There is no doubt that this week will be all about trade policy. But we still have a couple of economic reports, and Q1 earnings begin on Friday.

For economic data:

Tuesday: NFIB small business optimism index (101.3 expected)

The street expects a small increase over last month and I doubt the data will include responses after last weeks policy announcement. We’ll probably have to wait until next month, to get the full response of small business owners to these new policies.

Small business optimism soared after the election. As owners looked forward to reduced regulations and taxes. It remains above the long-term average but probably won’t stay there for long if there is no policy relief.

Thursday: Consumer Price Index (CPI) inflation (+2.6 y/y expected)

This will clearly be the most important data point of the week. CPI is expected to fall to 2.6% y/y, from +2.8% previously. The sharp fall in oil prices after the tariff announcement may put downward pressure on headline inflation for a while.

But core prices are expected to increase at a faster rate (+0.3% for the month, after +0.1% previously). So don’t be surprised to see y/y core inflation heat up while headline inflation cools down. Just another headache in this very complicated market dynamic.

Friday: U of M Consumer Sentiment (preliminary) (54.0 expected)

Consumers are as pessimistic as they have ever been and so far its been a self fulfilling prophecy. Sentiment has fallen 10%+ for the last 2 months, and Aprils forecast is for another decline in the range of 5%.

Earnings

12 ((166|S&P 500}} companies report earnings this week. Q1 kicks off on Friday, as JPMorgan (NYSE:JPM), BlackRock (NYSE:BLK), Morgan Stanley (NYSE:MS), and Wells Fargo (NYSE:WFC) report results.

For those looking for clarity on forward guidance when these companies start reporting, I wouldn’t get your hopes up. On the contrary, I expect companies to either increase the range of their forward estimates or remove them altogether.

