Equities

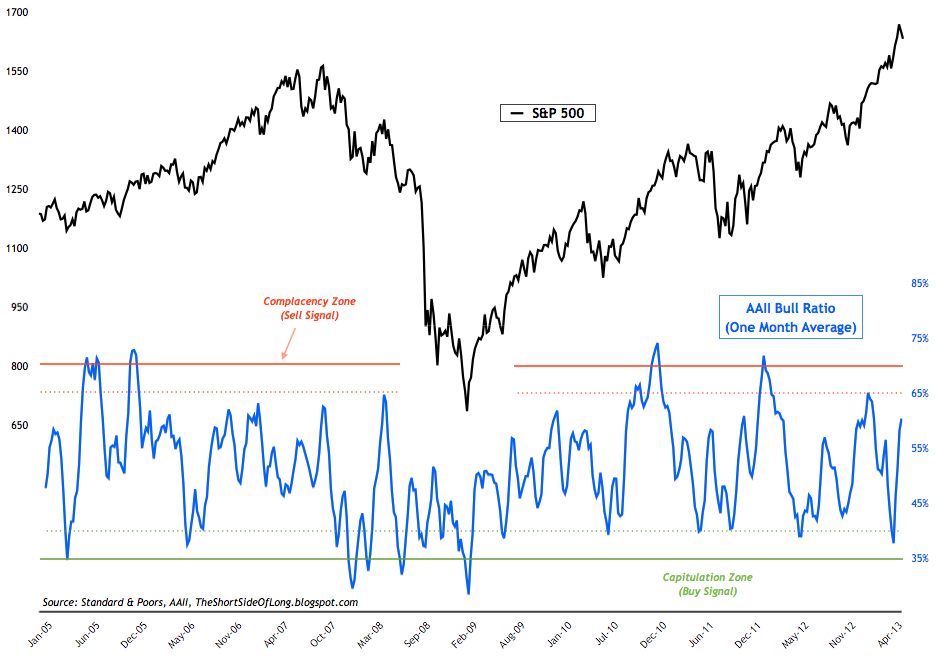

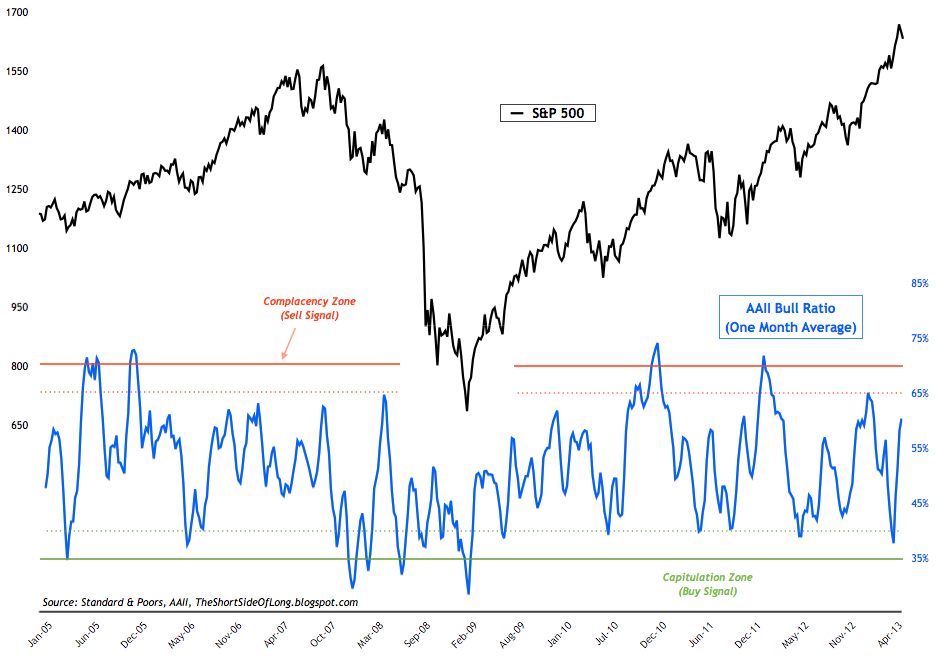

Chart 1: AAII monthly averaged bull ratio is now out of a buy signal

Chart 9: Hedge funds increased their Greenback bets to record highs!

