VIX made an 85% retracement of its initial rally to 21.48. The resistance levels are between 13.94 and 14.44. Short-term VIX dropped today to its lowest on record, suggesting that market complacency is at record highs.

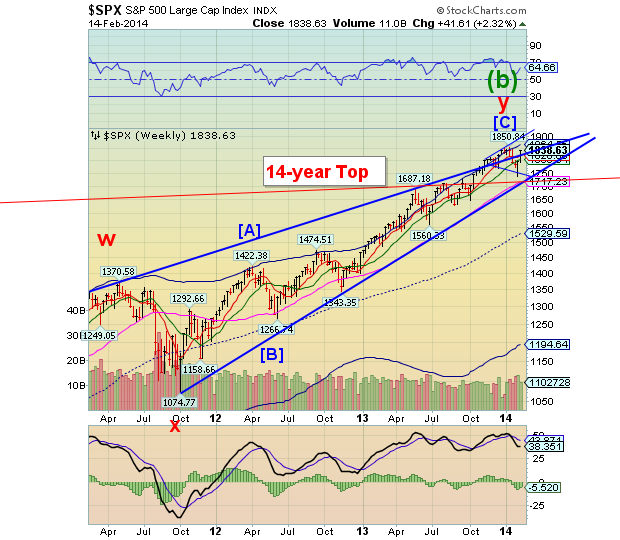

SPX closes above the Wedge formation.

After piercing the lower trendline of its Orthodox Broadening Top (Megaphone formation) at 1748.00,SPX continued its reversal above the Wedge trendline. This completes phase 7 of that pattern. The Phase 8 may be a potential crash, since this is a major reversal pattern. The Bearish Wedge implies a probable reversal to its origin. A new record high will not negate the effects of a Bearish Wedge. It only postpones it. Bearish technicians are now bullish.

(ZeroHedge) "Our bearish view on the S&P 500 is wrong," remarks BofAML'sMacneil Curry, as yesterday's close above 1,823 points to the larger uptrend resuming. However, despite the equity strength, Curry says "stay bullish Treasuries" as price action points to further gains.

NDX makes a new 13-year high.

NDX rallied to its Broadening Wedge top (red line). This type of rally is a bull trap, keeping investors reassured that all is well. This weekend is a key reversal time for all the indices, according to the Cycles Model.

(ZeroHedge) Nasdaq is now up 1.7% on the year and broke to new highs not seen since Dec 2000. There was a clear effort to get the more critical S&P 500 to unch in 2014 but it failed - despite slamming VIX to 13.5% (and STVIX to record lows). High-beta Nasdaq and Russell outperformed on the week and Trannies lagged.

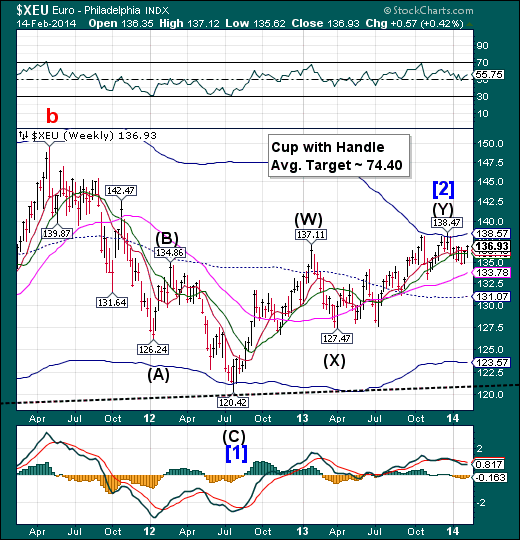

The Euro may have a head fake.

The Euro closed above weekly Short-term and Intermediate-termsupport. This may not be indicative of a new bull run in the Euro. The inability to make anew high indicated this may be a bearish head fake.

(NYTimes) The euro zone economy grew slightly faster than expected in the last three months of 2013, an official report showed on Friday, bringing welcome news for the global economy amid signs of slowing in the United States and China.

Although growth in the 18-nation currency union is still weak, at a 1.1 percent annualized rate, it was the euro zone’s third straight quarter in positive territory, indicating that the bloc is well beyond the year-and-a-half recession that ended in mid-2013.

