Market movement yesterday was distinctly subdued, and a quiet Asian session overnight has continued the rather uneventful week for currency markets overall. USD was the main gainer yesterday, as markets maybe became a little more nervous as to what the Fed may end up doing next Wednesday. Tapering chatter is once again the only topic that matters, it seems.

We had hoped that yesterday’s initial jobless claims numbers would furnish us with some further clarity over the state of the US jobs market. This was not to be, however. According to the compilers of the survey, a computer malfunction in 2 states – as yet unnamed – fouled up the number. There is no way of telling just how the wrong the number of 292,000 we received is. We will have to wait until next week for another go. For those that care, 292,000 would have represented the lowest level of claims since March 2006.

Yesterday may have signalled that the nascent recovery in the eurozone is already in trouble. The eurozone industrial production fell in July by a surprising 1.5%, against the -0.1% predicted. It is clear that the eurozone has a long way to go to shake off the pernicious effects of recession. Big falls were seen in Germany (-2.3%), Ireland (-8.7%), Greece (-2.8%), and Portugal (-3.2%) through the month of July.

Combined with slips in consumer confidence in eurozone economies, and the impact that will have on consumer spending, a fall in industrial production will only heighten chances that Q2 growth was temporary and a dip below the zero bound level in Q3 is on the cards.

Elsewhere in the eurozone, unemployment in Greece continues to drive higher, moving to 27.9% in June, up from 27.6% in May. Youth unemployment is currently running at 58.8%. Both measures seem to show no sign of slowing down – overall unemployment has increased in Greece by 3% in the past year.

The GBP has managed to maintain its recent strength against the greenback, after the testimony by Dr Mark Carney and other members of the Bank of England’s Monetary Policy Committee in front of the UK parliament’s Treasury Select Committee. The premise of the meeting was to go over the details of the Bank of England’s Quarterly Inflation Report, released last month, and, as a result, flesh out the Bank’s thoughts on all manner of monetary policy and economic issues – jobs, housing, average pay, growth to name but a few.

His view on the state of the economy was very much in keeping with ours; short term pick-ups in data are welcome, “but it’s early days and it’s a long way to get back to the potential of this economy.” Far from the chummy bonhomie of his previous confirmation hearing, yesterday was a test for the Governor as the assembled MPs attempted to draw the Governor forward on whether the housing market represented a bubble (“vigilance is needed”), and if the economy had turned a corner “It’s early days”. It will be key to see if the communication of forward guidance and the inherent lower rates leads to lower rate expectations or not.

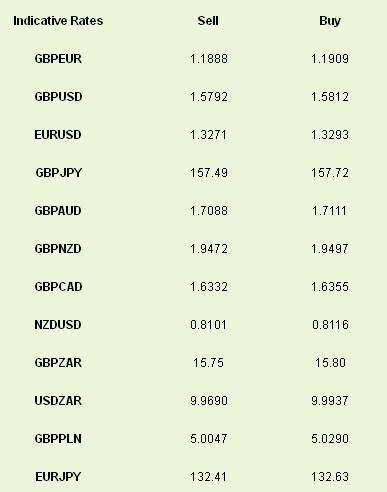

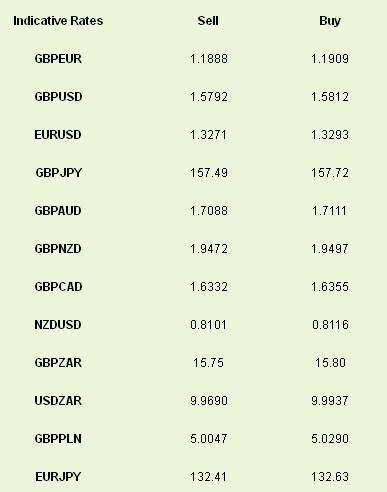

The GBP used to fall every time previous Governor Sir Mervyn King opened his mouth; it seems to have the opposite relationship with Dr Carney as the market continues to disobey his wishes for anchored rate expectations. GBP/USD remains close to 1.58 while, GBP/EUR is back near 1.19.

Further support for our recovery could be seen in construction output numbers due at 09.30 BST. The market is looking for an expansion of 2.1% in July. This afternoon we get the latest retail sales data from the US which should show a decent 0.5% increase, whilst PPI should show factory gate inflation remains benign across the Atlantic.

We had hoped that yesterday’s initial jobless claims numbers would furnish us with some further clarity over the state of the US jobs market. This was not to be, however. According to the compilers of the survey, a computer malfunction in 2 states – as yet unnamed – fouled up the number. There is no way of telling just how the wrong the number of 292,000 we received is. We will have to wait until next week for another go. For those that care, 292,000 would have represented the lowest level of claims since March 2006.

Yesterday may have signalled that the nascent recovery in the eurozone is already in trouble. The eurozone industrial production fell in July by a surprising 1.5%, against the -0.1% predicted. It is clear that the eurozone has a long way to go to shake off the pernicious effects of recession. Big falls were seen in Germany (-2.3%), Ireland (-8.7%), Greece (-2.8%), and Portugal (-3.2%) through the month of July.

Combined with slips in consumer confidence in eurozone economies, and the impact that will have on consumer spending, a fall in industrial production will only heighten chances that Q2 growth was temporary and a dip below the zero bound level in Q3 is on the cards.

Elsewhere in the eurozone, unemployment in Greece continues to drive higher, moving to 27.9% in June, up from 27.6% in May. Youth unemployment is currently running at 58.8%. Both measures seem to show no sign of slowing down – overall unemployment has increased in Greece by 3% in the past year.

The GBP has managed to maintain its recent strength against the greenback, after the testimony by Dr Mark Carney and other members of the Bank of England’s Monetary Policy Committee in front of the UK parliament’s Treasury Select Committee. The premise of the meeting was to go over the details of the Bank of England’s Quarterly Inflation Report, released last month, and, as a result, flesh out the Bank’s thoughts on all manner of monetary policy and economic issues – jobs, housing, average pay, growth to name but a few.

His view on the state of the economy was very much in keeping with ours; short term pick-ups in data are welcome, “but it’s early days and it’s a long way to get back to the potential of this economy.” Far from the chummy bonhomie of his previous confirmation hearing, yesterday was a test for the Governor as the assembled MPs attempted to draw the Governor forward on whether the housing market represented a bubble (“vigilance is needed”), and if the economy had turned a corner “It’s early days”. It will be key to see if the communication of forward guidance and the inherent lower rates leads to lower rate expectations or not.

The GBP used to fall every time previous Governor Sir Mervyn King opened his mouth; it seems to have the opposite relationship with Dr Carney as the market continues to disobey his wishes for anchored rate expectations. GBP/USD remains close to 1.58 while, GBP/EUR is back near 1.19.

Further support for our recovery could be seen in construction output numbers due at 09.30 BST. The market is looking for an expansion of 2.1% in July. This afternoon we get the latest retail sales data from the US which should show a decent 0.5% increase, whilst PPI should show factory gate inflation remains benign across the Atlantic.