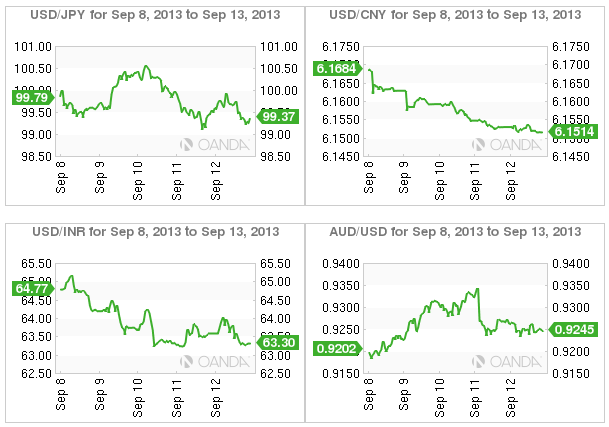

At present the dollar bulls may be in control, but in yen translation, the bear has awoken from its slumber as the greenback acquaints itself once again with the coveted ¥100 handle this week. Experienced investors have taken their time revisiting this familiar territory for many reasons. If it was not for geopolitical or event risk topping the yen’s barrier list to medium-term weakness, it was probably the deathly quiet trading month of August that silenced capital markets to the point of near paralysis that pushed traders to the sidelines.

With seasonality excuses all but forgotten, both the EUR and USD bulls are now within striking distance of last May’s yen lows – the danger here is that too many market participants are holding the same position and thinking the same thing.

Investors are banking on a lot of reckoning. Is Prime Minister Shinzo Abe’s proposed consumption tax a fait accompli? Current yen pricing appears to presume so as investors gamble on Japan’s economic growth being strong enough to support the tiered tax that is to be implemented next April. Abe is expected to announce a supplementary budget when the tax is formally introduced to Japanese taxpayers on October 1.

The country’s economy is steady at the moment and raising the tax as planned from 5 per cent to 8 per cent in April 2014, and by 10 per cent in October 2015, are important steps for the Abe government to take toward sustainability as it attempts to lower Japan’s crippling national debt. Aside from 15 years of deflation, Japan’s debt is the most frightening among industrialized countries, sitting at more than twice the size of the Japanese economy.

The markets, along with the prime minister’s critics within his own party, will have to wait to see if the sales tax hikes will help to slow the country’s consumption rate. Frustrating Abe is the fact he has limited options. On the flipside, failing to increase Japan’s sales tax could lead overseas investors who have been happily benefiting from the tenets of Abenomics to unload their Japanese assets at a gradual pace.

To be clear, the potential tax increase has nil to do with deflation. Deflation remains a monetary phenomenon that Bank of Japan Governor Haruhiko Kuroda continues to wrestle. The Bank has committed to buying about 70 per cent of planned bond issuances from the world’s most heavily indebted nation in an attempt to achieve Abe’s 2 per cent inflation rate target within two years.

For now, the yen bears, dominated by Japanese pension funds, can bask in the glory of a potential repeat of yen-funded trades, supported by an easing of U.S. credit even in the face of next week’s potential Federal Open Market Committee taper “lite” announcement. Extending the 2009 (¥100.10) dollar highs is very doable medium-term so long as the mayhem in Syria continues to recede.

The weakest yen bears’ biggest short-term fear is not fundamental, nor political, but technical. The market is predominately leaning one way and that’s looking for a higher dollar. Thus, any dollar resistance will only put pressure on the weakest of the yen shorts until the market can get a clear picture from the U.S. Federal Reserve.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week In FX Asia: Abenomics - Investors’ Reckoning Fuelled By Hope

Published 09/13/2013, 01:29 PM

Updated 07/09/2023, 06:31 AM

Week In FX Asia: Abenomics - Investors’ Reckoning Fuelled By Hope

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.