Equities

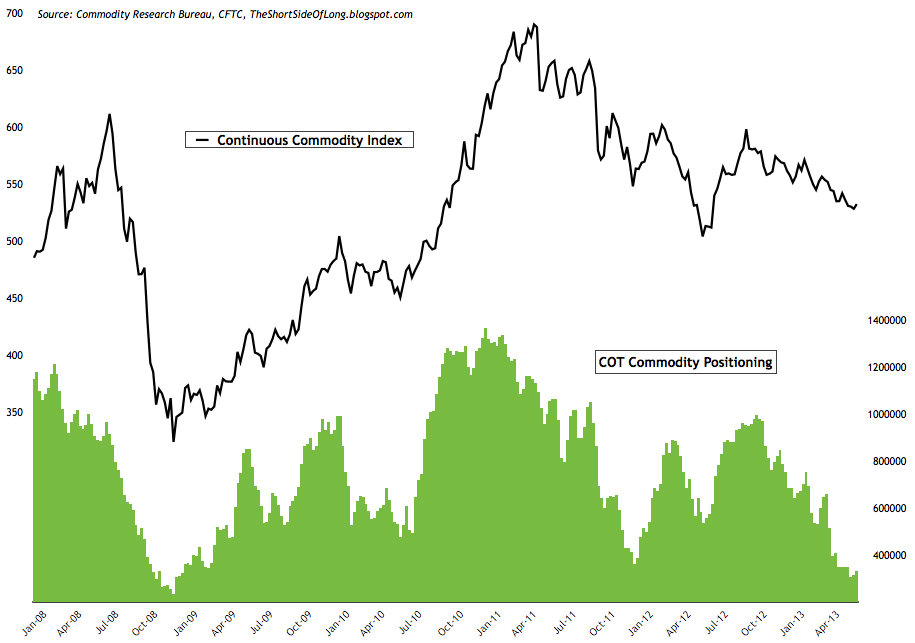

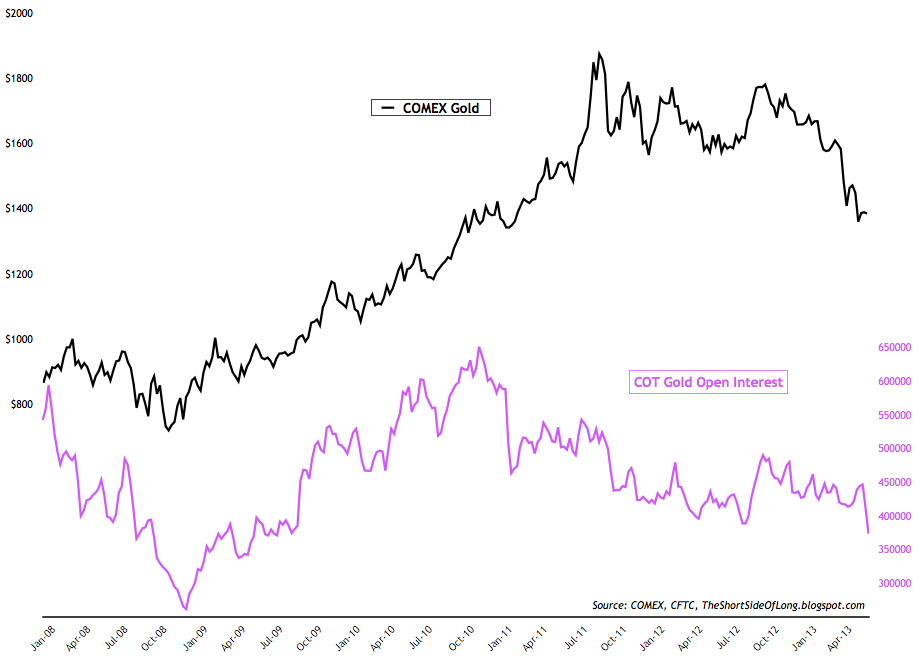

Chart 4: Hedge funds still remain extremely negative on commodities

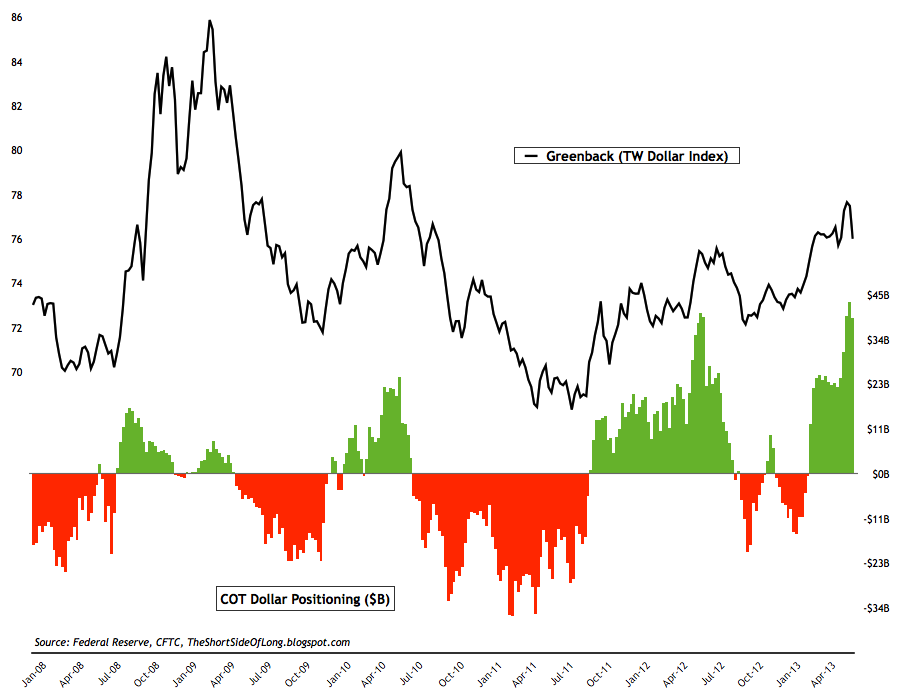

Chart 5: Hedge funds reduced their greenback positioning this week

- With market correction in progress, sentiment conditions are changing. This weeks AAII survey readings came in at 30% bulls and 39% bears. Bullish readings fell by more than 6% while bearish readings increased by more than 9%. The bull ratio (4 week average) currently stands at 43%, neither a "sell" nor a "buy signal". For referencing, recent chart of the AAII bull ratio chart can be seen by clicking here.

