Last week, oil nudged above $50 per barrel. US shale producers locked in new production at north of $50 for 2016 and 2017 delivery. This week it’s down below $50 again.

Data from the Energy Information Administration confirmed a large addition to US crude oil stockpiles last week, another sign that a global oversupply of crude isn’t going away.

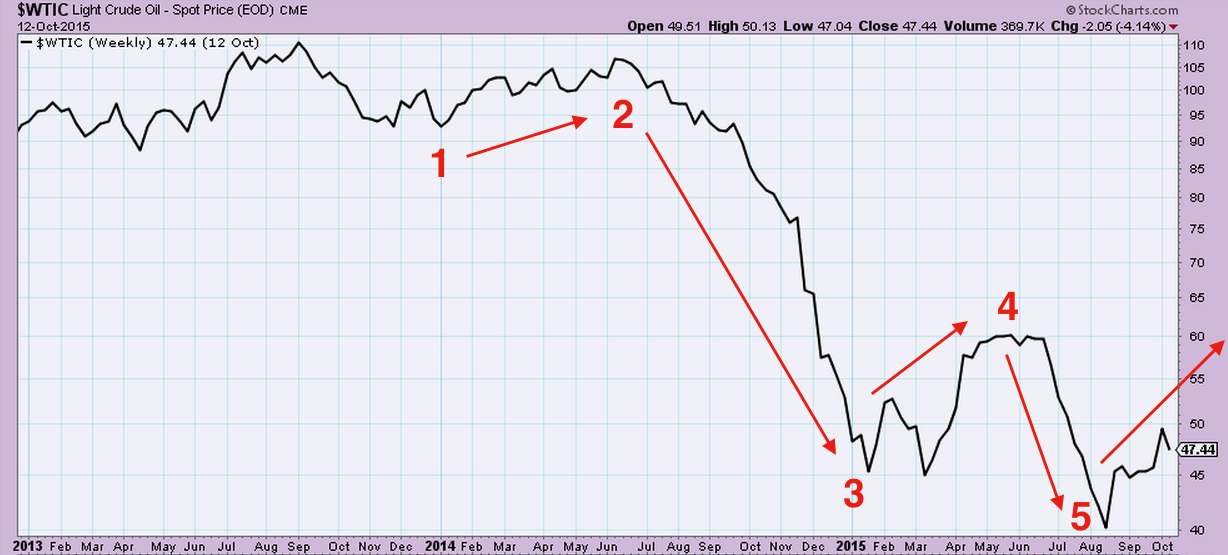

Oil Roller Coaster Now Down Again

While we saw some signs that metals prices might be going up this week – you guys hear about zinc and lead? – the oil roller coaster shows that we’re nowhere near out of the woods when it comes to commodities. My colleague, Raul de Frutos, didn’t buy it when a Reuters analysis said that oil had reached a bottom due to Fibonacci Retracements and, sure enough, crude fell again this week.

Source: MetalMiner analysis of @StockCharts.com data.

We regularly caution readers to not follow Fibonacci sequences or other trading fads, but rather long-term trends with well-defined levels of support and resistance.

Lead and Zinc Back Up

Meanwhile, back with zinc and lead, Glencore (L:GLEN) cut production at many of its mines this week and nearly singlehandedly eliminated a surplus of the metals. Lead prices went up 9% in only 2 days and broke short-term resistance. Zinc, for its part, went up 10% and also broke short-term resistance.

That escalated quickly.

We still cautioned readers that it’s too early to call a bottom, but Glencore’s actions show some players in the market are finally getting serious about cutting production.

Gold, Too

Another metal that surged this week was gold, which reached a 3-month high bolstered by a weaker dollar and expectations the Federal Reserve will not hike interest rates this year.

The Fed’s last meeting, in September, recently had its minutes released, which showed that most policymakers believed that current economic conditions coupled with the outlook for economic growth, inflation, and the labor market made them feel that “conditions for policy firming had been met or would likely be met by the end of the year.”

Silver and gold enjoyed a nice bounce, but even if the Fed does not raise interest rates this year, what about early next year? There’s certainly pressure to hike borrowing rates but until then precious metals could keep seeing a rebound.

So, we’re still in a bearish commodities environment.

by Jeff Yoders