Thankfully the longest Central Bank goodbye is finally over. Now officially the ex, Mark Carney should be vacating Canada’s Central Bank’s Ottawa building this weekend, handing his key pass over to Stephen Poloz, the new BoC Governor before he makes his way across the pond where he will officially take the reins as the Governor of the Bank of England on “Canada Day” (Nice touch!).

Outgoing BoE Governor, Mervyn King officially presides over his last rate meeting next week. The rest of the Canadian Market can now get back to watching economic fundamentals rather than reading about the first foreign national BoE Governor’s shortcomings in the English press.

On Friday the Canadian economy beat expectations for Q1, growing at the fastest pace in six-quarters, supported by the best exports gain in nearly two-years (+1.5% and five times faster than imports). GDP grew at +0.6%, q/q or +2.5% annually, just beating its largest trading partner’s expansion figure of +2.4%. The market consensus call was for a growth rate of +2.3% where as the BoC had projected a +1.5% expansion in April’s Monetary Policy report. Final domestic demand rallied +0.1% in Q1 (slowest pace in 4-years), as consumer spending and business investment weakened (another global phenomena) while the Harper government spending remained unexceptional.

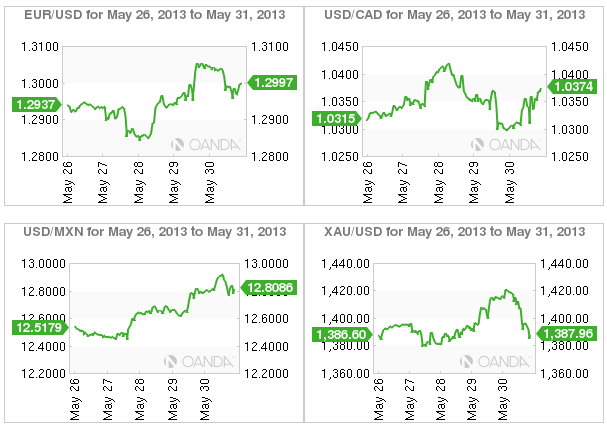

The loonie remains relatively active in a modest range, predominately pushed by month end requirements and excess oil dollar selling. Short-term dollar resistance remains close to 1.0385-90 with dollar support sub-1.03 at 1.0265-70.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week In FX Americas – Carney: No Loonie No More

Published 06/02/2013, 04:21 AM

Updated 07/09/2023, 06:31 AM

Week In FX Americas – Carney: No Loonie No More

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.