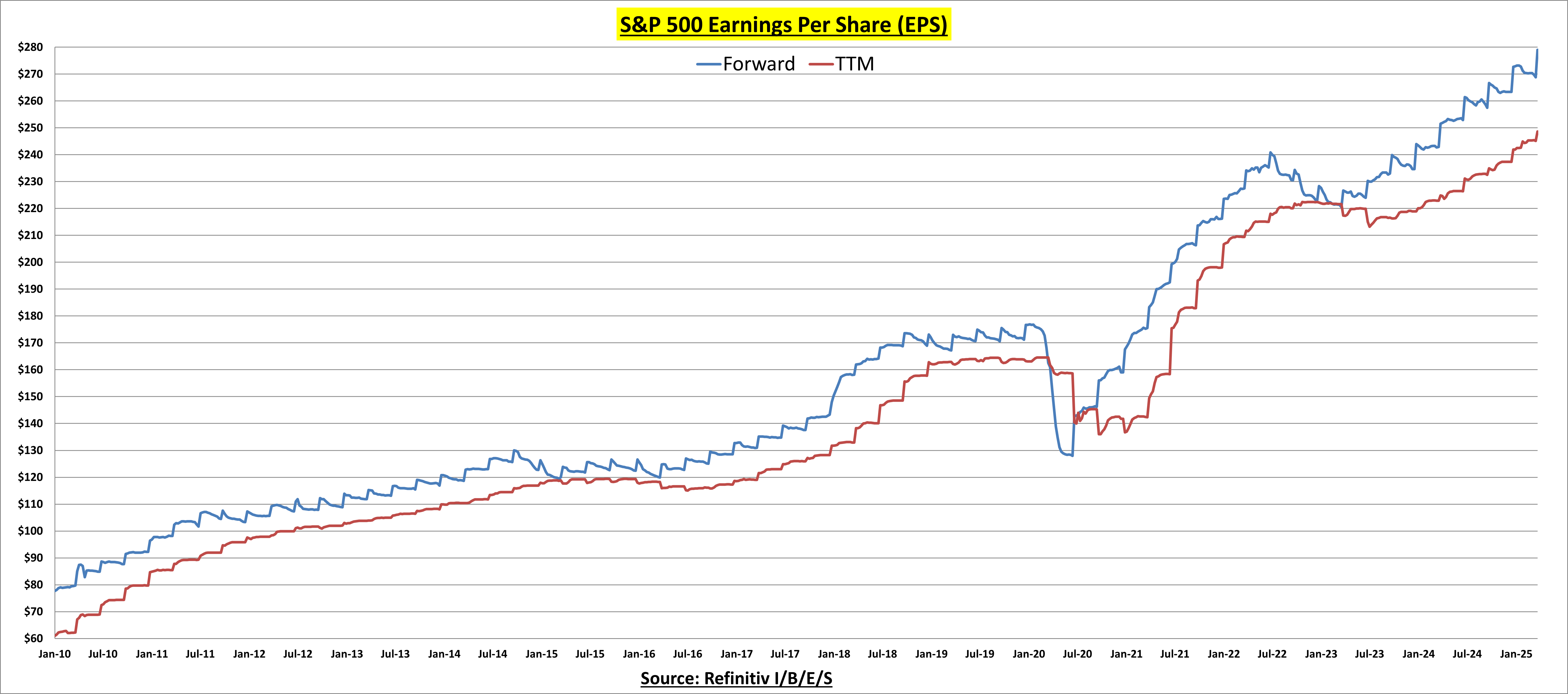

S&P 500 companies have reported a combined $248.66 in EPS over the last twelve months (TTM) while the street expects $278.96 in EPS over the next 12 months (forward), for a 12.2% growth rate.

The problem with forward estimates is that they aren’t reliable during times of high uncertainty. Expect major revisions to come.

Now that Q4 earnings are in the rearview, we can review the progress. Earnings grew 17.1%, well above the recent average of 11.5%.

Sales grew 5.2%, slightly below the recent average of 6.5%.

73.5% of companies’ results came in better than expected (vs. 76.2 avg)

And results came in a combined 6.9% above expectations (vs. 8.3% avg)

The forward PE is still about 7% above the long-term average, while the trailing PE is still 9.5% above average.

The price-to-earnings growth (PEG) ratio is now 1.5x

Barring a trade compromise, I don’t expect the market to bottom until we get into the 4630-4820 zone highlighted on the chart above. And who knows if that will even be enough to hold it.

But there is a lot of confluence around there. The midpoint of the rally off the 2022 lows is around 4800. 4820 would match the size of the 2022 bear market in terms of points. Along with the “valuation reset” targets I mentioned in prior posts.

I would like to see the volatility index or VIX spike above the August 2024 high at 65. That could be a signal of at least a short-term capitulation.

Interest rates on the 10-year treasury fell below 4% this week, as investors anticipate slower economic growth and/or flight to safety from the volatility of stocks.

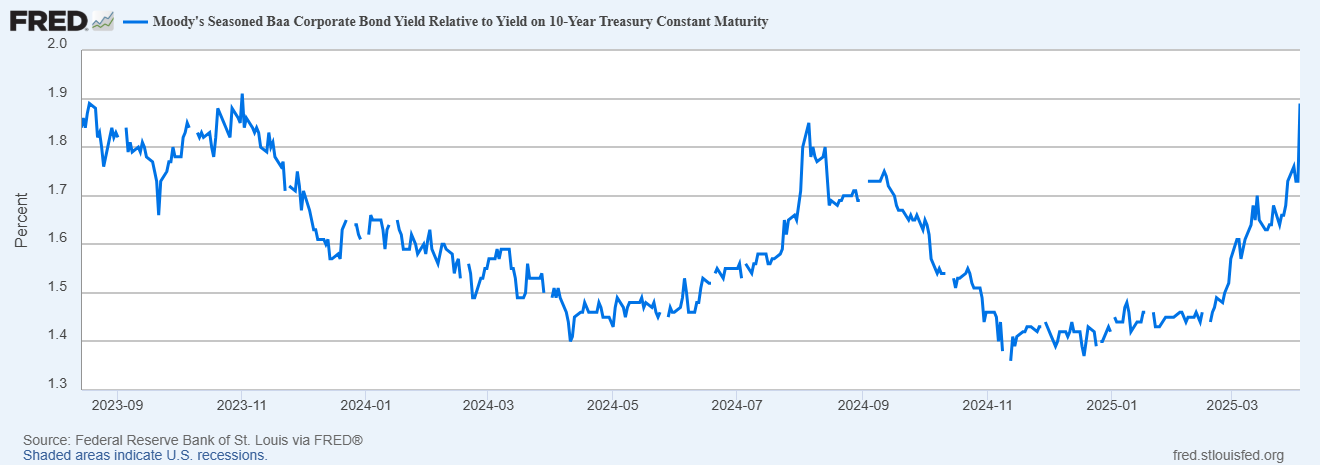

Credit spreads are starting to show signs of stress as both high yield and investment grade bond spreads are now above the 2024 highs after the Japanese Yen volatility spike. They remain in decent shape as of now but are trending in the wrong direction.

The US dollar had a wild week. Falling as much as 2.5% on Thursday, although regaining much of it to end the week.

The administration clearly wants lower interest rates and a lower dollar. Be careful what you wish for.

Bottom line: The only thing that matters is trade policy. If we get some hope that this “solution” can be reversed or amended, then markets will go up. But if not, its probably going to be ugly for a while. The inflation numbers will bring with it a variety of possibilities. I suspect that will be the next battle, but we’ll cross that bridge when we come to it.