The first point I would like to make is that many are probably wondering how I could reverse my long-term bearish view on the precious metals complex to a bullish view in such a short period of time. The other point I’ve been trying to make is to get readers positioned and willing to sit tight, as this new bull market is just getting started.

Understanding the Chartology of this sector from the many different precious metals stock indexes, to individual PM stocks and especially the combo ratio charts, paints a picture that, if one keeps an open mind and truly understands what is taking place right now, justifies getting positioned and sitting tight. This is easier said than done of course.

Many are surprised by the magnitude of this bull market rally in the precious metals complex and are trying to come up with all kinds of reasons why it should or shouldn’t be taking place right now, based on whatever trading discipline they’re using. Most are looking for at least a correction to relieve the overbought conditions before the bull market can make any progress higher. That may very well happen, but I’ve been showing three very important combo ratio charts which are telling me a different story based on the Chartology and inter-market ratios for the PM complex.

I coined the phrase “Reverse Symmetry” years ago when I first picked up on it after looking at literally thousands of charts and studying their price behavior. Once you become aware of this particular piece of Chartology you begin to look for it and will see it everywhere, from short-term minute charts to long-term monthly charts. It’s no big mystery why it works, but it can tell you what to look for during certain market conditions. The precious metals complex is giving us a perfect example of reverse symmetry right now.

I’ve been showing at least three different combo ratio charts for the PM complex which showed the end of the bear market and the beginning of the new bull market. Keep in mind this is unique to Chartology and my interpretation of the Chartology. There are many good trading disciplines out there which investors can master and be successful with, though most will give up the minute it doesn’t work perfectly. Sticking with whatever trading discipline you choose—whether its cycles, Elliott Wave, Gann, or even watching the COT numbers—affords the time to fully understand and grasp its principals before giving up on it. For me personally, Chartology is the road I chose to travel and after experimenting with several different trading disciplines I always came back to Chartology.

So why am I so bullish on the precious metals sector right now?

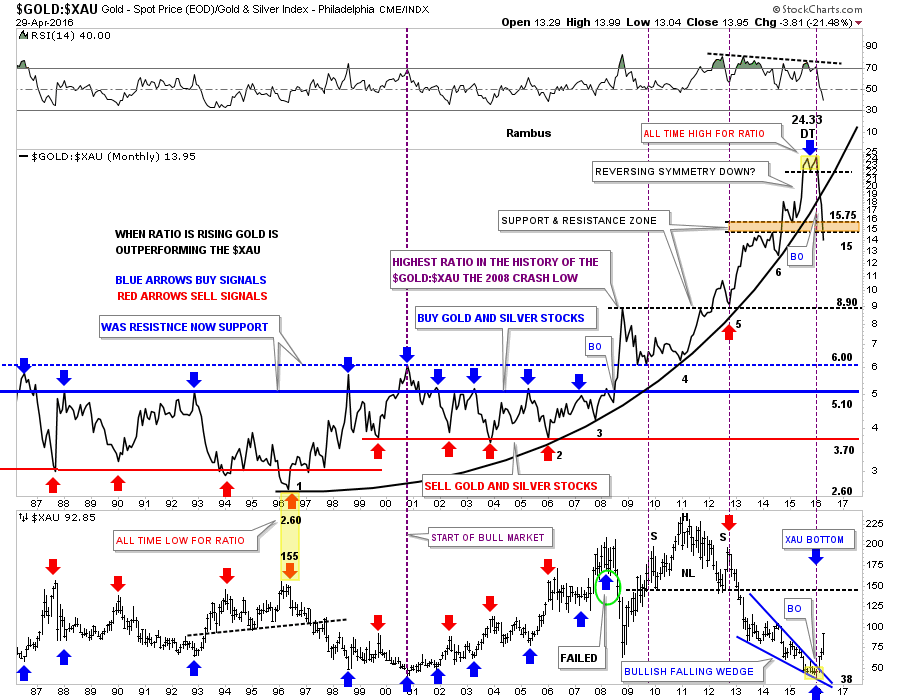

1. Gold:XAU Ratio Chart

When this is rising, gold is stronger than the gold stocks and when it is falling gold stocks are stronger than gold, which is Bullish for gold.

