Central bank rate decisions, national elections, trade data and if that was not enough next week will close with the biggest indicator in forex, the non farm payrolls report. Let us not forget that the headline grabbing situation in Greece is still an ongoing concern and it all adds up to a memorable week in the FX market.This week the USD resurged after disappointing data had reduced demand for the greenback. The Federal Reserve put it a good word about their confidence that current weakness is temporary which is driving the dollar.

Tuesday May 5 – 12:30am Cash Rate RBA Rate Statement

RBA Caught Between Strong AUD and Housing Bubble

The Reserve Bank of Australia (RBA) will announce its interest rate decision on May 5 at 12:30 am EDT. The RBA has faced a constant battle to depreciate the AUD in order to remain competitive in global exports. Interest rate cuts and verbal intervention have been used pro actively by central bank Governor Glenn Stevens to keep the Aussie from rising higher as the interest rate is Australia is still an attractive 2.25 percent. The central bank held rates on the last meeting prompting economist to increase the probability of a rate cut in the meeting this month. The market is divided in its expectations from what once was an almost unanimous forecast of a rate cut in May.

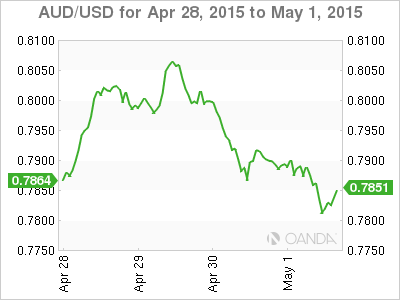

The AUD/USD has been boosted by the rise in prices of iron ore and a struggling USD. The rate differential has given the Australian currency more demand along with the rise of commodities. The USD has regained some of the ground lost as the U.S. economy got a somewhat confident endorsement from the Federal Reserve. Central banks continue to drive the FX market and the RBA will be in focus as it announces its rate decision next week to be followed by employment and economic forecast data. This will be an interesting week for Aussie traders as data dependancy is on the rise.

Tuesday May 5 – 8:30am CADTrade Balance

Canadian Trade Balance Deficit to Narrow But Volumes a Concern

The deficit between exports and imports narrowed in February in Canada to 1 billion. The March deficit is forecasted to be lower as the effect of a weaker CAD continues. The estimate of a -0.6 billion gap will be a good sign, but some concerns have been raised about the declining volumes of both exports and imports. Energy exports have suffered as the price of oil hit a slump as the supply glut worsened only to recover in the last month. The Canadian economy has not found a way to transition away from its energy exporting dependancy and a worse than expected trade balance could signal further trouble for the loonie.

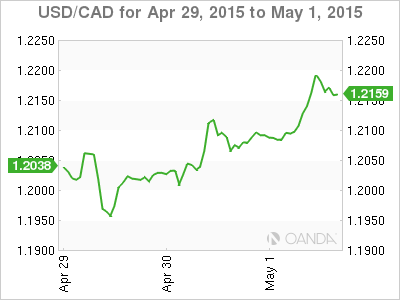

The USD/CAD was lower after U.S. economic data had disappointed but it has managed to get back on track after the FOMC statement was released. While not a glowing endorsement of U.S. economic strength it did not signal a change of course for the Federal Reserve whose members still see a benchmark interest rate hike later this year. The question of the timing has been left dependant on economic data. This adds some volatility to data releases and explains some of the enthusiasm for the U.S. unemployment claims release that marked the best week in 15 years boosting the USD against all major currencies. Canadian and U.S. employment figures will be released on Friday as the biggest economic indicator in forex, the non farm payrolls report is published at 8:30 am EDT.

Thursday May 7 – All Day UK Parliamentary Elections

UK Elections too Close To Call

The end is near in what turned out to be one of the closest election races in the UK. After a majority of voters cast their ballot supporting one of the two major parties, this election is witnessing a rise of the minor parties. In some surveys the balance still favours Labour and Conservatives, but gone are the days of their 95 percent combined share. Now as much of the third of the electorate is seeking a different alternative. This of course complicates matters when it comes down to forming a government. The election will be won by either Labour or Conservative but in such a tight race a ruling majority is out of the question. Labour leader Ed Milliband has ruled out reaching out to the Scottish National Party to form a government if they maintain their current lead in the polls over the Conservatives.

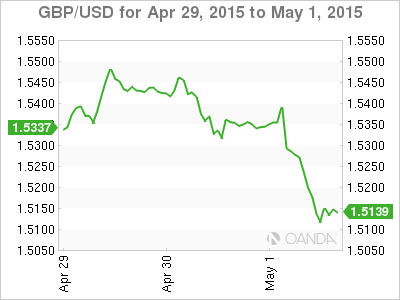

The GBP/USD has not been immune to political indecision. With softer data out of the United Kingdom the pound has struggled even against a weaker USD. The one month period ahead of the election has put the Bank of England in a “no comment” zone for fear of influencing the decision of British voters. The GBP/USD has broken the 1.52 price level awaiting important employment data out of the U.S. and the end of a close electoral race.

Friday May 8 – 8:30 am Non-Farm Employment Change

USD Awaits for NFP on Busy Week

Up until last month’s disappointing non farm payroll (NFP) report the U.S. dollar could count on the employment component to keep it bid. Economic data around American jobs was one of the few positive outliers as other indicators like retail sales and gross domestic product have failed to gain traction. The NFP report in March came in 100,000 jobs below expectations. The first under 200,000 in six months and the worst print since the report published in February that came it at 113,000. The Federal Reserve has stressed that the schedule of benchmark interest moves depends on economic data releases. After the softer NFP last month the expected timeline started to be pushed back from the June and September meetings and even further by some analysts.

The U.S. dollar is riding a wave started by the Federal Open Market Committee (FOMC) statement last Wednesday.

While not a glowing endorsement of U.S. economic strength, the FOMC did not signal a change of course from its current monetary policy, though Federal Reserve members still see a benchmark interest rate hike as being likely later this year. The question of the timing of a rate hike has remains dependant on economic data. This adds some volatility to data releases, and explains some of the enthusiasm for the U.S. unemployment claims release that marked the best week in 15 years, boosting the USD against all major currencies.

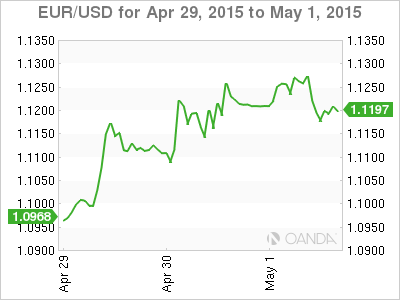

The FOMC endorsement and better-than-expected unemployment claims this week boosted the USD versus all major pairs except the EUR. The EUR/USD continues to climb and broke the 1.12 level recently. Major pairs like the USD/JPY march onward to the 120 level, and the Canadian loonie had its wings clipped at 1.20 to trade at 1.2120. The impact of strong employment is clear and as the NFP is published the USD will be immediately affected.