Chart 1: AAII monthly averaged bull ratio is now out of a buy signal

- Time for another sentiment update! This weeks AAII survey readings came in at 36% bulls and 30% bears. Bullish readings fell by 13% while bearish readings increased by 8%, as the market correction began. The bull ratio reading over the last one month (4 week average) has now exceeded 60% readings, but not near a "sell signal". The chart above also shows us that the "buy signal" given a month ago, is not in play anymore.

- Investor Intelligence survey levels came in at 52% bulls and 20% bears. Bullish readings fell by 2% while bearish readings increased by 1%. Furthermore, bull ratio still remains on a "sell signal" at 72.5% reading. For referencing, recent chart of the II bull ratio chart can be seen by clicking clicking here.

- NAAIM survey levels came in at 77% net long exposure, while the intensity came in at 30%. For months now, net long exposure has remained near some of the highest levels since the surveys inception. For referencing, recent NAAIM sentiment chart can be seen by clicking here.

- Other sentiment surveys also still remain in the sell signal territory. Consensus Inc survey & Market Vane survey remain at or near extremely elevated level associated with previous market tops (seen in the chart above). Hulbert Newsletter Stock Sentiment surveys have slightly pulled back from frothy levels seen last few weeks. For referencing, recent Hulbert Nasdaq Sentiment survey chart can be seen by clicking here.

