- US inflation report to take centre stage as dollar remains well bid.

- China’s economic policies to come under scrutiny as Q4 GDP on tap.

- UK CPI and GDP figures to be watched as pound’s pain worsens.

US CPI Likely to Stay Hot for Now

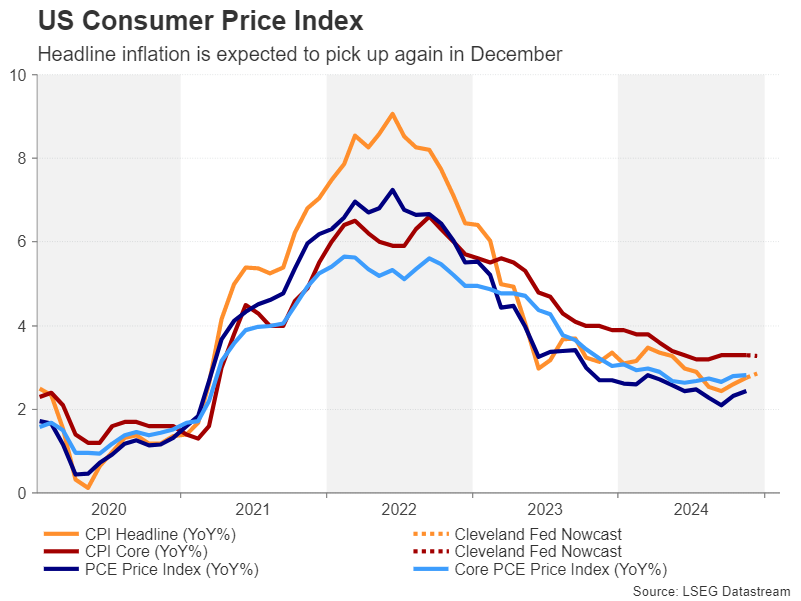

The Fed made little progress on inflation in 2024, with most measures ending the year only marginally below where they started. Policymakers had been hoping that inflation would be settling closer to 2.0% by now but the persistence of upward price pressures has seen the convergence take place nearer 3.0%.

Yet, as the Fed shifts its stance to a more cautious one, there were some encouraging signs in the November CPI report that the price increases within the shelter and the broader services categories, which have been the biggest contributors to the stickiness in inflation, have started to temper.

This makes a downside surprise on Wednesday not improbable, but any slowdown is more likely in the first few months of 2025 than in December. Analysts expect CPI to have increased by 0.3% month-on-month, which is less than the 0.4% gain predicted by the Cleveland Fed’s Inflation Nowcast model. According to the latter forecast, annual CPI rose by 2.9% from 2.7% in November.

The Nowcast estimate for year-on-year core CPI is 3.3%, unchanged from the prior month.

With markets already pricing in less than two 25-basis-point rate cuts for the whole of 2025, a strong report may not necessarily generate much reaction in Fed fund futures and merely underscore the US dollar’s latest advances. However, if the CPI readings miss the forecasts, the dollar would be vulnerable to a notable selloff.

Retail Sales Also on Investors’ Radar

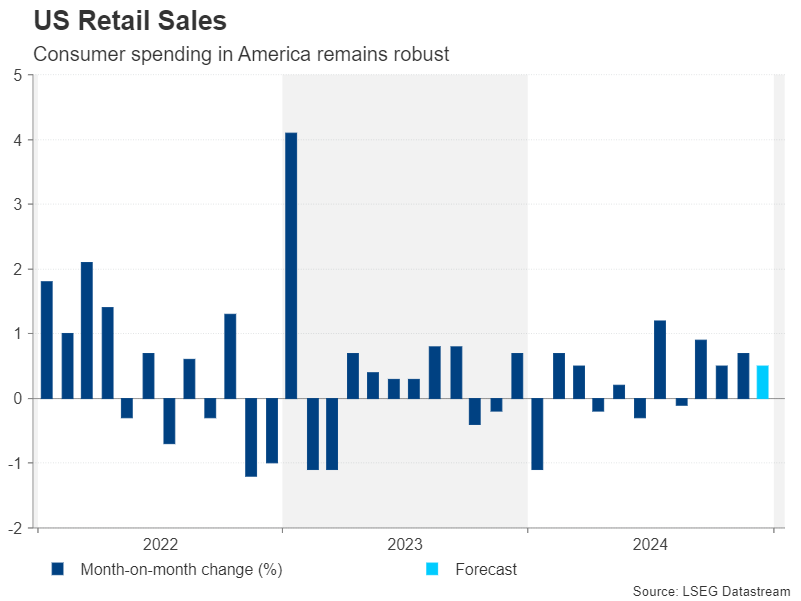

Prior to the CPI data, investors will be watching December’s producer price index on Tuesday, while on Thursday, all eyes will be on retail sales.

