A few week’s ago I discussed the post-election surge in the market based on rather optimistic outlooks as opposed to the technical underpinnings that currently exists. As I specially stated in the weekend newsletter entitled “Dow 20,000” the market was beginning to take on an eerily similar feeling:

“If this market rally seems eerily familiar, it’s because it is. If fact, the backdrop of the rally reminds me much of what was happening in 1999.

1999

- Fed was hiking rates as worries about inflationary pressures were present.

- Economic growth was improving

- Interest and inflation were rising

- Earnings were rising through the use of “new metrics,” share buybacks and an M&A spree. (Who can forget the market greats of Enron, Worldcom and Global Crossing)

- Stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

If you were around then, you will remember.”

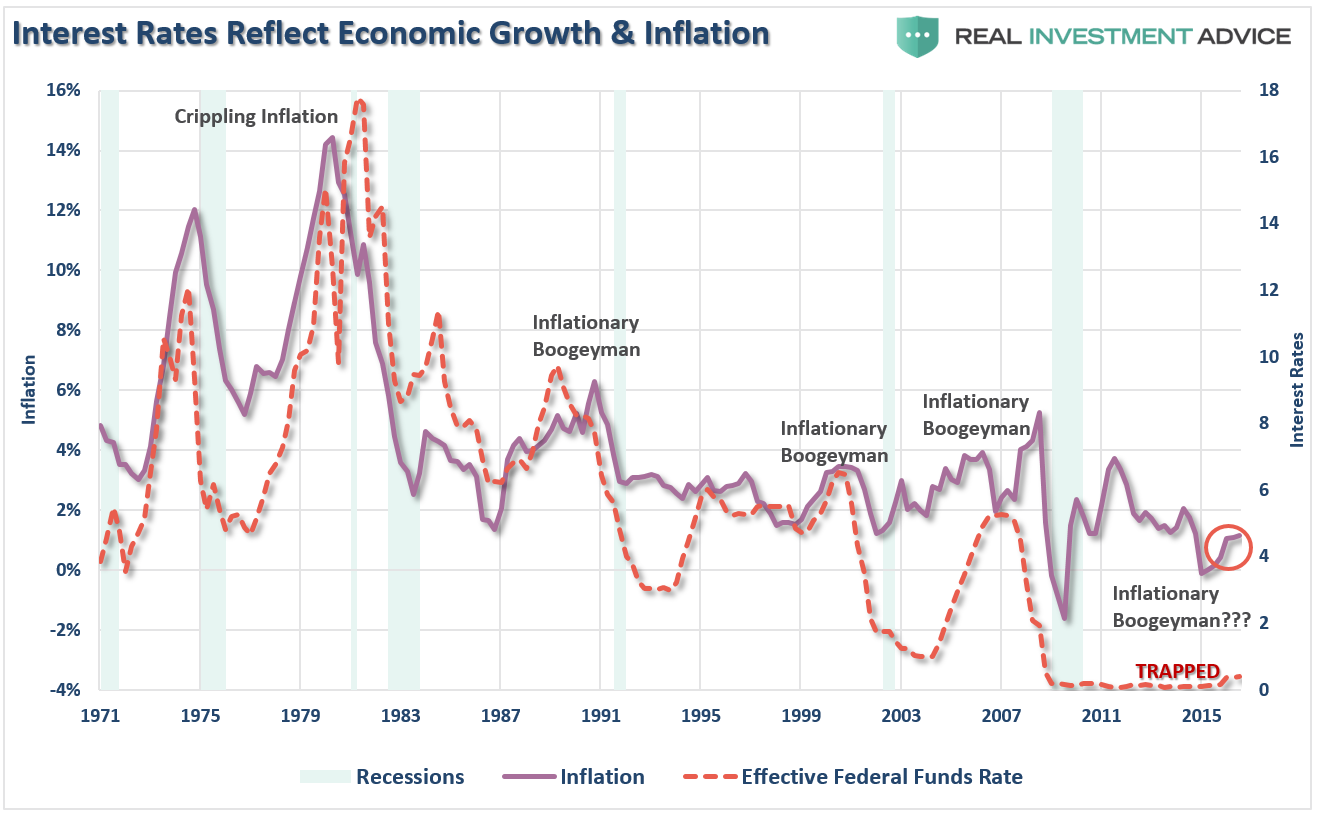

With Janet Yellen and the Fed once again chasing an imaginary inflation “boogeyman” (inflation is currently lower than any pre-recessionary period since the 1970’s) the tightening of monetary policy, with already weak economic growth, may once again prove problematic.

“But Lance, this is the most hated bull market ever?”

If price acceleration in the market is a sign of investor optimism, then the chart recently published by MarketWatch should raise some alarm bells.

The only other time in history where the Dow advanced 5000 points over a 24-month period was during the 1998-1999 period of “irrational exuberance” as the Fed was fighting the fears an inflationary advance, while valuations were rising and GDP growth rates were slowing.

Maybe it’s just coincidence.

Maybe “this time is different.”

Or it could just be the inevitable beginning of the ending of the current bull market cycle.