This first combo ratio chart, is something I’ve been showing about once a week so readers can follow the price action. I’ve been showing this combo ratio chart for years, but when I see the double top put in place at the top of the chart, in the yellow shaded area, I know what a double top looks like and this double top formed at the end of a 20 year parabolic move where gold had been outperforming the Gold/Silver Index (XAU).

The break below the double top hump came in January of this year, which was the first real clue that the nearly five year bear market may be coming to and end. And which, of course, would usher in a brand new bull market.

I won’t go into detail again as I’ve been covering this chart in depth since the double top reversal pattern completed. When the ratio chart first broke down from the double top, I said to look for reverse symmetry to the downside, as the rally leading into the double top was a near vertical move. In just three short months, look at how the price action has been declining in a vertical move down, breaking below the parabolic arc and now the brown shaded S&R zone between 15 and 15.75.

This is one reason to have gotten positioned and to sit tight. A break below a parabolic arc strongly suggests that the move to follow will be just as strong or stronger to the downside vs the upside. It’s just the nature of a broken parabolic arc.

You can see what is happening to the XAU in the lower chart as it bottomed at the exact same time as the ratio chart double-topped. The ratio chart is unwinding its parabolic rise while the XAU is doing the very opposite by rallying in a near vertical move.

We don’t get this kind of set-up everyday. This is a rare phenomenon that's simply more apparent via Chartology. I doubt anybody on the planet is looking at the precious metals complex from this particular angle.

This combo ratio chart shows one reason the bear market has ended, and a new bull market has begun. This combo ratio chart also shows why the vertical move up in the precious metals stocks is taking place and that sitting tight is the prudent thing to do right now.

We are dealing with a breakout of a 20 year parabolic uptrend that is reversing direction in favor of the PM stocks, which is a big deal. Getting positioned at a bottom like this in the PM sector or any stock market for that matter doesn’t happen for most investors, it’s only a dream.

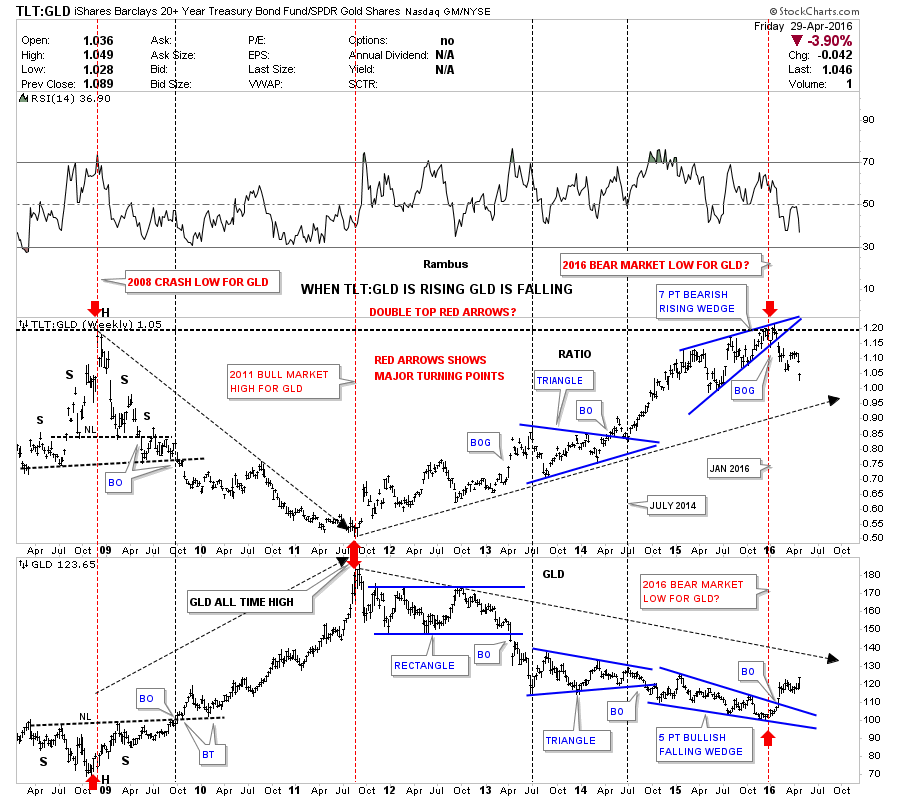

2. TLT:GLD Ratio Chart

The iShares 20+ Year Treasury Bond (NYSE:TLT) is the ETF for US Treasury bonds and the SPDR Gold Shares (NYSE:GLD) is the ETF that tracks gold. When this ratio is rising bonds are outperforming gold, when falling gold is outperforming bonds, which is bullish for gold.

