Gold: Geopolitical Concerns Fuel Safe Haven Demand

Gold prices rallied this week as the market saw a strong influx in safe haven demand due to rising geopolitical uncertainty. The escalation in tensions between the US and China due to Trump’s protectionist import tariffs and Beijing’s subsequent reciprocation has been a key focal point for markets over the last couple of weeks. Equity prices and commodity prices were rocked as Beijing announced reactionary measures with import tariffs if its own. America immediately hit back with Trump releasing a statement saying that he had ordered the US Trade Secretary to find a further $100 billion worth of tariffs to impose.

Following these developments, the market was then hit by a second geopolitical grenade as President Trump took to Twitter to warn Russia that it would be taking military action against Syria following President Assad’s use of chemical weapons on his people. The President’s tweet was a direct response to Russia’s warning that any US missiles fired over the enclave of Douna (held by rebels) would be shot down.

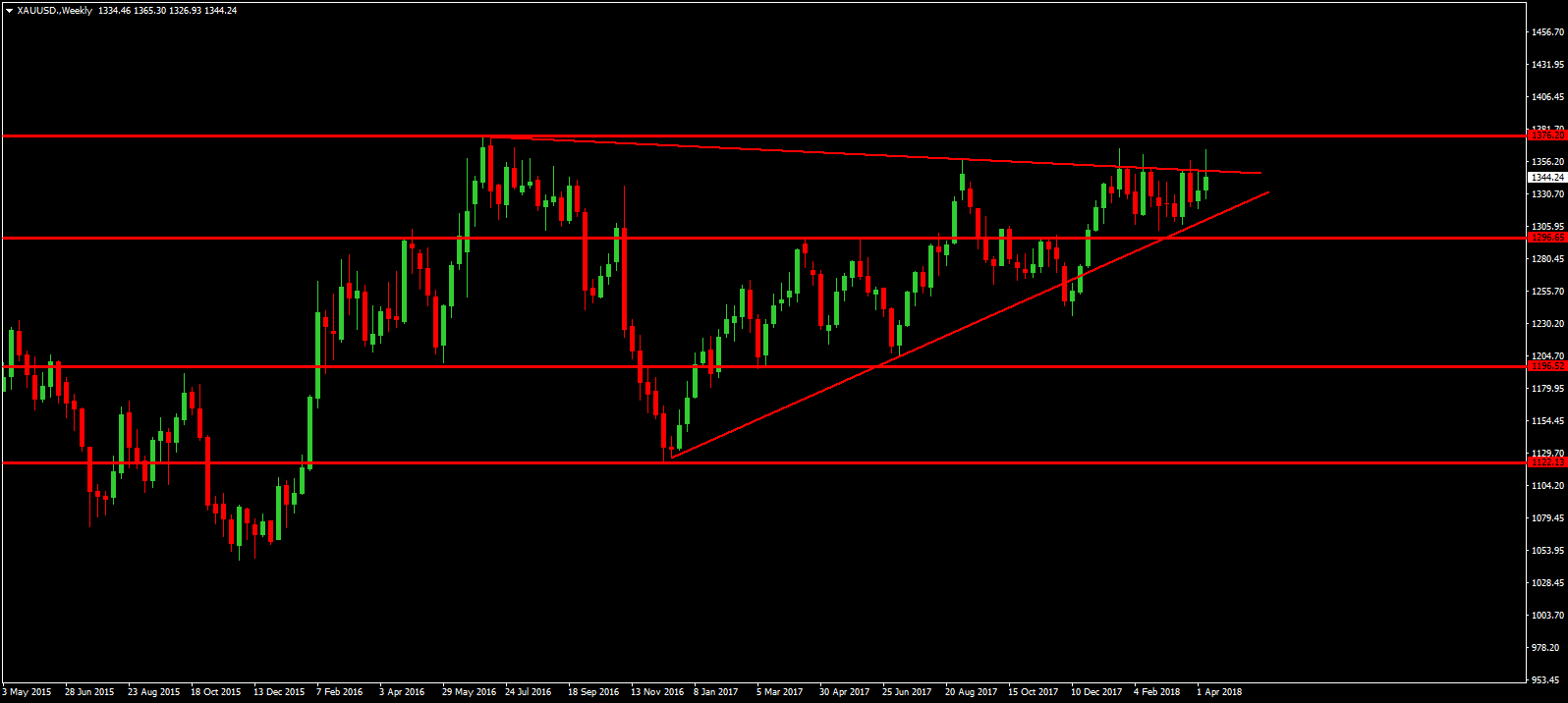

Gold prices rallied this week but were once again capped by the resistance trend line of the long term contracting triangle pattern which has framed price action over the last two years. Momentum has thoroughly dried up over recent weeks as the market struggles to build a directional view amidst conflicting forces.