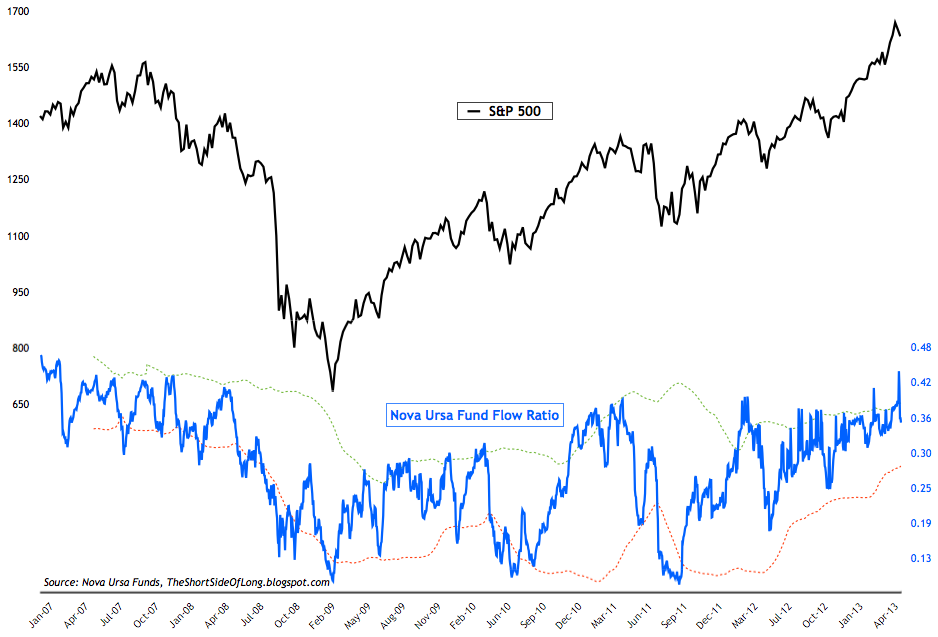

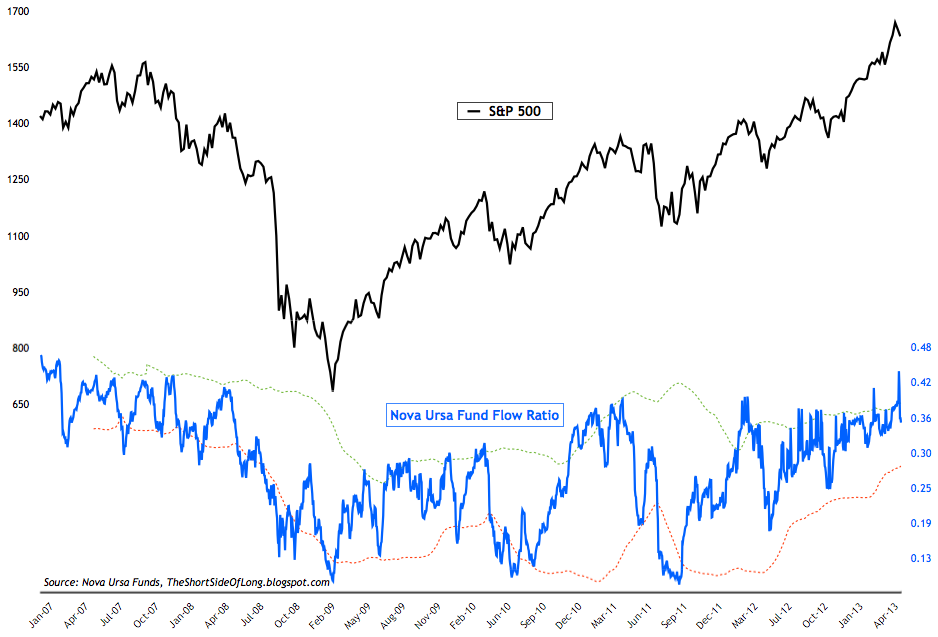

- This weeks ICI fund flows report showed "equity funds had estimated inflows of $2.46 billion for the week, compared to estimated inflows of $2.42 billion in the previous week." For referencing, recent ICI global equity fund flow chart can be seen by clicking here. As mentioned last week, Rydex fund flows have jumped to extreme levels surpassing previous readings for the cycle. Nova Ursa fund flows in the chart above illustrates this well. Furthermore, leveraged bullish funds have experienced dramatic inflows and cash levels have pretty much collapsed over the couple of weeks.

