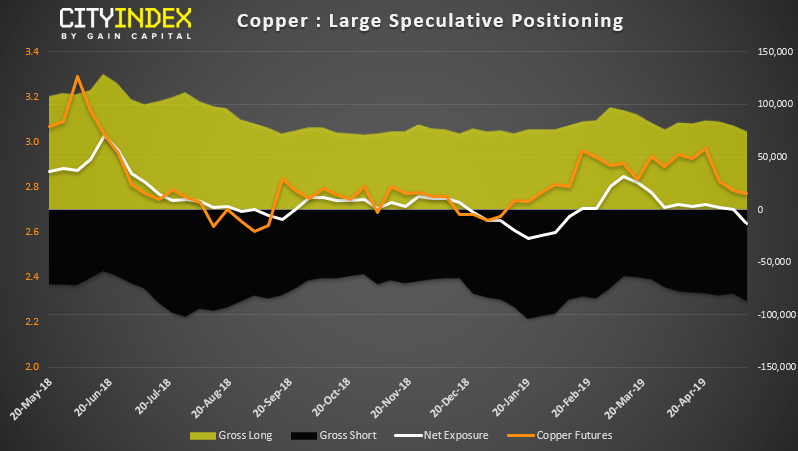

- Large speculators are their most bearish on Copper since early February.

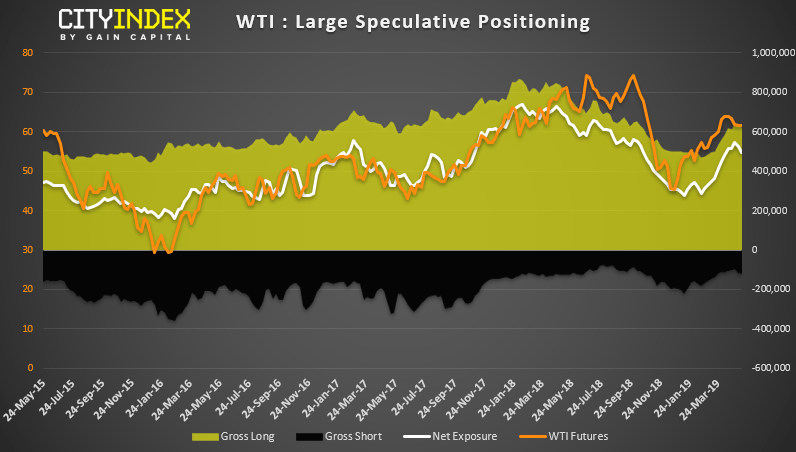

- WTI traders trimmed net-long exposure by -29.8k contracts.

- Gold was the only metal we track to see an increase of net-long exposure.

- Silver flipped to net-short.

WTI: Net-long exposure fell for a second consecutive week by -29.8k contracts (about 4% of total volume) which was fuelled by -21.5k longs closed and +8.3k shorts added. WTI continues to coil above $60 and we remain bullish above $58.20, although we’ll continue to monitor this closely as a break lower would catch a lot of bulls off-guard and run the risk of this being a much deeper correction. For now, the near-term bias remains for a break higher from compression whilst $60 holds as support.

Copper: Copper traders pushed next-short exposure to its most bearish level since early February. We noted back at the end of March that Copper’s failed break higher could see further downside, although price action has been far from clean. Still, we remain bearish whilst it remains beneath the $2.90 with a view for it to try and re-test the $2.50-60 region.