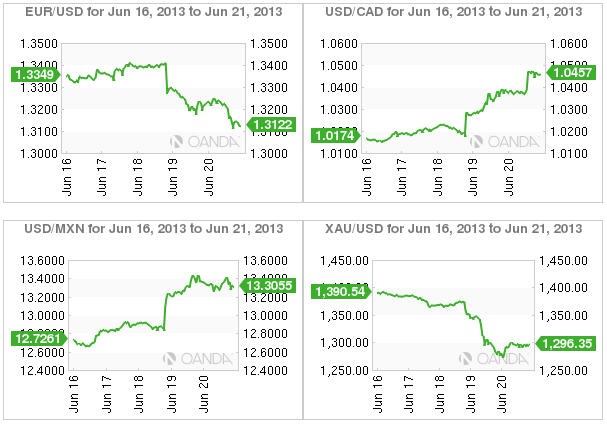

Finally, someone is looking to ‘lean on the loonie’. This currency is only now trying to play catch up with its antipodean foes -the Aussie and the Kiwi. Both of those currencies of late have found fault with their largest trading partner, China, and with their own strong correlation relationship with commodity prices. The currency pairs have lost -10% in the past month alone. Mind you, the respective central banks rhetoric has also been allowed to lend a directional helping hand.

In Canada, Friday’s domestic story was the weaker than expected inflation (+0.2%) and retail sales reports (-0.3%). With the lack of other fundamental data published Stateside, softer numbers have managed to lead the CAD astray, just shy of 1.05. Not helping the loonies’ plight is the recent “spat of market volatility and sentiment” that has been driven by the Fed’s transparent thoughts and copy this week.

Soft inflation (+1.1% vs. an expected +1.2%) is not just a Canadian issue; it’s a global one. This number should not be a huge shock for the new BoC Governor Polaz, who politely declined to comment on the Bank’s 14-month tightening bias at his first press conference this week. However, the inflation surprises continue to run to the lower side of expectations this year. Analysts have already noted that there is no new timetable for the BoC rate hikes due to the Fed’s recent moves. Today’s data again confirms that the BoC should remain on hold until H2 of next year at least.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week in FX Americas: Go On, Lean On The Loonie

Published 06/21/2013, 01:18 AM

Updated 07/09/2023, 06:31 AM

Week in FX Americas: Go On, Lean On The Loonie

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.