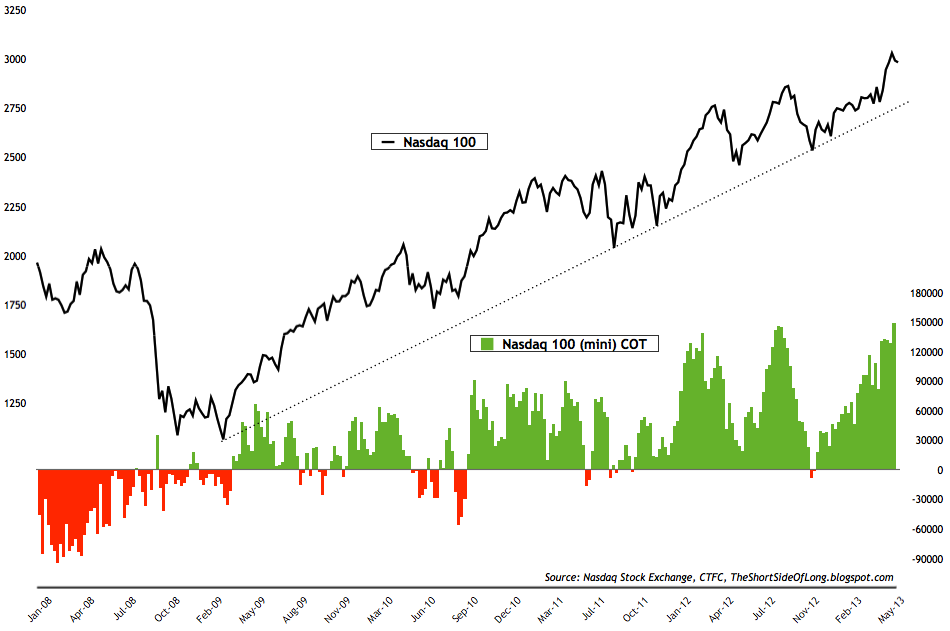

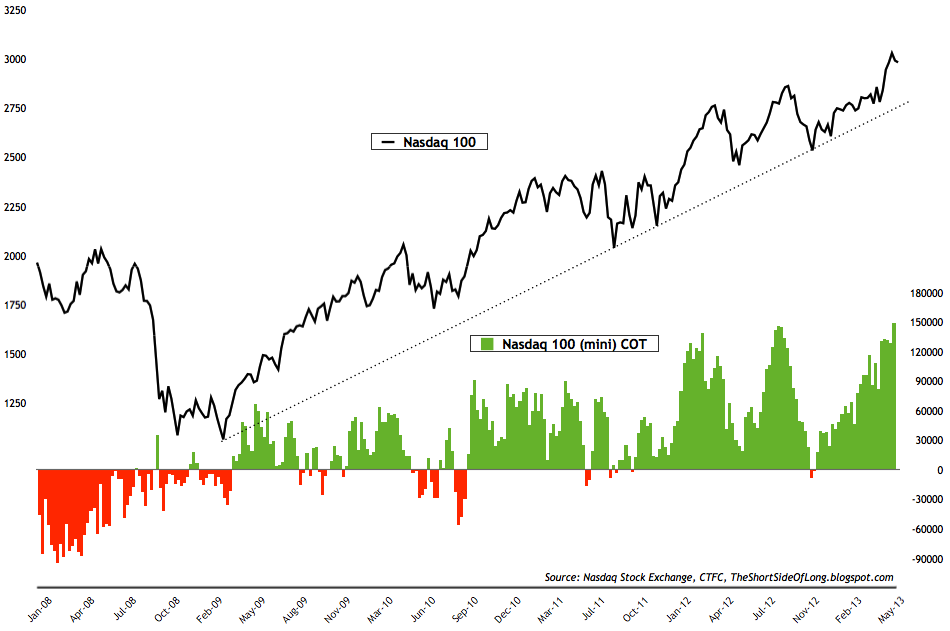

- Latest equity commitment of traders report showed that hedge funds and other speculators now hold record bullish bets on US technology stocks. Commitment of traders reported that contract positions came in at over 148 thousand net longs. As already reported previously, bullish bets have been persistently extreme, indicating that a intermediate market top could be in place.

