* Japan jobless improves to16 year low and CPI grows at fastest pace in 32 years

* Chinese PMI expands for first time this year easing slowdown fears

* India’s PM Modi to present Budget in July

JAPAN

The USD/JPY got a boost from solid economic figures this week. Inflation indicators were very positive validating Prime Minister Shinzo Abe’s goals of ending deflation. Tokyo Core CPI posted a 2.8% gain, while National Core CPI jumped 3.2%, as both indicators matched expectations.

Early in the week, BOJ Governor Kuroda said the central bank’s quantitative and qualitative easing policy was achieving its goals and gave no indication about any plans to change current monetary policy. Kuroda noted that growth had improved and deflation curbed, but that inflation was around 1%, well short of the target of 2%. The BOJ had hoped to reach its inflation target by 2015, but Kuroda acknowledged that this goal would take longer, and pledged that the BOJ would continue its current stance of large-scale monetary easing until the inflation target was reached. This means that we could see USD/JPY continue to trade at high levels for quite some time.

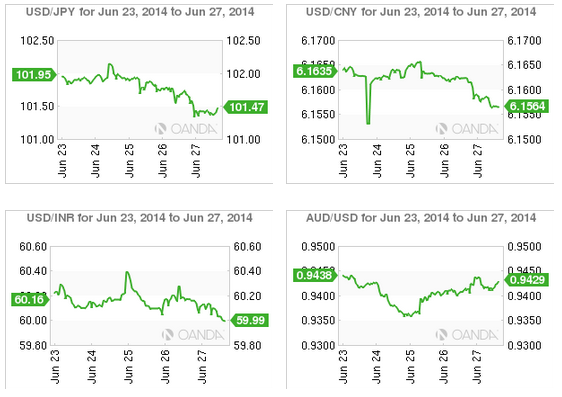

The BOJ has the final word on the JPY which has appreciated to 101.37 and will continue on the current range unless there is a significant change in monetary policy from either the Japanese central bank or the US Federal Reserve.

CHINA

The HSBC purchasing managing index for Chinese manufacturing came in at 50.8 in June. This is the first time since December that the index has been above 50, a level which suggest expansion. In May the reading was 49.4 which increased expectations that the mini stimulus program started by the Chinese government would push the reading out of the contraction it found itself in the first half of this year. The government started a program to boost growth via small business tax cuts and big infrastructure investments.

The CNY continues to rise versus the USD to reach a two week high. After a short depreciation run the currency has again seem to be back on an appreciation trend. The USD/CNY started the week at 6.1635 and on Friday was trading at 6.1566.

INDIA

Indian Prime Minister Narendra Modi will present his first federal budget in July 10. A 5 minute video on youtube best describes Modi’s strategy: Skill, scale and speed. With rising inflation and a high trade deficit the new government has the challenge of boosting growth while at the same time controlling food and energy prices. Modi was elected with the promise that he can deliver on both and the Rupee has reacted to him winning India’s top job. The USD/INR continues rangebound slightly above 60.00.

Next Week For Asia:

The week will have an Asian focus at the beginning to close with an American and European bent. Manufacturing figures will be released in Japan on June 30. The Reserve Bank of Australia interest rate decision on July 1st highlights the Asian contribution to the economic calendar.

July 3rd is a release heavy day. That’s the date the U.S. nonfarm payrolls report will be issued one day earlier than usual because of Friday’s July 4 holiday. Also on July 3, Canada and the U.S. will publish their respective trade numbers, and there will be a European Central Bank rate decision and press conference. As if that wasn’t enough data to make an investor’s head spin, the U.K. services purchasing managers index (PMI), an American jobless claims report, and the Institute of Supply Management’s non-manufacturing PMI are all due on the same date.