The broader 28-member European Union also grew, though weakly, for the third consecutive quarter. The Union, with a market of 500 million consumers and an economy worth about 11.7 trillion euros, or $16 trillion, is one of the pillars of the global economy, and the extended weakness there has been a major source of concern for officials in the United States.

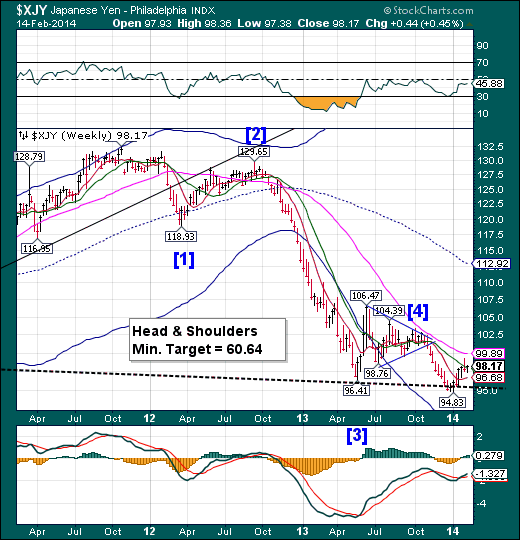

The Yen challenging Intermediate-term resistance.

The Yen slipped beneath weekly Intermediate-term resistance at 97.97, but closed above it on /Friday. Further decline is anticipated by the Cycles Model. The next break of the Head & Shoulders neckline may bring the Yen beneath its 2008 lows.

(Bloomberg) Japan’s Topix index fell, erasing its weekly advance and capping a sixth week of declines, as the yen reversed losses and consumer lenders tumbled.

All but one of the 33 Topix (TPX) industry groups retreated. Toyota Motor Corp., the world’s biggest carmaker, decreased 1.3 percent after rising as much as 1.1 percent. Aiful Corp. plunged 10 percent, pacing declines among consumer lenders, after saying it would not provide a full-year forecast as the outlook is “uncertain.” Kirin Holdings Co., Japan’s biggest beverage maker, tumbled 9.2 percent to lead declines on the Nikkei 225 Stock Average after its net-income forecast missed estimates.

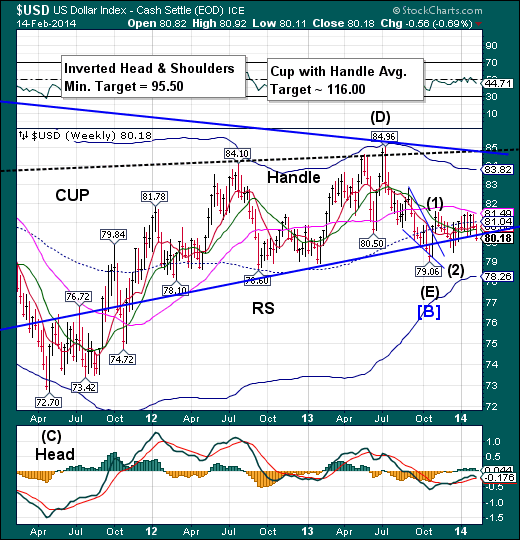

U.S. Dollar fell beneath its Triangle trendline again.

The dollar declined back through its Triangle trendline at 80.40 again. The next level to watch is the December low at 79.50.A reversal above that level reinstates the bullish view on the Dollar.The Cycles Model suggests that it has about a week to confirm the decline or reverse higher.

(Bloomberg) The dollar declined to its weakest level in almost two months after factory production in the U.S. unexpectedly declined in January by the most since May 2009, adding to evidence severe winter weather weighed on the economy.

“With this week’s U.S. data generally subdued and euro-zone data modestly firm in tone, the greenback is ending the week on a defensive note,” Nick Bennenbroek, the head of currency strategy at Wells Fargo Securities LLC in New York, wrote in a client note. “We expect the U.S. dollar’s softer bias could continue into next week.”