Now let's look at another combo ratio chart which compares TLT:GLD on top and GLD on the bottom, which shows the inverse relationship these two have most of the time. Again I won’t go into a lot of detail as we’ve been following this combo ratio chart pretty closely. Just a quick summary shows how the ratio chart on top formed a H&S top during the 2008 crash, while GLD formed a H&S bottom inversely to the TLT:GLD ratio chart. Then when GLD topped out in September of 2011, the TLT:GLD ratio chart shows it bottomed at the same time...as shown by the red arrows in 2011.

Looking at the ratio chart on top, we can see the one year blue rising wedge that ended up having seven reversal points, which is a reversal pattern that was confirmed with the breakout gap to the downside. Up until the blue rising wedge broke to the downside, there was potential that it could have just been a consolidation pattern if the price action had broken to the upside instead. But we got the breakout gap to the downside which sealed the fate for the bear market in GLD, which then gave rise to the new bull market in GLD.

Note the near perfect inverse correlation between the ratio chart on top and GLD on the bottom during the January 2016 reversal points on both charts. As the ratio chart gapped down, out of its blue bearish rising wedge, GLD broke out of its bullish five point falling wedge reversal pattern at the same time.

One last bit of interesting price action on the ratio chart. The recent top in January of this year matches the same high made back in 2008. That top on the ratio chart in 2008 shows the head of the H&S reversal pattern, which matches the head for GLD on the bottom.

That important high on the ratio chart, which was also the low on GLD, led to GLD embarking on its final move up to its September of 2011 all-time highs at 1920, in just three years. Again, January of 2016 comes into play as an important low for the precious metals complex based on the ratio chart.

This next combo ratio chart shows another good example of why I think the bear market is over and a new bull market has begun in the precious metals complex since mid January of 2016. What fascinates me the most about Chartology is how it can show the future price action before the fundamentals come into play.

