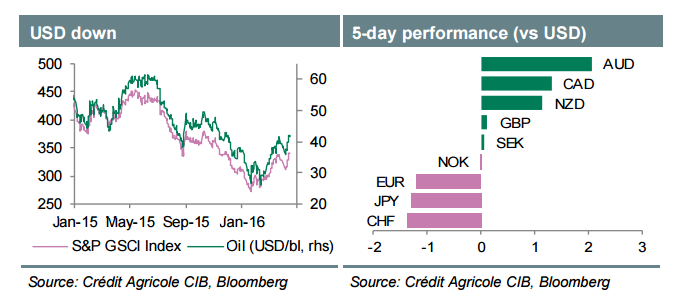

These are happy days for G10 commodity currencies. Global commodity prices are recovering as fears about a hard landing in China and the oil-supply glut are abating. Also, the February G20 meeting in Shanghai seemingly put an end to the global currency war and the Fed launched the ‘Yellen Put’ in March. We have repeatedly highlighted the risks to that view – ranging from persistent downside risks to global growth, to our belief that the global currency war is merely pausing. We further suspect that the Fed cannot ignore the return of inflation for too long and may have to abandon the ‘Yellen Put’ in coming months.

Another important driver of the rally in the G10 commodity currencies is market hopes of a deal to freeze global oil output at the meeting between OPEC and non-OPEC producers in Doha on 17 April. We fear that a ‘Doha deal’ may not reduce the imbalances in the oil market, however. Demand concerns could persist, given ample inventories, while oversupply fears are lingering in view of growing Iranian production and a potential stabilisation of US shale oil output.

The above considerations may seem like less imminent risks to a well established market view so the resilience of the G10 commodity currencies could persist for now.

Given that a correction may be a matter of days away, however, on the back of a disappointing Doha deal or evidence that the global currency war is staging a return, we advise against chasing the rally in CAD and NOK. AUD may prove more resilient but mainly vs EUR, GBP and JPY. We are calling for further outperformance of SEK ahead of the April Riksbank meeting, where we expect unchanged policy and an upgrade to the inflation outlook.

We maintain a fairly constructive view on USD over the longer term but recognise that it would take tangible evidence of a rebound in US economic activity and inflation to see sustained USD gains. We believe that the JPY rally has reached a turning point and expect the BoJ to announce more aggressive easing on 28 April.

EUR has come off its highs and should not feature prominently at the April ECB meeting. While this may encourage some EUR buying,we prefer to express any more constructive EUR view against other funding currencies like JPY. The longer-term risks for EUR remain to the downside, however, given that potential risks from the UK’s EU referendum or Greece are still to be priced in by the FX markets.