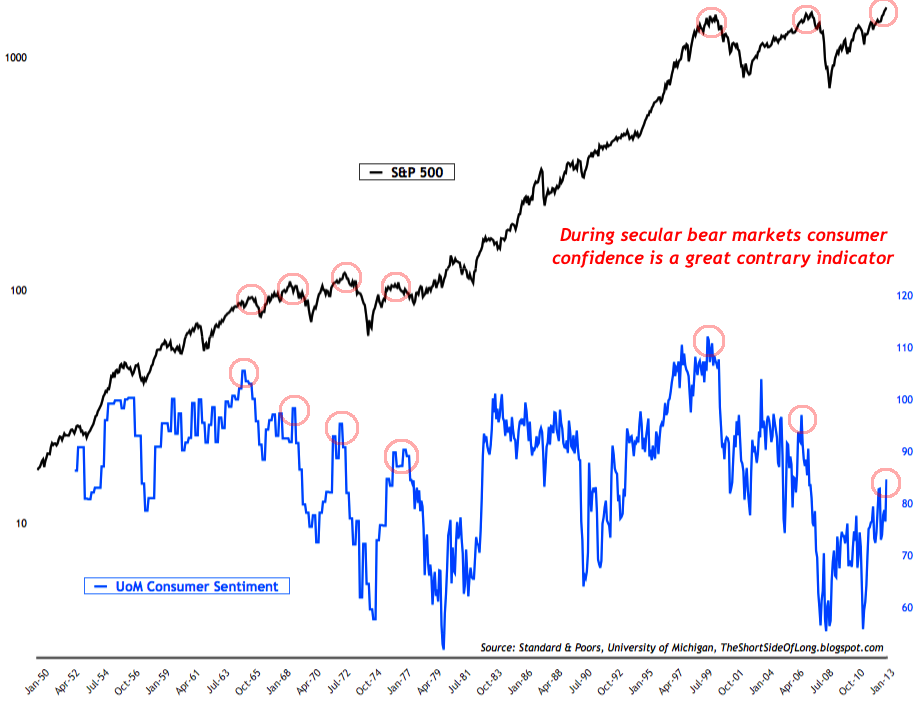

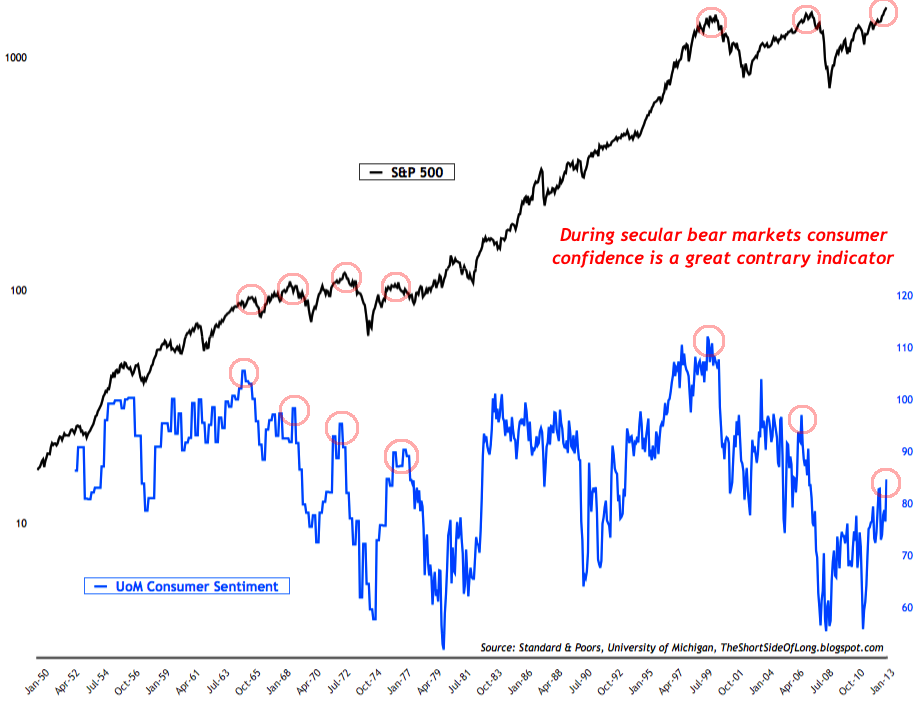

- While the economic indicator above might sound like "good news" to economists, contrarian investors are definitely not celebrating its reading level. Historically, business cycles and bull markets last about 5 years on average, so the fact that we are in our fifth year and consumer confidence is a 5 year highs, lets us now that we might be very close to the end of the bull market. After all, it is the public that gets excited last. Furthermore, we could make an observation by stating that during secular bear market trends, consumer confidence has done a great job warning us of a potential peak in stocks. This might be the case yet again today...

- Bond sentiment surveys continue to mingle around previous weeks readings. The name of the game for investors is quite neutral and undecided. While many agree that bonds are overvalued in the long run, the question is where will the investors hide during a possible stock market correction? Hulbert Newsletter Bond survey has now turned ever so slightly towards net short in its recommended exposure. For referencing, recent weekly chart of the Hulbert Bond Sentiment survey at the bullish extreme can be seen by clicking here.

- Recent commitment of traders report shows that small speculators remain net short the Treasury Long Bond by 11 thousand contracts. This weeks sell off in bonds (rise in yields) has most likely forced even more of a reversal in positioning, so the next weeks COT report could show a higher number of short positions. For referencing, a recent chart of Long Bond COT chart can be seen by clicking here.

