Investing.com’s stocks of the week

COT analysis slightly delayed this week due to the Thanksgiving holiday, but some extremely interesting positioning into December. That said be wary of the key risk events this week the switching in positions could merely be a frontrunner to the risk events and reducing positions/taking profit. End of this week could set the tone for December.

EUR/USD first up with Non Commercial now net short in this pair showing a distinct switch from Net Long positioning. That said they are only just net short but this would suggest a clear signal to exit long positions and look for potential upcoming short opportunities. EUR/USD 1" border="0" height="767" width="1024" />

EUR/USD 1" border="0" height="767" width="1024" />

GBP/USD shows a slightly different picture with Non Commercials still, but only just Net Long, with the index holding above the key 70 mark means long positions in this pair remain in tact. GBP/USD Weekly" border="0" height="959" width="1280" />

GBP/USD Weekly" border="0" height="959" width="1280" />

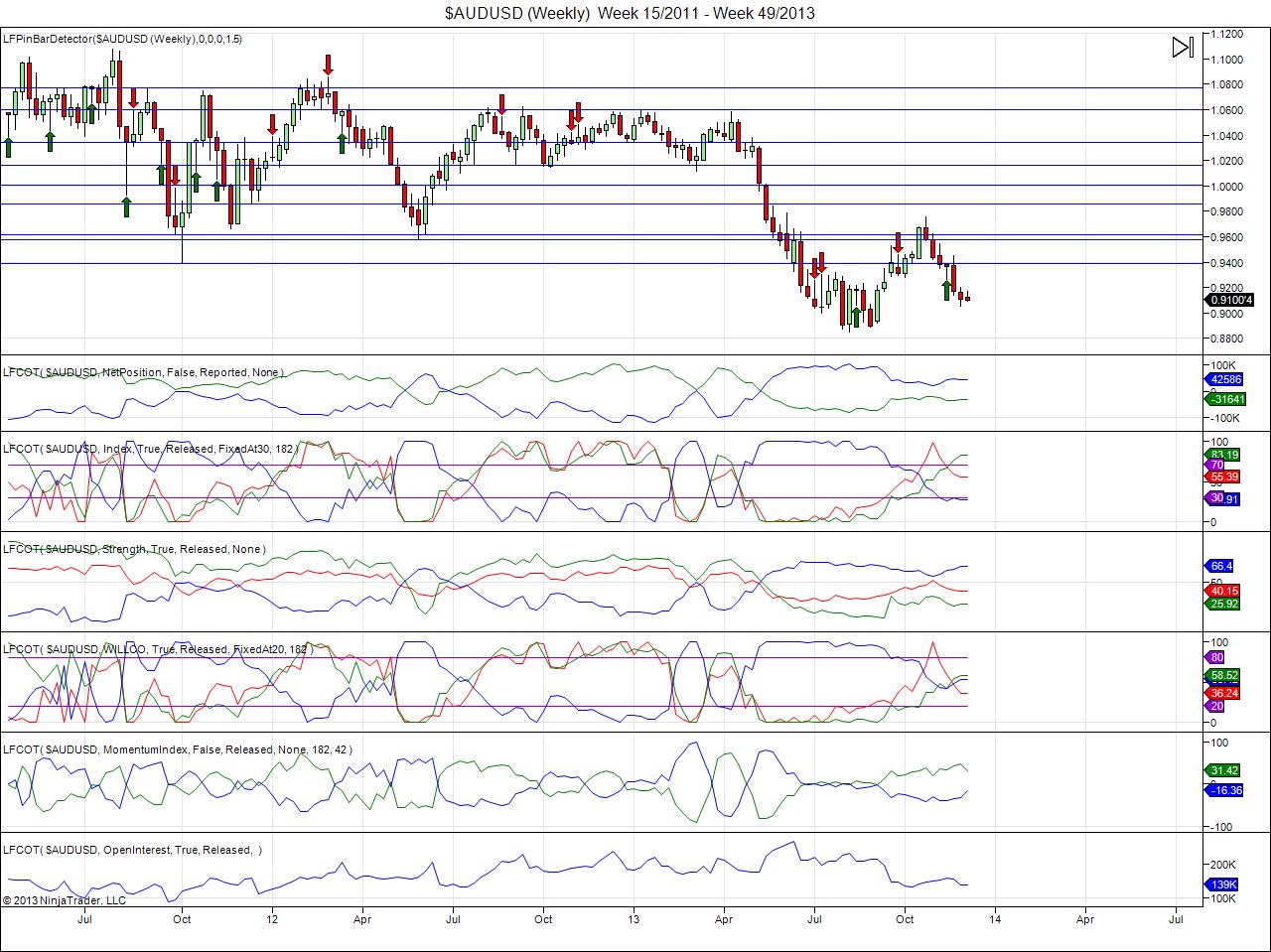

Non Commercial momentum in AUD/USD also remains to the upside although has taken a slight slow down recently on the recent pull back. Non Commercials still remain short but with the index now above 70 we could be looking for a minor bounce in this pair. AUD/USD Weekly" border="0" height="959" width="1280" />

AUD/USD Weekly" border="0" height="959" width="1280" />

Non Commercials continue to hold longs in USD/JPY and the recent move above 70 in the index pointed out the other week has continued to pay off to the upside. We continue to hold longs this pair for the time being, although note the strong resistance above. USD/JPY Weekly" border="0" height="959" width="1280" />

USD/JPY Weekly" border="0" height="959" width="1280" />

Like USD/JPY, USD/CAD non Commercials continue to like potential upside in the pair and the index has recently crept above the 70 mark, with momentum to the upside as well. We therefore prefer longs given the recent brake and would use any pullbacks to enter into our positions. USD/CAD Weekly" border="0" height="959" width="1280" />

USD/CAD Weekly" border="0" height="959" width="1280" />