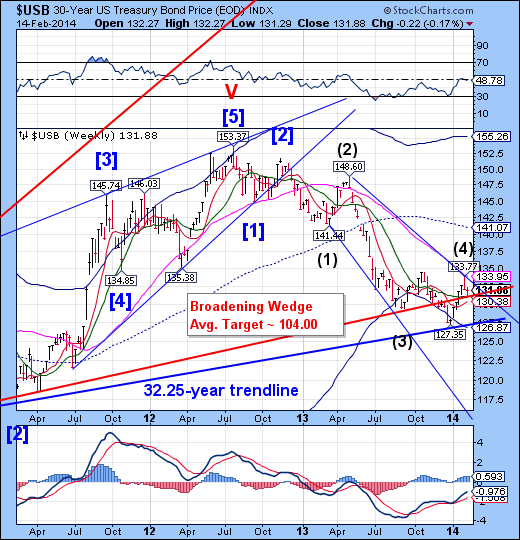

Treasuries bounce off the Broadening Wedge.

Treasuries bounced off its Broadening Wedge trendline and weekly Intermediate-term support at 130.93. It is probable that declining overheadresistance may be tested again this coming week. Unfortunately, the Cycles Model suggests a renewed decline into the end of February or early March.

(Bloomberg)Treasuries rose for the first time in three days as U.S. retail sales unexpectedly fell in January by the most since June 2012 and initial claims for jobless benefits rose more than forecast last week.

U.S. government securities extended gains as the Treasury sold $16 billion of 30-year bonds at a yield of 3.690 percent, the lowest since August. Current 30-year yields dropped from almost the highest this month. Ten-year note yields after inflation, called real yields, were at almost a three-week high. The drop in retail sales amid inclement weather came as the Federal Reserve plans to keep reducing bond purchases.

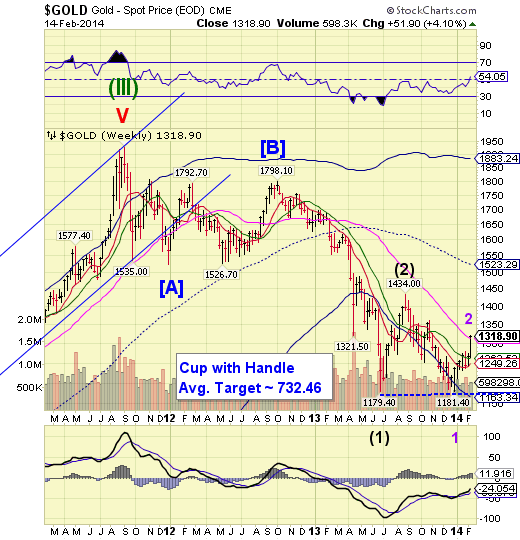

Gold rockets to Long-term resistance.

Gold rose over 4% to challenge its Long-Term resistance at 1313.36 and closed above it.Unfortunately, the rally may be over, or nearly so, after making a 54.5% retracement of the prior decline.The Cycles Model calls for a month-long decline that may break through the Lip of a Cup with Handle formation. The potential consequences appear to be severe. See the article below to gauge the sentiment of the analysts.

(Bloomberg) Gold prices are poised to extend their 2014 rebound and reach $1,400 an ounce, the highest since September, according to technical analysis from Citi Futures and RBC Wealth Management.

Prices yesterday settled above the 100-day moving average for a second straight day for the first time since October. The metal has also closed above its 50-day measure in every session since Jan. 23. The pattern signals prices will rally 8.5 percent by the end of March, Chicago-based Sterling Smith of Citi Futures said.

Crude falls short of a 50% retracement.

Crude peaked on Wednesday, an important pivot day, and eased down into the close. It had only managed to complete a 47% retracement of its decline from 112.24. There is a Head & Shoulders formation at the base of this rally, which, if pierced, may lead to a much deeper decline.

(CBSMoneywatch) Oil prices slipped closer to $100 a barrel Friday as fresh U.S. economic data and higher-than-expected crude supplies pointed to weaker demand.

By early afternoon in Europe, benchmark U.S. crude for March delivery was down 16 cents to $100.19 a barrel in electronic trading on the New York Mercantile Exchange. On Thursday, the Nymex contract eased 2 cents to close at $100.35.

A report showed that cold weather caused U.S. retail sales to drop in January for a second straight month as Americans spent less on autos and clothing and at restaurants during a brutally cold month. Weekly jobless claims were also higher than expected.

China stockschallenge resistance.

The bounce from the January 20 low may be nearing completion if not already so. The Shanghai Index rallied up to weekly Long-term resistance at 2828.33, the target for this retracement. Once accomplished, the secular decline resumes with the next significant low in mid-March. There is no support beneath its Cycle Bottom at 1951.53.