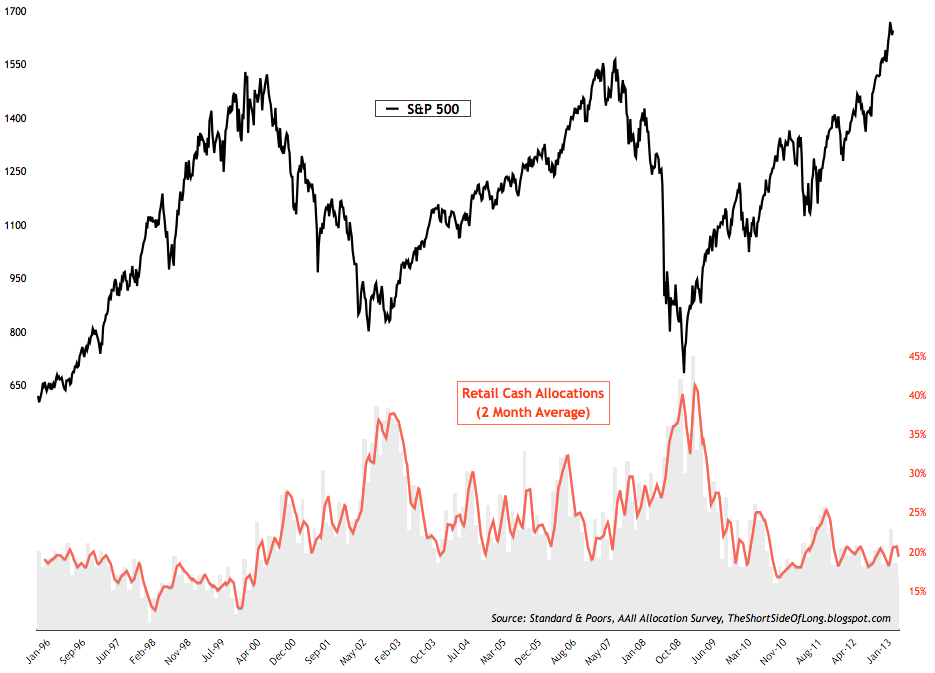

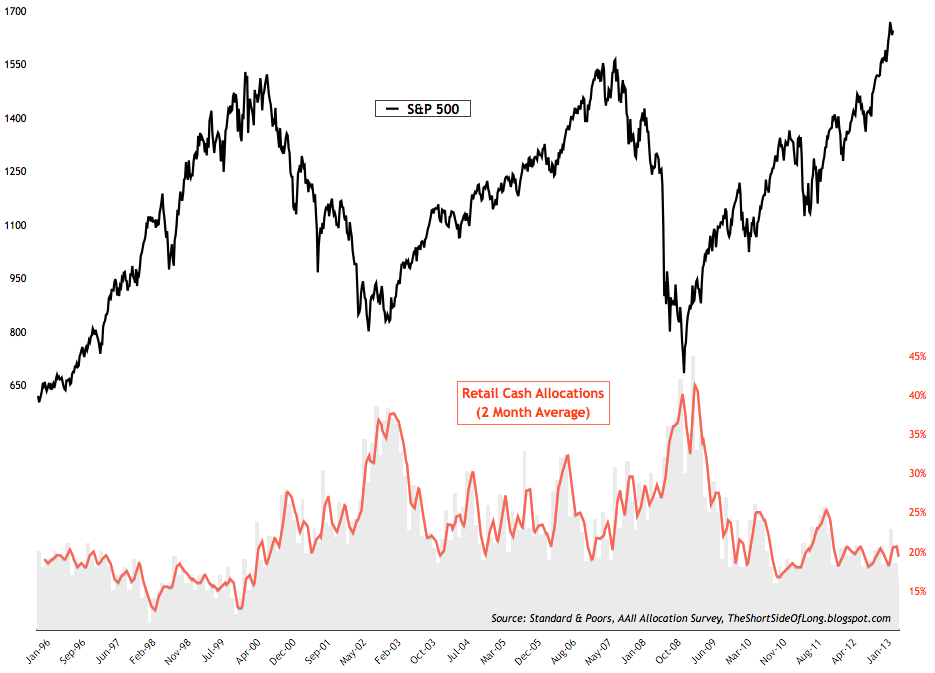

- As previously mentioned, I prefer to follow the monthly AAII asset class allocation. In the recent monthly survey, retail investors increased their equity exposure towards 65.2% of the portfolio, which is the highest for the investment cycle since the March 09 bottom. At the same time, investors decreased their cash levels to 16.7%, one of the lowest levels in over two years. I have previous wrote about the term consistently used by experts quoting that there is "plenty of cash on the sidelines", however the survey shows that cash levels are some of the lowest in over a decade and half. This is not a good time to be a buyer of equities, instead this is a good time to be holding a large amount of cash!

- Investor Intelligence survey levels came in at 46% bulls and 21% bears. Bullish readings fell by more than 6%, while bearish readings increased by a slight 1%. After giving a "sell signal" for quite a few weeks, the II bull ratio has recent fallen below the extreme territory as S&P 500 started correcting. For referencing, recent chart of the II bull ratio chart can be seen by clicking clicking here.

- NAAIM survey levels came in at 52% net long exposure, while the intensity came in at 75%. This is a first time in months that the net long exposure has fallen below extremely bullish readings. It definitely looks like the recent drop in price is changing the market conditions and fund manager exposure. For referencing, recent NAAIM sentiment chart can be seen by clicking here.

- Other sentiment surveys still remain in the "sell signal" territory. Consensus Inc survey & Market Vane survey remain at or near extremely elevated level associated with previous market tops. The same can be said for the Hulbert Newsletter Stock Sentiment surveys, which remain very close to the frothy levels seen few weeks ago. For referencing, recent Consensus Inc survey chart can be seen by clicking here.

- This weeks ICI fund flows report showed "equity funds had estimated outflows of $1.00 billion for the week, compared to estimated inflows of $2.63 billion in the previous week." The chart above shows that retail investors have been net buyers of world equities for the last five months. Last time we saw a five month inflow streak was in early parts of 2011, just as global equities peaked. Rydex fund flows remain near extreme levels, as reported in previous weeks. Use of bullish leverage funds is also widely evident throughout. For referencing, recent Nova Ursa fund flow chart can be seen by clicking here.

- Latest equity commitment of traders report showed that hedge funds and other speculators continue to remain persistently bullish on US technology stocks, with exposure remaining near record. Commitment of traders reported that contract positions came in at over 137 thousand net longs, a slight decrease from last week. For referencing, recent Nasdaq COT chart can be seen by clicking here.

