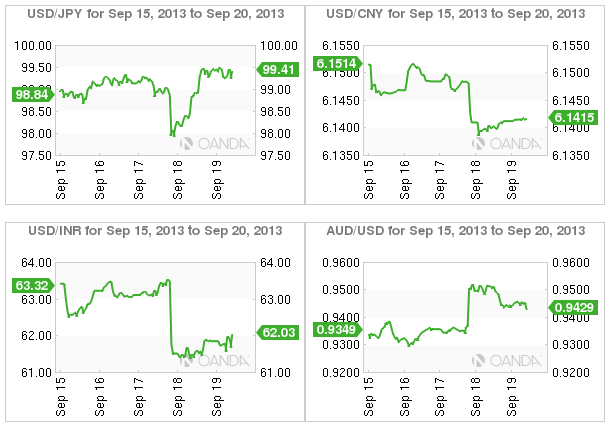

Asian markets are heading into their weekend still coming to terms with the Fed’s surprise “no” taper announcement this week. Emerging market currencies have received some of the largest support while the dollar has returned to familiar territory just shy of the ¥100 psychological barrier.

The Japanese press is reporting that Japan’s PM Abe is said to have decided to proceed with raising consumption tax from 5% to 8% in April as previously scheduled. The government is expected to implement ¥1.4T worth of corporate tax cuts as part of a previously announced stimulus plan and consumption tax hike.

A drastic tax cut is deemed necessary. By lowering the country’s high effective corporate tax rate (38.01%) down to a level on par with other nations, PM Abe hopes to improve the financial strength of companies. These companies are then expected to increase wages and salaries to help improve consumption.

Finance Minister Aso remains reluctant to approve corporate tax cut as proposed by Abe. He is concerned that ending reconstruction tax on businesses “could rouse discontent in disaster-hit areas and derail any efforts to half the nation’s primary balance deficit in fiscal 2015.”

However, Abe plans to make a final decision on October 1st. The government is currently trying to agree on a +¥5t economic package to prevent the tax hike from causing the Japanese economy to falter.

The benefits of Abenomics weak currency policy are already been seen. Japan’s trade deficit has eased and exports are growing the most since 2010. Japan’s trade deficit eased to -¥960.3b in August while exports grew +14.7%, yoy in the same month.

Much has been made about the damage a planned sales tax would do to Japanese confidence and growth. The nation is forecasted to grow +2.8% in the fiscal year to March 2014. While growth is expected to slow to +0.7% in the following fiscal year as the first sales tax reduces consumer spending.

The USD/JPY rally since Thursday’s FOMC decision is being blamed on the markets rush to sell yen to fund ‘carry.’ All it has basically done is increase the already large short yen spec positions. The pair is currently straddling pre-FOMC levels. Due to the depth of yen shorts across the board further weakness will be a “grind”. On the flipside, the lack of more dollar buyers could weaken support and squeeze some weaker yen shorts out of their current positions.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week In FX Asia: Yen Weakness Remains

ByOANDA

Published 09/20/2013, 06:49 AM

Updated 03/09/2019, 08:30 AM

Week In FX Asia: Yen Weakness Remains

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.