(ZeroHedge) The bailing out of the much-watched 'Credit equals Gold #1' wealth management product and safe liquidity-strewn (CNY375 billion from the PBOC) survival of the lunar new year liquidity crunch has manybelieving the worst is over. Though we discussed this fallacy in great depth here, the following chart of the total collapse in the largest Chinese coal producers says this is far from over. Trading at or below book values, investors are clearly signaling concerns about the quality of assets summed up perfectly by one local analyst - China's coal industry (whose loans back a massive amount of the wealth management products) is "dead."

The India Nifty bounces at Long-term support.

The CNX Nifty bounced from its Long-term support at 5983.06, closing above it. CNX Nifty may attempt another probe to Short-term resistance at 6186.85, but the rally may not last. The potential loss of Long-term support could be deadly for India stocks. The Cycles Model calls for a decline through mid-May.Could there be some economic disappointments ahead?

(ZeroHedge) A week ago, the Dell dude warned that it's going to be a layoff "bloodbath" as the recently LBO-ed firm began firing 15,000. Now it's IBM's turn.

According to WRAL Tech Wire, the company which has underperformed Wall Street's expectations for many quarters, has begun "cost-rationalizing" terminations in India - the country that hosts some 100,000 of IBM's employees and where IBM reportedly employs the greatest number of workers. The unit targeted is the Systems Technology Group which is the troubled hardware group selling its low-end x86 server business to Lenovo for $2.3 billion and where Big Blue's executives have launched "Resource Action", also known as "rebalancing" but best known as mass, across the board terminations where by some estimates up to 13,000 of IBM's 434,000 workers are set to be let go.

The Banking Index breaks, then retraces to its trendline.

BKX attempted a challenge of weekly Short-term resistance at 68.93, but failed to close above it. The uptrend line is broken and, more importantly, stands as a resistance to any further rally.The Cycles Model suggests a new low may be seen in the next two weeks. Might there be a flash crash?

(ZeroHedge) We recently cited the work of Sean Darby, equity strategist at Jefferies, regarding the exposure of Hong Kong banks to the Mainland (see: “How Dangerous is China's Credit Bubble for the World” for details). Although Hong Kong is technically part of China, it is a foreign country in terms of its economic system and currency, and should therefore be regarded as a foreign creditor. In fact, the incentives that mainly influence the business decisions of Hong Kong's banks include the US Federal Reserve's monetary policy as a very important factor, due to the fact that the Hong Kong dollar is pegged to the US dollar via a currency board.

Mr. Darby has in the meantime continued to dig into topic of foreign bank exposure to the Mainland, and has recently released his latest findings. Here is a Bloomberg chart that shows how these claims have grown since 2005:

(ZeroHedge) Chinese capital markets are quietly turmoiling as debt issues are delayed and demand for "Trust" products - the shadow-banking-system's wealth management 'investments' - is tumbling. As Nikkei reports, since January, 9 companies have postponed or canceled issuance plans (around $1 billion) and is most pronounced in privately-owned companies (who lack an implicit government guarantee). This, of course, is exactly what the PBOC wanted (to instill some fear into these high-yield investors - demand - and thus slow the supply of credit to the riskiest over-capacity companies) but as non-performing loans in China surge to post-

crisis highs, fear remains prescient that they will be unable to "contain" the problem once real defaults begin (as opposed to 'delays of payment' that we have seen so far).

(ZeroHedge) Those of our readers focused on the state of the housing market will undoubtedly remember this chart we compiled using the data from the largest mortgage

originator in the US, Wells Fargo. In case there is some confusion, as a result of rising interet rates (meaning the Fed is stuck in its attempts to push rates higher), the inability of the US consumer to purchase houses at artificially investor-inflated levels (meaning housing is now merely a hot potato flipfest between institutional investors A and B), and the end of the fourth dead-cat bounce in housing (meaning, well, self-explanatory), the bank's primary business line - offering mortgages - is cratering.

(RollingStone) Call it the loophole that destroyed the world. It's 1999, the tail end of the Clinton years. While the rest of America obsesses over Monica Lewinsky, Columbine and Mark McGwire's biceps, Congress is feverishly crafting what could yet prove to be one of the most transformative laws in the history of our economy – a law that would make possible a broader concentration of financial an