- Bond sentiment surveys continue to remain in the neutral territory. All three major surveys including the Consensus Inc survey, Market Vane survey & Hulbert Newsletter Bond survey remain in the middle of their historical readings. For referencing, recent weekly chart of the Hulbert Bond Sentiment survey at the bullish extreme can be seen by clicking here.

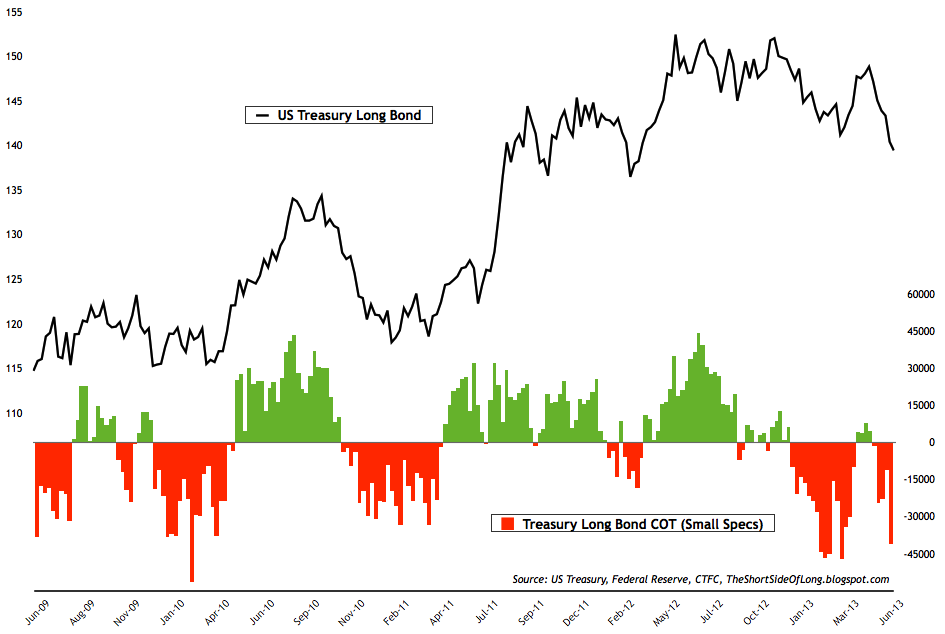

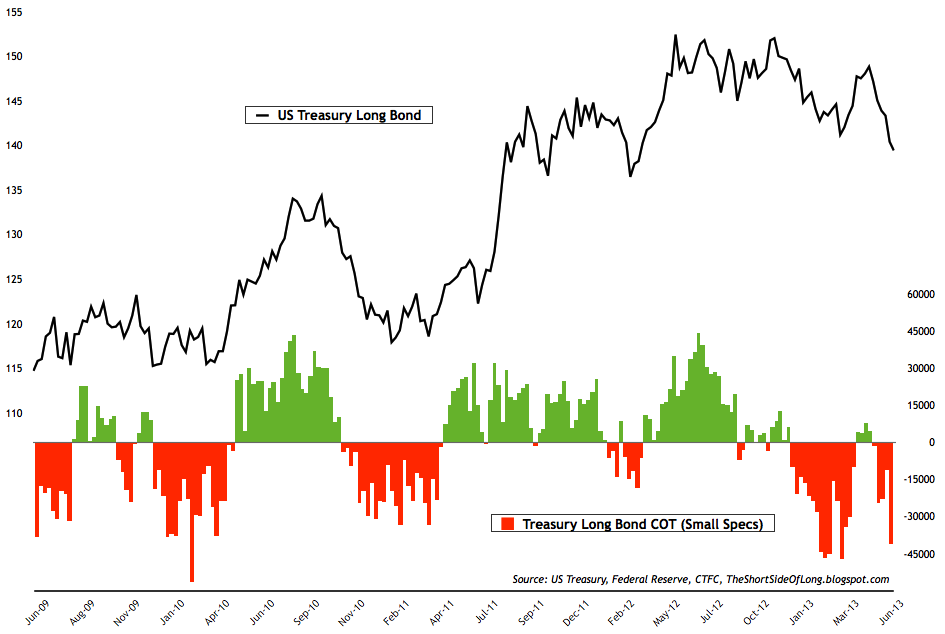

- This weeks CFTC's commitment of traders report shows that small speculators remain net short the Treasury Long Bond by 41 thousand contracts. This is one of the largest weekly negative increases going back to at least a few quarters. It is important to reiterate previous comments where net short positions could resume while the price sell offs, the same way that net long positions persisted since February 2011 low. Technical traders are also looking at the recent failed rally as a first lower high, which is now being followed by a lower low. Is this a first bond market price downtrend in two and half years?