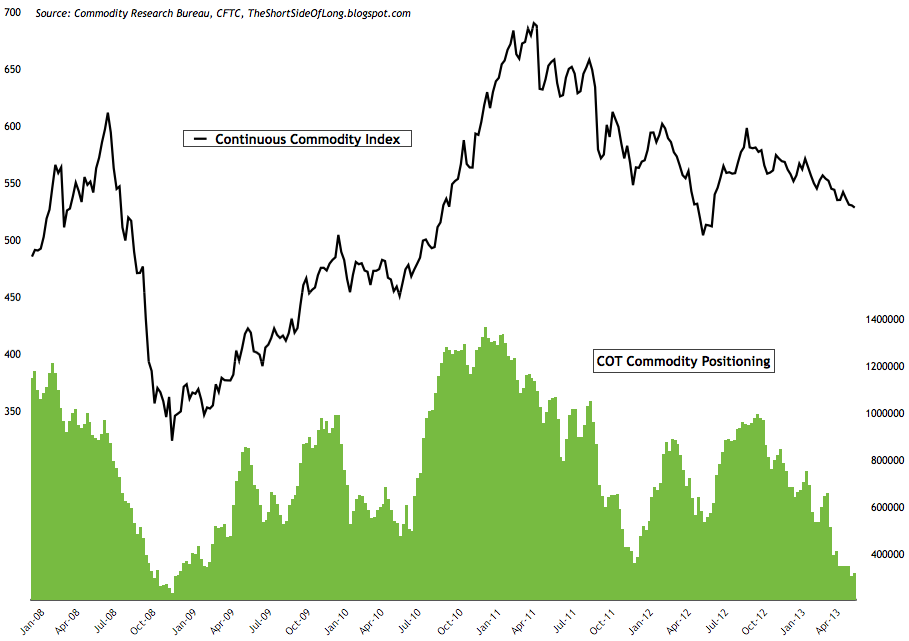

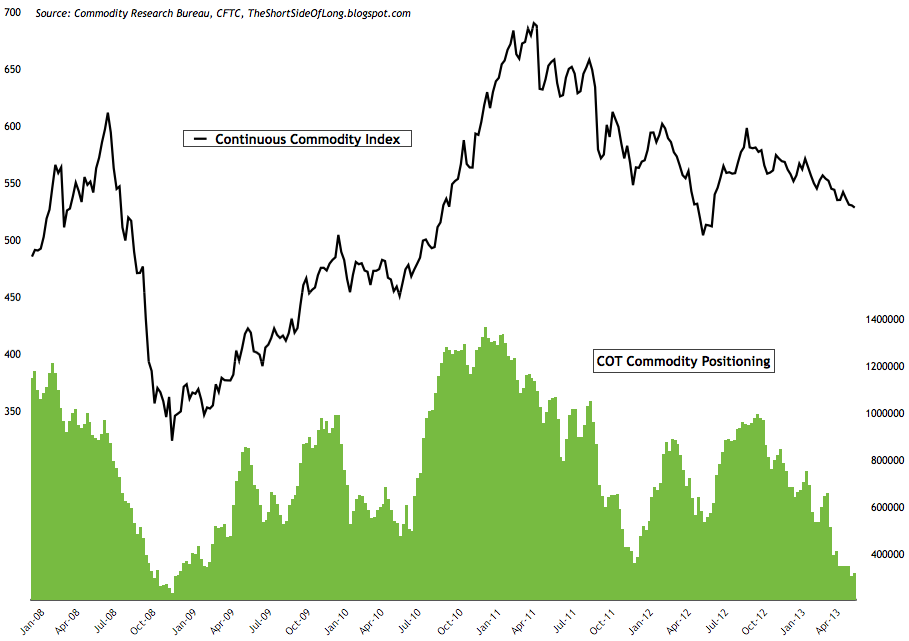

- Latest commodity commitment of traders report showed that hedge funds and other speculators reduced net long bets towards 315,000 contracts. The current net long exposure still remains at one of the lowest levels since the beginning of 2009. Agricultural soft commodities in particular are disliked sector of the raw material market, with continuous multi-month short bets against Sugar and Coffee. There is a bit of a conundrum in the Energy positioning space, with Crude Oil bets near a historical high while Heating Oil bets are at a historical low. Which indicator is telling us the truth?

- Commodity Public Opinion surveys in general show mild bearish tendency, but we are not yet at any major extremes. However, a lot of individual commodities are still very much disliked. In particular Lumber, Sugar and Coffee make the top of the list. The chart above, thanks to SentimenTrader, we can see that bearishness on Coffee has reached a new low for the downtrend. The price peaked above $3.10 in early 2011, just like many other commodities. Current market price $1.27 - almost 60% lower!