Silver: Silver Prices Remain Deadlocked

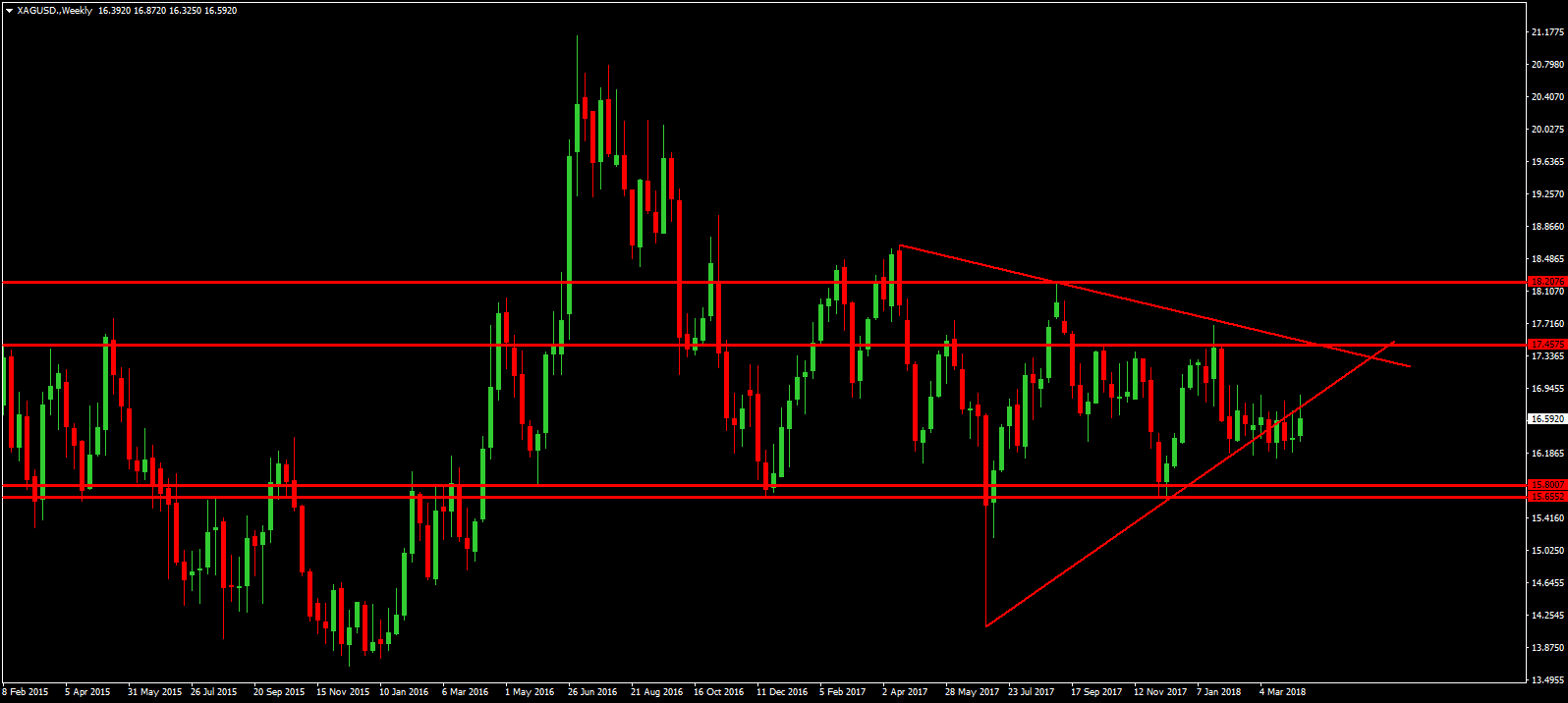

Silver prices were similarly stronger this week, tracking the move in Gold. Despite the rally, silver prices remain firmly constrained within the range that has endured over the last two and a half months as the market is yet to find a catalyst for a strong directional move.

Silver prices remain deadlocked just above key structural support at the 15.65 – 15.80 level which was major level over the last couple of years. While above this level the market will remain in range mode.