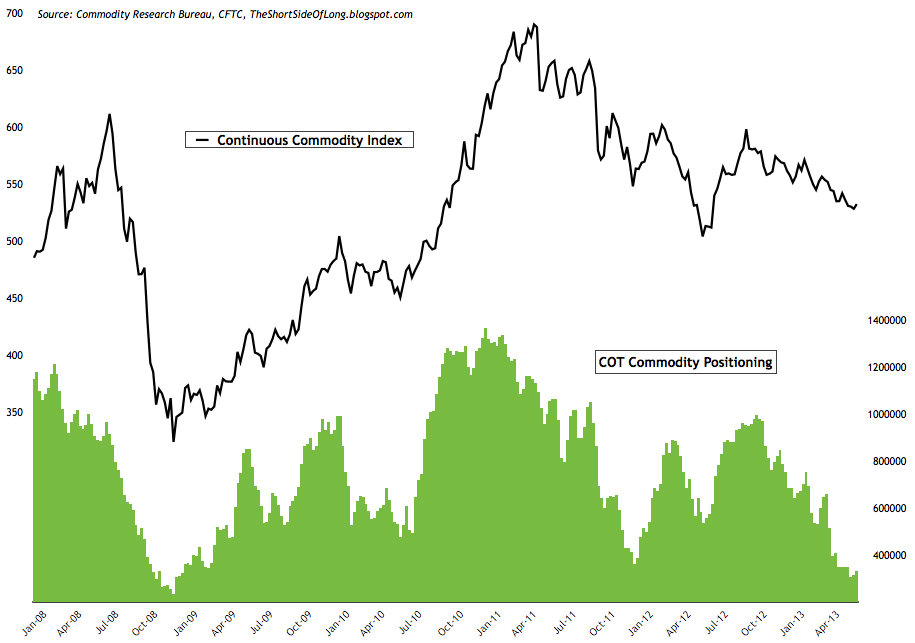

Chart 4: Hedge funds still remain extremely negative on commodities

- Latest commodity commitment of traders report showed that hedge funds and other speculators slightly added towards the net long exposure for the second week running. However, exposure towards commodities remains very depressed. Net long positions now stand at 328,000 contracts. While agricultural exposure increased, it mainly came from grains, as softs positioning declined once again. Energy bets were decreased for the second week running, while metal bets were increased this week.

- Commodity Public Opinion surveys continue to show a bearish tendency, but nothing extreme to discuss in depth. Having said that, quite a few commodities still remain disliked including Heating Oil, Copper, Cattle, Coffee, Lumber, Sugar and Wheat. That covers all sectors from Energy to Industrial Metals and finally Agriculture.