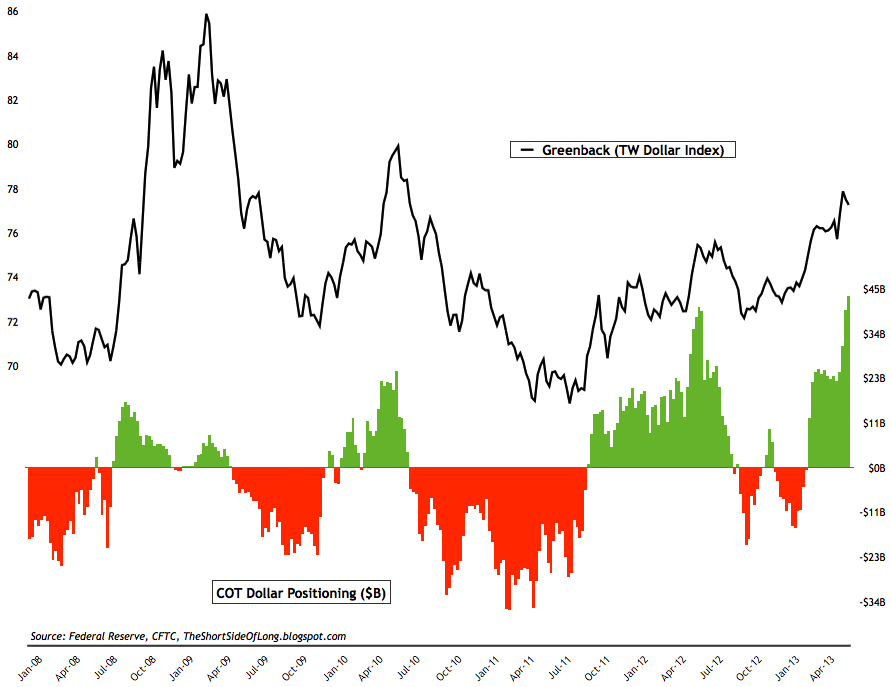

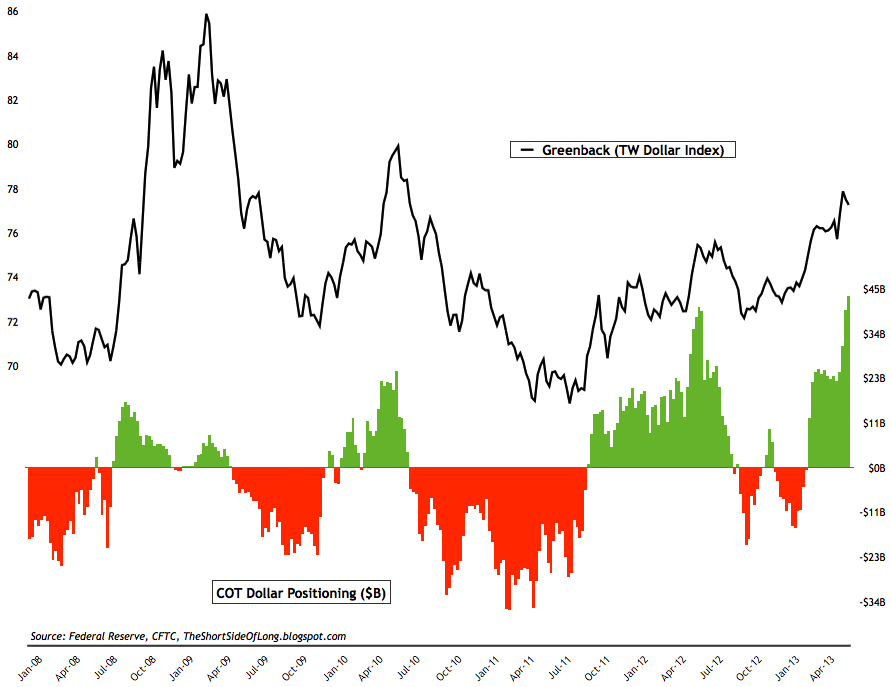

Chart 9: Hedge funds increased their Greenback bets to record highs!

- Latest currency commitment of traders exposure towards the US Dollar increased to record high levels. Cumulative Dollar positioning is now exceeding $43 billion for the first time in history. Historical, all time, record net short positions (excuse to emphasis, but they are large positions) are evident on the British Pound and the Australian Dollar. Hedge funds also hold wildly large bearish bets against the Japanese Yen and the Swiss Franc. Furthermore, short bets are held on every single G-10 currency in the Trade Weighted Dollar Index, apart from the Kiwi Dollar.

- Currency Public Opinion survey readings on the US Dollar still remain near some of the highest levels of optimism seen in years. Public Opinion on the Euro, Yen, Swiss Franc and even the Pound are now approaching extreme bearishness. Investors are positioning themselves in a manner where they view the Greenback as the only currency game in town. From a contrary point of view, that is usually a recipe for disaster as it precedes a major peak!