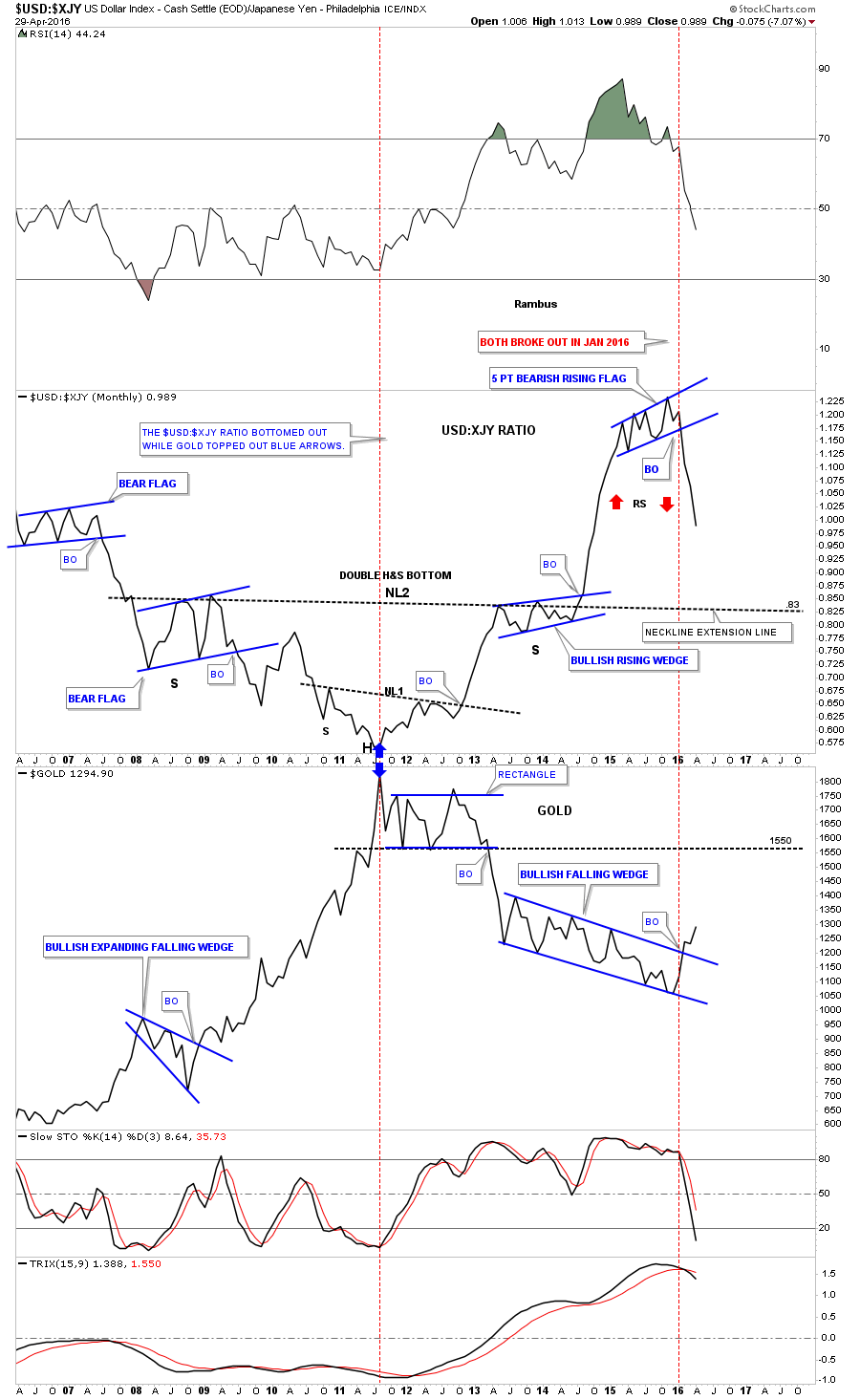

3. U.S. Dollar:Japanese Yen Ratio Chart

This ratio rises when the dollar is rising against the yen, which is bearish for gold; when it is falling, the yen is rising against the dollar, which is bullish for gold.

As most of you know, the Japanese yen has been on a rocket ride for the last week or so, faking out just about everyone. We’ll hear stories of manipulation or by the Bank of Japan, or the Fed, or other fundamental reasons why it’s doing what it’s doing. I don't get involved with that because the Chartology already showed what was coming. It constantly amazes me the Chartology knows before anybody what is coming down the pike.

Below is another combo ratio chart, which has the USD:XJY ratio on top and gold on the bottom. I’ve been showing this chart for many years, but most importantly since the ratio broke down from that blue five point bearish rising flag reversal pattern in January of this year, while gold—on the bottom chart—was breaking out of its bullish falling wedge reversal pattern at the same time.

Back in late January of this year, I said there was a good chance we could see some reverse symmetry to the downside in the ratio chart which would be bullish for gold. I had absolutely no idea why the US dollar would collapse against the yen, but collapse it has.

Again, note the parabolic rise the ratio chart made in 2014 to the top in late 2015. The rise was so steep no consolidation patterns formed on the way up, so there is nothing to offer any support on the way down until neckline #2 came into play around the .83 area.

As the ratio keeps falling we should see gold rising, which has been the case. If we see the ratio chart on top hit neckline #2 at .83, and gold hits the bottom rail of its blue rectangle consolidation pattern that formed on the way down at 1550 or so, it will most likely mark a period of consolidation for both the ratio and gold.

These three combo ratio charts show me how the bear market ended and how the new bull market began in the precious metals complex. There are never any guarantees when it comes to the markets, but by following the price action one can take out a lot of the confusing noise.

What I believe is happening since each of the tops were put into place on these charts is that the parabolic move leading into those tops is now reversing symmetry back down over the same area. This is the reason I’ve been so adamant about getting readers buying their favorite precious metals, and to sit tight until some decent support is hit on these ratio charts.

This could be one of the easiest or hardest trades you’ll ever make. It could be easy because all you have to do is buy your favorite PM stocks and then do nothing. The hard part would be trying to outsmart the new bull market by over-trading. At that point you'd fin yourself on the outside looking in.

A correction is coming, but what is going to surprise most readers is the strength of this first impulse leg up. Some are waiting for the right signal to call the new bull market in the PM complex, while many are trying to trade in and out of this strong impulse move, which is just almost impossible to do.

The moves we’ve seen since mid-January of this year are frustrating bulls and bears alike. This is a perfect start to the second leg up of the secular bull market which began at the turn of the century.