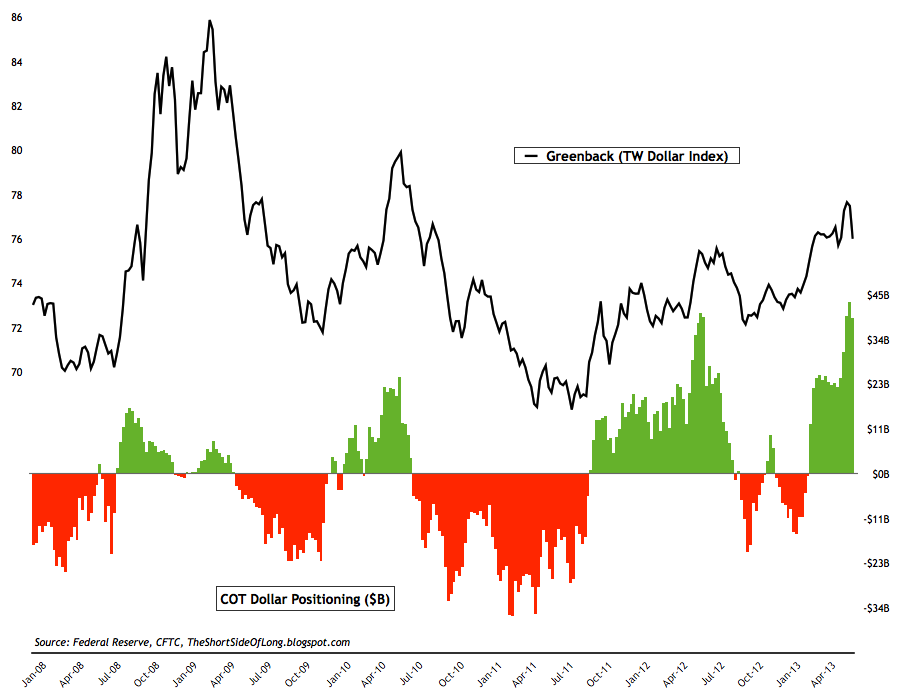

Chart 5: Hedge funds reduced their greenback positioning this week

- Latest currency commitment of traders exposure towards the US Dollar slightly decreased from previous weeks record high levels. Cumulative Dollar positioning is now stands around $39 billion, only a few billion away from all time extreme. Extremely pessimistic currency exposure is held on the British Pound, the Australian Dollar, the Canadian Dollar and the Japanese Yen. Furthermore, it is worth noting that hedge funds hold record short positions against the Pound and the Aussie. As its been the case already, short bets are held on every single G-10 currency in the Trade Weighted Dollar Index, apart from the Kiwi Dollar.

- Currency Public Opinion survey readings on the US Dollar pulled back slightly from some of the highest levels of optimism seen in years. Nevertheless, Public Opinion on the Euro, the Yen and the Loonie still remain near some of the most bearish levels in years. Investors continue to position themselves in a manner where they view the Greenback as the only currency game in town.

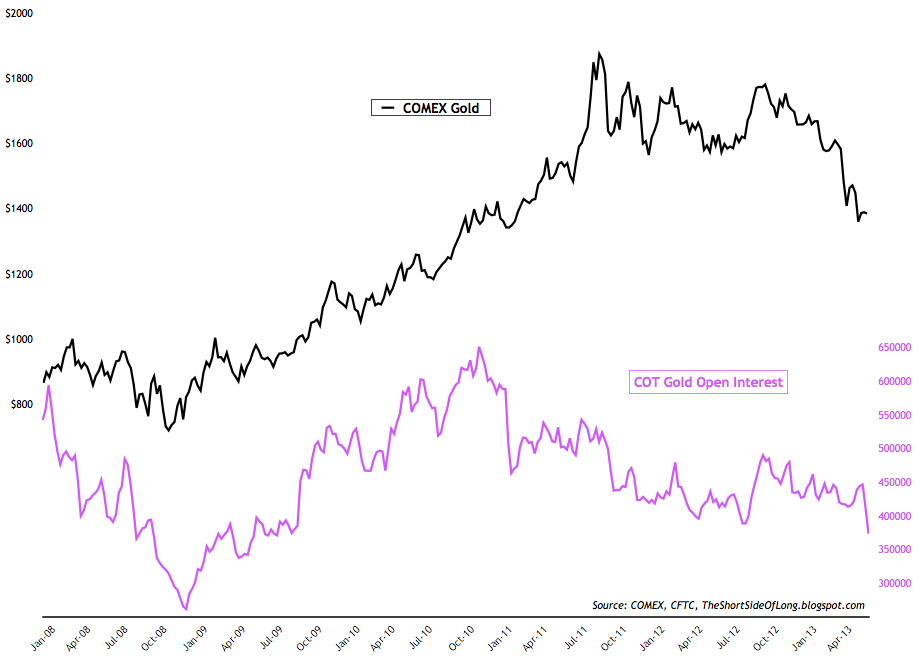

- Alternative currency commitment of traders report showed hedge funds and other speculators remain underexposed towards the PMs sector. Hedge fund positions on Gold rose slightly this week towards 61 thousand bullish contracts, while in Silver positioning rose towards the 5,000 contract level. Both of these levels are some of lowest since early 2005, almost 8 years ago. Furthermore, it is also worthing noting that this week saw an sharp drop in Gold's overall open interest (chart above). The three month rate of change has now dropped by 15%. Last time we saw such a dramatic drop was around December 2011, which marked an intermediate low for Gold and Silver.

- Public opinion on alternative currencies like Gold and Silver still remains depressed, confirming the COT report discussed above. Outright bearishness and despair are the only things to report here.