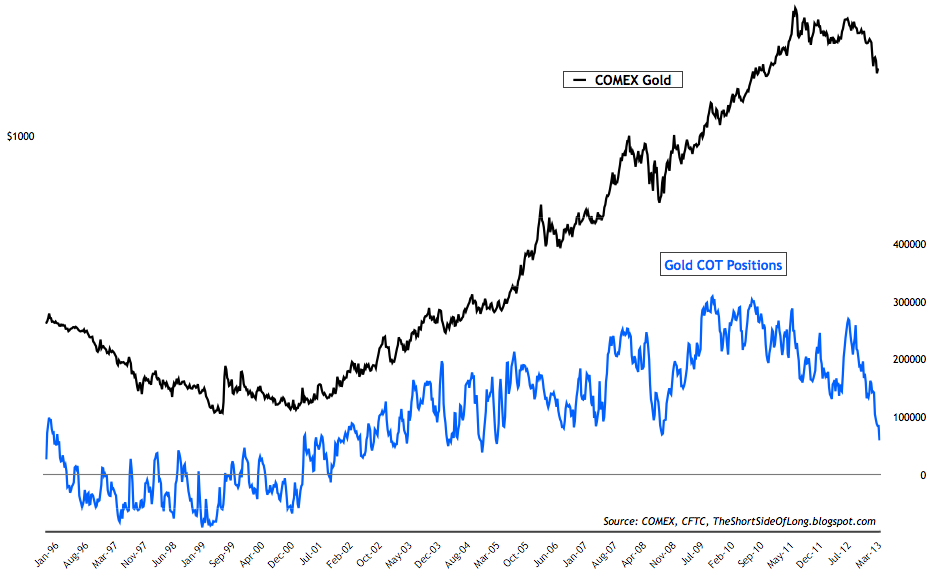

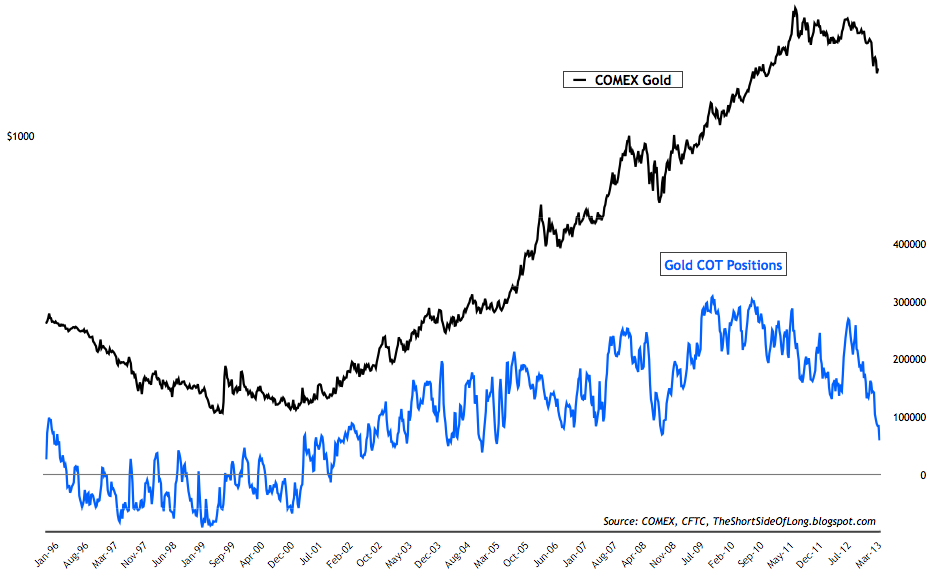

- Alternative currency commitment of traders report showed hedge funds and other speculators entered panic liquidation in PMs sector, and in particular Gold's positioning. The chart above shows that hedge fund positions have now fallen towards 57 thousand bullish contracts, while in Silver positioning has dropped to extremely rare 4,500 contract level. These levels are now at the lowest exposure extremes since early 2005, surpassing both Gold and Silver panic selling seen in later parts of 08.

- Public opinion on alternative currencies like Gold and Silver still remains depressed, confirming the COT report discussed above. Not much to report from the previous weeks update.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.