The shortened week has the potential to peter out, with light trading volumes noticeably affecting trading conditions heading into the Easter long weekend.

Commodities have continued to come off this week, led by crude oil down 4%. This of course means that commodity currencies such as the Australian/Kiwi and Canadian Dollars are all pulling back with them.

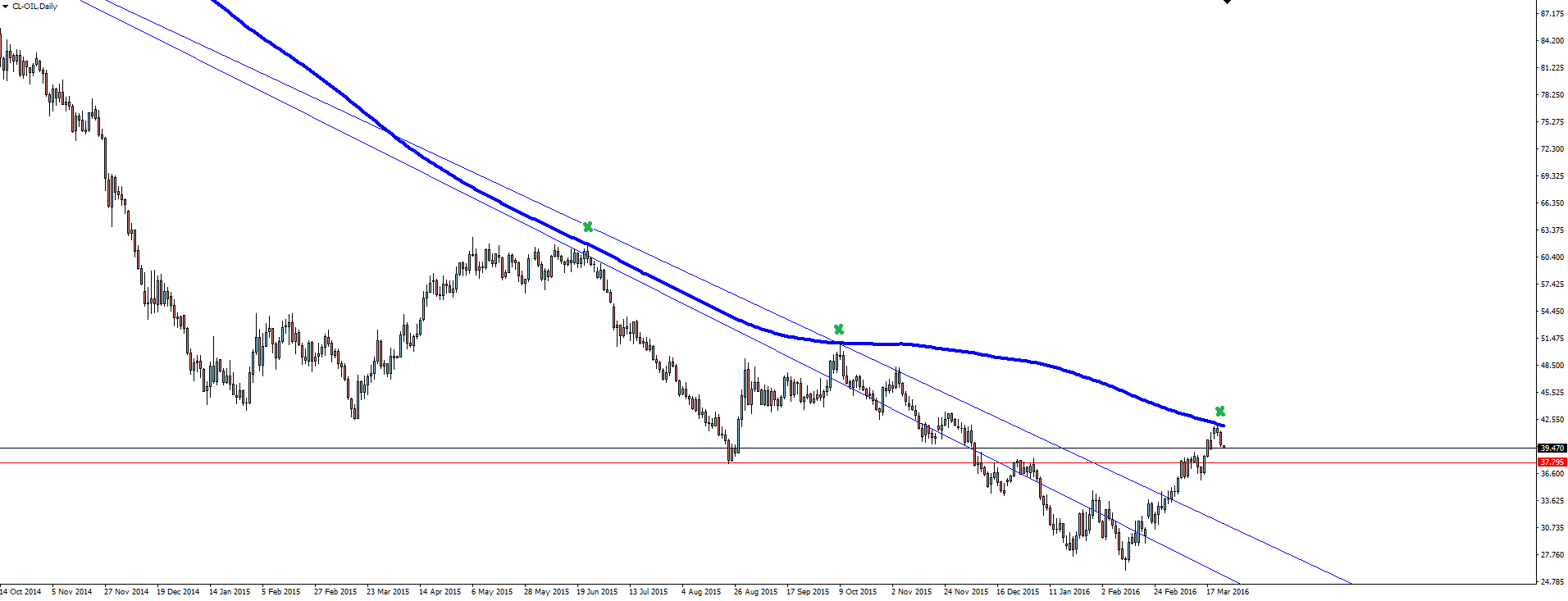

I’ve spoken a lot about the bulls not being able to ‘do any technical damage’ to the chart. Technical damage being broken resistance levels, higher highs on the Oil daily etc. Well finally some damage has started to be inflicted, and more importantly sustained.

Oil Daily:

There is however one technical indicator that stands out, the 200 SMA. Although not something that I look at a lot, I had a colleague here at Vantage FX bring this chart to my attention and the cleanliness of the touches are just too much to ignore.

Forex markets have also seen some US dollar strength recently, with Fed speakers coming out of the woodwork to contradict the perception that the Fed’s hands are tied on rate increases this year. Bullard was the latest speaker overnight on Bloomberg:

“You get another strong jobs report, it looks like labour markets are improving, you could probably make a case for moving in April. I think we are going to end up overshooting on inflation and the natural rate of unemployment.”

Arguing against the constant scrutiny and analysis by media of where rates are headed in the short term:

“I am not revealing my dot. I want to get out of the game of how many rate increases this year.”

I just thought that was funny as the financial media continues to go bananas over the dot plot.

This is all a far cry from the rhetoric in the last FOMC meeting where interest rates were left unchanged and rate hike projections for the year halved.

Make sure you have no loose change in your pockets, you’re about to hit the corkscrew loop on the Fed roller-coaster!

Chart of the Day:

We haven’t taken a look at an Indices chart all week, so today’s chart of the day goes to the Australian SPI 200 stock index.

SPI 200 Daily:

After price has been rejected off wedge resistance, it’s pulled back to open on a previously significant support/resistance level.

The ideal scenario would be that the bulls take control around this level and we get the opportunity to pre-empt a breakout of the wedge? Something to consider.

On the Calendar Thursday:

NZD Trade Balance (339M v 75M expected)

GBP Retail Sales m/m

EUR Targeted LTRO

USD Core Durable Goods Orders m/m

USD Unemployment Claims

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.