Despite a cooldown in the labour market, the US consumer appears to have finished the year unscathed and retail sales are expected to have risen by 0.5%, moderating slightly from November’s 0.7% pace.

Other releases include the New York and Philadelphia Feds’ manufacturing gauges on Wednesday and Thursday, respectively, as well as building permits and housing starts on Friday. Industrial production numbers for December are also due on Friday.

Chinese Growth Probably Accelerated in Q4

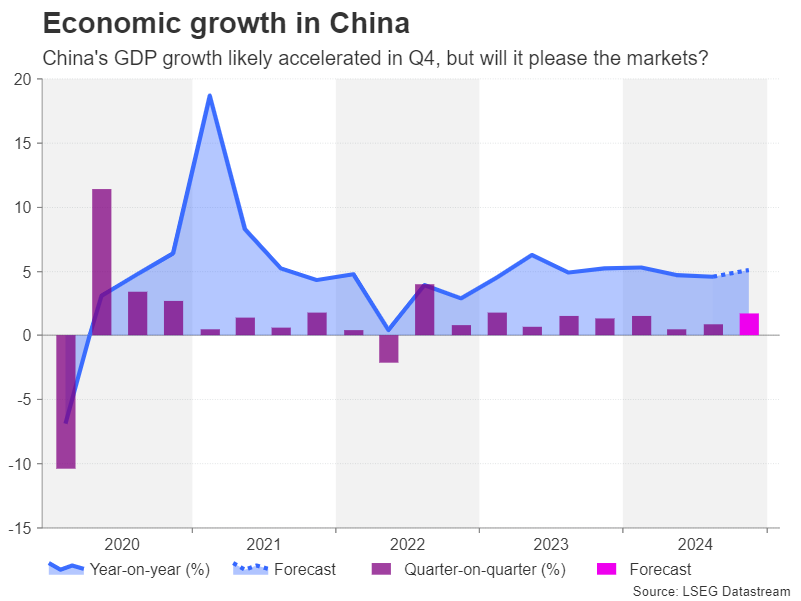

As the Fed battles a strong economy and stubbornly high inflation, Chinese authorities are grappling with the opposite problem – deflation and growth stuck in the slow lane. However, after numerous policy announcements by Beijing over the past year aimed at kickstarting the economy, it is expected that GDP growth picked up some gear in the fourth quarter, rising by 5.1% y/y versus 4.6% in Q3.

The GDP report is out on Friday and will be accompanied by the December readings for industrial output and retail sales, as well as a press briefing explaining the data. Ahead of all that, the spotlight will be on monthly trade figures on Monday.

With the yuan depreciating by more than 4.5% against the dollar since the end of September, Chinese officials will likely try to paint an upbeat picture of the economy to prevent the currency coming under further selling pressure, particularly if the numbers are weaker than projected.

However, in the event that GDP grows more than expected in the final three months of 2024, global equities and risk-sensitive currencies such as the Australian dollar are likely to benefit from any ensuing improvement in market sentiment.

Aussie traders will also be tracking Australian employment stats that are due on Thursday.