Copper: Copper Positioning Down Sharply

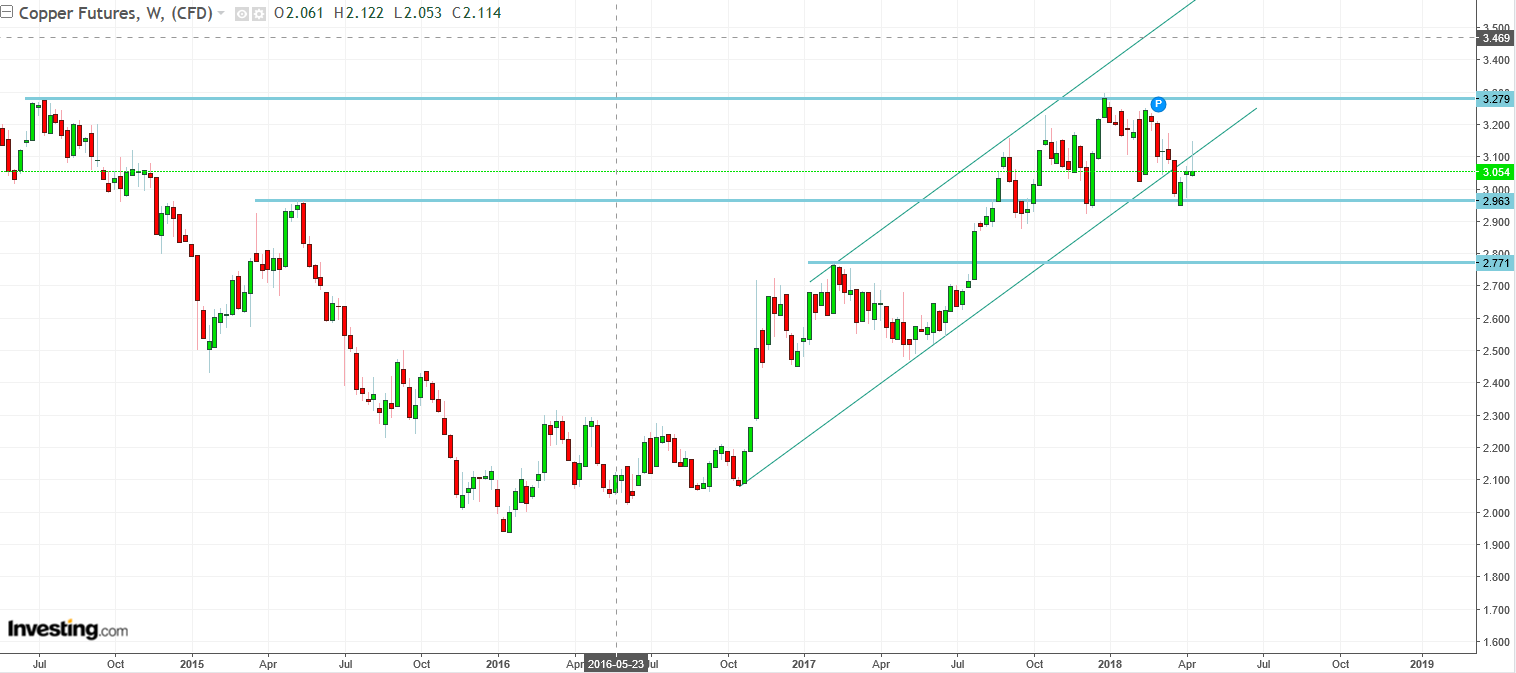

Copper prices saw a particularly volatile session this week, falling back quickly after rally initially on the week. The upside move in copper which was fuelled initially by Trump’s election campaign has seen a strong loss in momentum over recent months. Indeed, institutional positioning data shows that the record copper long position, which had built to a peak of nearly 125,000 contracts in August last year, has now fallen to just over 3,000 contracts. The prospect of an intensifying trade war between the US and China has spooked markets while further threats to risk sentiment from the US/Russia situation are having a similar dampening effect on commodity prices.

After retesting the broken bullish channel support, copper prices have since stalled and turned lower again. While above the 2.963 level (broken 2015 high) focus remains on a rotation back towards the 2018 high. A break of the 2.963 level opens up a run down to deeper support at the 2.771 level.

Iron: Chinese Steel Market Losses Weigh on Iron

Iron ore prices suffered this week also, falling back due to losses in Chinese steel prices. With iron one of the main ingredients in the steel making process, any weakness in steel prices tends to negatively impact iron ore prices as demand lessens. The losses in steel prices are mainly linked to concerns over the economic impact of the China/US trade war.

Iron ore is still battling it out around the long term bullish trend line which was pierced over recent weeks. If price can hold back above that trend line, focus will be on a further rotations higher. If price makes its way back below the trend lien focus will be on a run down to the next key structural level around $59.