Expect Bernanke to play down the significance of one employment number – Friday’s headline print will do little to clarify the Fed’s QE tapering debate and by default the dollar’s position. This will make for a relatively volatile summer in FX, and by default making each future data point release to take on more significance.

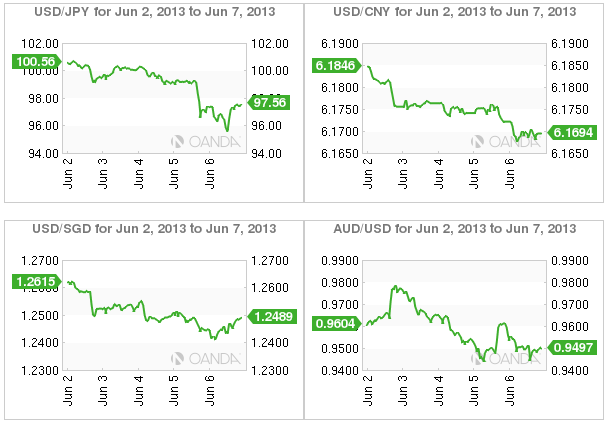

All of this will become a bigger headache for Abenomics. This week’s breakdown in the Nikkei and USD/JPY will have many who have entered into the two most crowded trades (long Nikkei and short Yen) worried. The wild Yen move is trying to confirm technically, what many have believed was a correction of Abenomic rallies, may in fact be considered a reversal, especially now that the Nikkei has broken through its -25% correction level and USD/JPY printing a sub- ¥96.00 low.

Not making it any easier for the dollar and any equity bull this week is that the volume being traded is on the rise – signs of potential mass liquidation will only lead to similar moves like last Thursday’s ‘currency panic attack.’ The dollars positive reaction to the NFP release just shows how much of the mighty ‘buck’ had been oversold in the previous sessions on panic momentum.

What’s Japan to do to stem Abenomics opposition? The MoF will have to consider how far they can test the remaining G20 members if they ever contemplate implementing any “possible intervention.” Finance Minister Aso said that they are watching the currency moves, and there is no immediate need to intervene. Economic finance Minister Amari has indicated that equities and FX moves will continue to be driven by external factors.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week In FX Asia: Is The Yen’s Apocalyptic Move Over?

Published 06/09/2013, 07:13 AM

Updated 07/09/2023, 06:31 AM

Week In FX Asia: Is The Yen’s Apocalyptic Move Over?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.