Surging Yields Come Back to Haunt Sterling

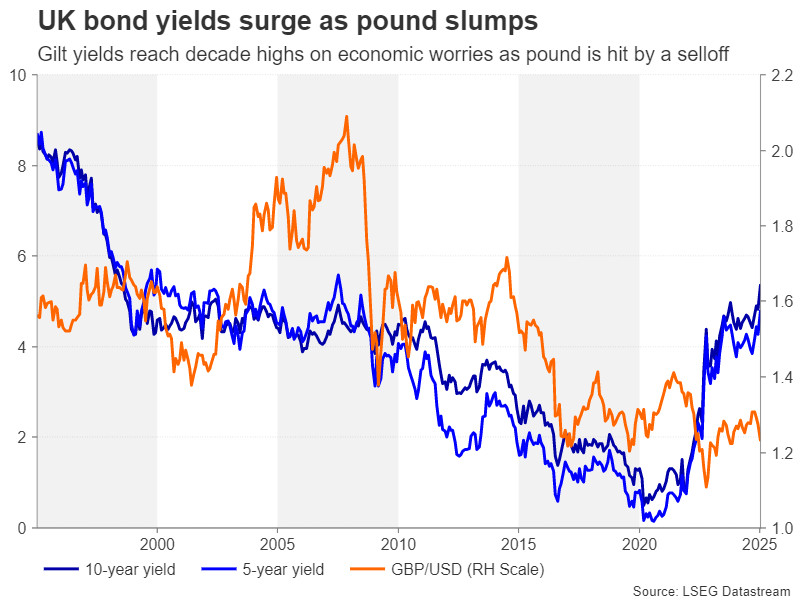

The pound has taken a battering in the past week, slipping to more than one-year lows against the US dollar. Whilst the greenback’s latest upswing is a big factor, sterling has been targeted by investors much more so than other major currencies amid renewed concerns about the UK government’s finances.

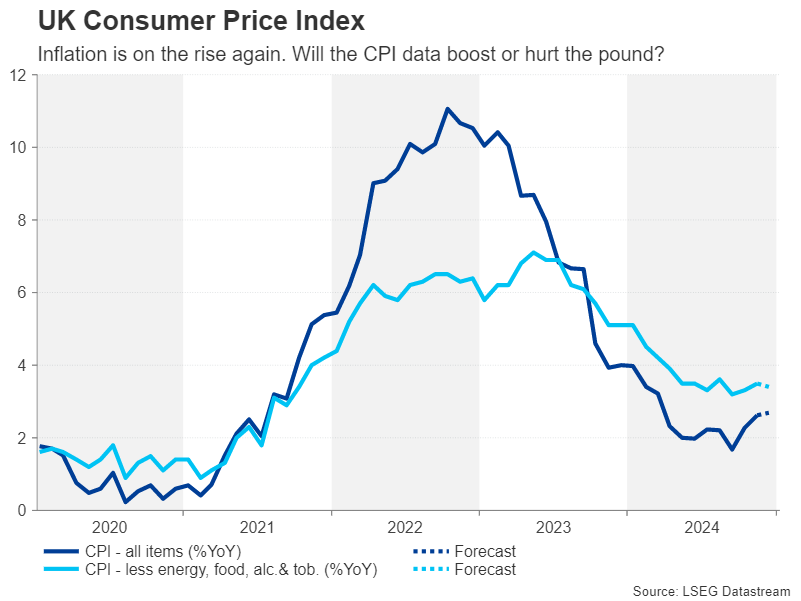

The pound, along with the euro, has been mired by stagflation fears lately. The UK economy has barely grown since the summer and inflation has started to edge up again. The situation worsened when Labour won the general election in July. Not only did the record tax increases announced in the Autumn budget do little in tackling the growing deficit problem, but the government’s tactic of talking down the economy to justify the ‘tough decisions’ went too far, denting investors’ confidence in Britain’s economic prospects.

Subsequently, UK government bond yields have been creeping up again, with the 10-year yield reaching levels last seen during the 2008 financial crisis. A spike in yields at a time when government borrowing is deemed to be too high tends to hurt the currency rather than boost it as it exacerbates the cost of financing new debt.

UK Data Barrage to Decide Pound’s Fate

Next week’s data could be crucial in either stemming the bleeding or intensifying it. The CPI figures are up first on Wednesday. The headline rate had jumped to 2.6% y/y in November and a further increase in December would dent expectations of a rate cut by the Bank of England at its February meeting. The core and services CPI rates will also be monitored closely.

However, as far as the pound is concerned, investors may prefer to wait for Thursday’s GDP numbers before responding in case there was a rebound in growth in November. A bounce back in monthly GDP would ease stagflation concerns and combined with a hot CPI report, the pound could recover some lost ground.

The British currency will be put to the test again on Friday when the latest retail sales data is released. Any unexpected decline in retail sales in December during the vital Christmas period would not bode well for the outlook, adding to sterling’s woes.