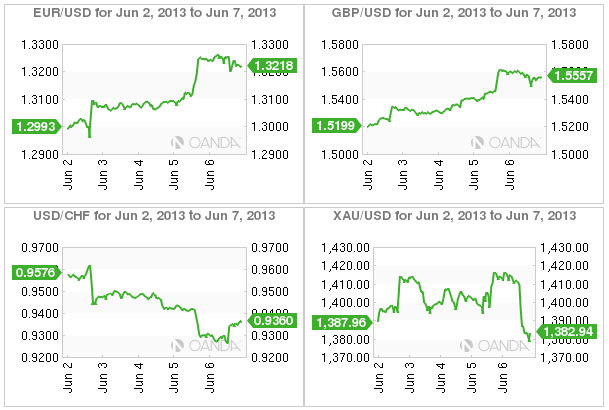

The past week has more to do with the flight of the Yen rather than the rise of the EUR. The dollar was beaten down during a liquidity fire sale ahead of a QE tempering employment argument release, rather than the market love for a “unionized currency” that was temporarily pushed to test new quarterly highs. The 17-member single currency recent strength has mostly been a direct byproduct of dollar positioning under threat ahead of a highly influential US data point.

Now that the NFP release has come and gone, and an FX market no more the wiser on the Fed tapering QE question front, will surely lead to an volatile summer for most asset classes. Expect investors to find themselves living from one fundamental benchmark to another.

The supposed backbone of Europe, Germany, will hold two bond auctions next week. It comes at a time when the Euro-zone bond market is being heavily influenced by the “possible timing and speed of the Fed’s plan to scale down its bond-buying program.” Last Friday’s US employment results should make taking down the auctions a wee bit easier. The total German sales will be €16- billion. To date, Bund yields have bee rising since the end of last month, mostly on the back of Fed members implying that it was considering reducing its bond purchase.

Also next week, the ECB pledge to buy bonds under the OMT program comes under German constitutional scrutiny on Tuesday, a day after what historically is the quietest trading day of the month – the first working session after NFP (investors will want to lick their wounds and figure out the Fed’s next possible move). Do not expect any German constitutional decision ahead of September’s federal elections.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week In FX Europe: German Bond Traders Just As Bewildered As FX Dealers

Published 06/08/2013, 08:14 AM

Updated 07/09/2023, 06:31 AM

Week In FX Europe: German Bond Traders Just As Bewildered As FX Dealers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.