This week the Japanese government approved a $182 billion package to follow through on Prime Minister Shinzo Abe’s goal of reaching 2 percent inflation in 2 years. The first arrow of the Abe plan has been successful so far. The Bank of Japan has pledged to double the monetary base and have delivered. The announcement earlier this year turned out to be one of the most pro-active actions from a Central Bank since. In a year where there was a lot of rhetoric and back tracking, the BoJ deserves a lot of credit for their actions.

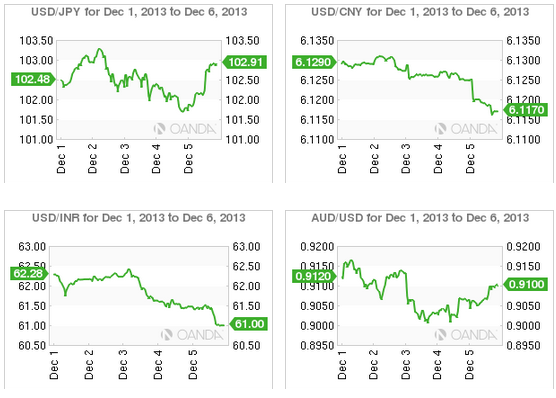

The effect in the Yen was almost immidiate to the point that it sparked another round of “currency war” comments from emerging market economies. The G7 stood by Japan and dismissed manipulation claims. So far so good for Abe, but his other two arrows have not been as effective. Fiscal flexibility and structural reforms have struggled due to internal political pressures.

The package announced this week is intended to reassure markets that Abe will continue to push a growth strategy coupled with structural reforms. There are question marks about how effective the $55 billion package can be. The headline number of $182 billion includes government loans and local government budgets which is nothing new. So far the move is seen as a positive, but if it needs to deliver on its 1% growth boost and job creation goals.

The stimulus package is also a way to offset the effects of the sales tax that will be introduced next year. The tax increases is a much needed move to reduce Japan’s debt burden. In order to compensate for the potential hit to consumption that a higher sales tax will have Abe needed to introduce this package.

The fall in the yen, which is a boon for an exporting nation like Japan, has benefited corporate Japan but so far corporations have not raised wages. This week Japanese corporations have increased capital spending in the third quarter which was stagnant before and could signal wage increases if the momentum is maintained.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week In FX Asia: Japan’s $182 Billion Package To End Deflation

Published 12/06/2013, 02:58 PM

Updated 03/09/2019, 08:30 AM

Week In FX Asia: Japan’s $182 Billion Package To End Deflation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.