THINK Ahead in Developed Markets

United States

- Given the backdrop of 3% growth, low unemployment, equity markets at all-time highs, and inflation still above 2%, you could be forgiven for questioning why the Fed cut rates 50bp and why the market expects the Fed to cut rates down to 3%. Those questions could intensify over the coming week.

- GDP (Wed): Resilient consumer spending should power a second consecutive 3% GDP print next week. High-income households are going from strength to strength, but lower-income households are feeling more pain as inflation’s legacy hurts spending power much more. Residential construction should also be a bit of a drag, while business capex looks to be running fairly weak.

- Core PCE Deflator (Thu): Core CPI rose 0.3% MoM in September and the market is split as to whether we will get a 0.2% or a 0.3% reading for the Fed’s favored core PCE deflator measure of inflation. Based on the inputs from CPI and PPI, the general sense is that we will get something around 0.24-0.26%MoM. 0.3% would obviously be visually less palatable and would keep the YoY rate up at 2.6%. Muted MoM prints from October to December last year mean, at best, we are likely to see the annual inflation rate end the year in a similar place.

- Jobs Report (Fri): After last month's sizeable 254k increase, the consensus is looking for a weaker outcome this time around. The weather will play a part, with hurricanes in the South East impacting workers’ ability to get to their place of employment. Likewise, the strikes at Boeing (NYSE:BA) will weigh on the payroll number, with likely knock-on effects on suppliers. Consequently, we see the risk of a slight downside miss to the consensus. We forecast a 100k increase with the unemployment rate ticking up to 4.2%. Wage growth should also be more muted after a surprise 0.4% MoM jump in September.

United Kingdom

- Budget (Wed): Chancellor Rachel Reeves has little choice but to increase day-to-day spending on government departments. That inevitably means higher taxes, potentially centered on employers. Higher investment is coming toom, but we expect this boost to be more modest as the Treasury seeks to avoid a steep increase in borrowing that might unsettle markets.

THINK Ahead for Central and Eastern Europe

Poland

- Flash CPI (Thu): We forecast that CPI inflation increased further in October amid higher annual growth in fuel prices (low base from October 2023) and a continued rebound in food prices. At the same time, core inflation remains elevated (above 4%YoY). Rising inflation is the key factor preventing the NBP from starting the monetary easing cycle.

Hungary

- GDP (Wed): According to our short-term forecast, the Hungarian economy is experiencing another technical recession, following a previous one in late 2022-early 2023. The economic challenges are mainly attributed to the negative impact of agriculture due to a high prior-year base and adverse weather conditions this year, coupled with declining output in industry and construction in 3Q24. If we are right, this will lead to significant downward revisions to growth forecasts for 2024 and 2025.

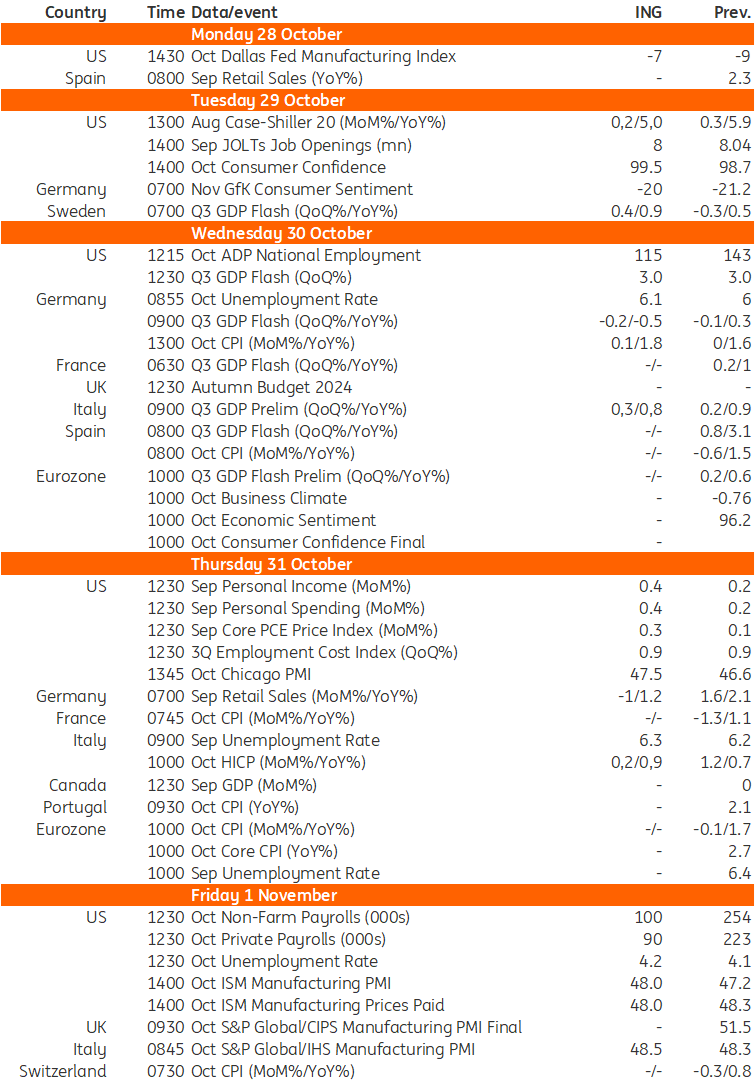

Key Events in Developed Markets Next Week

Key Events in EMEA Next Week

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more