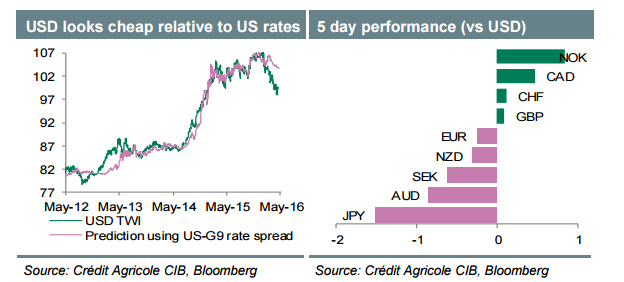

The deviation of USD from levels that are consistent with gauges of the relative Fed hawkishness like the spread between US 2Y rates and the G9 average has widened to record levels recently. The USD is cheap and we believe that some of the factors that have driven the currency’s undervaluation may be starting to abate. In particular, global economic and financial conditions could remain supportive while upcoming US data could confirm that the end of the ‘soft patch’ is drawing near.

Another reason for the USD to lag behind US rates seems to be the recent drop in US real rates and bond yields as inflation continues to accelerate, and the Fed still seems willing to let the economy run hotter for longer. Next week’s CPI data and the April Fed minutes will therefore attract considerable attention. Evidence that the persistent inflation pressure did not go unnoticed at the FOMC could help push up US nominal (and real) yields, burnishing the USD appeal once again.

One potential risk to our constructive USD-view could be the G7 meeting of finance ministers and central bankers in Tokyo on 20 and 21 May. The US Treasury has stepped up its criticism of competitive devaluation recently and we expect more of the same from the Treasury Secretary next week. USD may thus struggle to outperform the currencies of the US main trading partners – EUR and JPY. We are more comfortable calling for sustained USD appreciation against AUD.

Elsewhere, the gradually diminishing global excess supply of oil has kept CAD and NOK well supported. In addition, the announcement of aggressive fiscal stimulus programmes alleviated some of the pressure on the BoC and the Norges Bank to ease further, helping the two oil currencies. All that said, next week’s Canadian CPI and retail sales data could put the CAD-bounce to the test if it signals that the recent FX appreciation has dampened inflation while domestic demand waned.

Investors will also focus on next week’s UK inflation, labour market and retail sales data releases. Further evidence that the economy is slowing under the weight of growing uncertainty about Brexit that could keep GBP on the defensive.

In terms of trades we went long SEK and short JPY. In both cases against the EUR*, which should remain range-bound on the back of stable ECB expectations.

*This trade is recorded, tracked, and updated in eFXPlus Orders.