Investing.com’s stocks of the week

The strength that Friday’s jobs report afforded the market has largely been erased over the course of the weekend and the overnight Asian session. Payrolls all but met estimates with 114k jobs created in September vs an estimate of 115k. The big surprise was the large decline of the unemployment rate from 8.1% to 7.8% due to a large increase in the household rate. A lot of the new jobs seem to be part time which is obviously not ideal but a solid report was what was needed and what we eventually got.

Risk slithered higher on the announcement with GBP/USD touching the 1.62s and EUR/USD gaining above 1.30 but these gains have been erased over the weekend.

There are a fair few reasons why sentiment could be lower this morning, with the most obvious being happenings on the continent. There is a Euro zone Finance Ministers meeting today with Spain, Greece and Cyprus due to be discussed, however these meetings tend to yield nothing but angst. The last meeting of multiple Fin Mins came a few weeks ago when it was decided that the ESM would not be used for legacy problems within the Euro zone banking sector. Any further announcements along that route will confirm things lower this afternoon.

Some weakness in euro will also be coming from the slight downward revision of growth prospects by the Banque de France for the French economy. They had expected to see 0% growth in Q3 but have revised this lower to -0.1% with the official numbers out in the next fortnight. Central banks tend to be over-exaggerators of growth as we have seen through the crisis, so thoughts are that -0.1% may still be too optimistic.

In the UK, the Conservative Party Conference starts today and we will be looking for hints and clues as to what can be included in the government’s Autumn Statement, due in December. The political risk premium on sterling has increased over the past few months and any sign of fracture at the conference will continue this.

German industrial production is the key indicator today following a poor few weeks of data from the country. Factory orders slid by 1.3% in August which will do nothing for the already low levels of business confidence. We have spoken about the negative correlation of GBP/EUR and German industrial production and therefore look for a weak number to back up our expectations of further GBP/EUR strength. It is due at 11am BST.

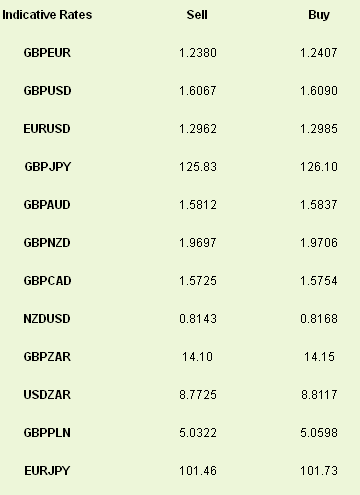

Latest exchange rates at time of writing