Last week’s Greek extension approval dominated the market and keep most pairs trading in a range awaiting the final decisions. After the release of approving statements the market could finally trade on economic fundamentals, which is why the release of the U.S. CPI triggered a dollar rally.

This week is jam packed with economic data releases from around the world culminating with the biggest indicator in the FX world, the U.S. non-farm payroll reports published on Friday.

Here is a list of the most important events in the forex market this week:

CNY HSBC Final Manufacturing PMI

The official Chinese PMI numbers were released earlier today with a positive outcome 49.9 although still under the reading of 50 that will constitute an expansion. The HSBC Manufacturing PMI data will be close with a 49.8 forecast. There is little surprises expected from this release as the market has already priced in a continued slowdown in Chinese Manufacturing. The People’s Bank of China cut one year lending rates by 0.25 percent on Saturday to further stimulate the economy.

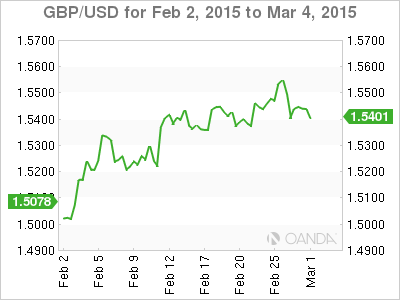

GBP Manufacturing PMI and Construction PMI

This week the two PMI numbers will be released. British Manufacturing PMI rose to 53.0 points in January, very close to the forecast of 52.9 points. UK construction PMI jumped to 59.1 points, up from 57.6 a month earlier. The GBP/USD continues to rally on the back of strong fundamentals and optimistic verbal intervention by the Bank of England. The manufacturing PMI is expected to come in close to 53 at no change, but still on expansionary territory. Construction is expected to come in lower if only slightly at 59.0. The market will be looking at these two leading indicators this week to get more insight into the state of the UK Economy as the headwinds from Europe and Asia increase while the electoral process starts to ramp up market uncertainty. The final PMI numbers coming in close to estimate will continue to boost the pound across all pairs.

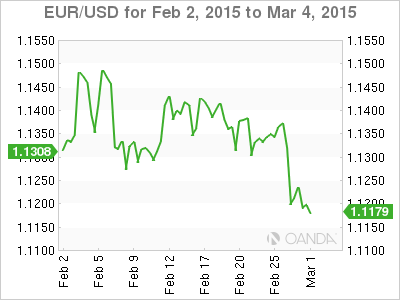

EUR CPI Flash Estimate

Fear of deflation was the trigger that finally unleashed the QE bazooka from the European Central Bank so its no surprise that the advance estimate of European inflation is eagerly awaited. It is too early to gauge any actual effect from the easing program but the estimate will guide market participants about how deeply rooted deflation is in the European Union. The forecast is –0.5% after last months reading of –0.6%. The final report will be released two weeks after the advance estimate.

USD ISM Manufacturing PMI

The economic data out of the U.S. has been mixed. Dollar positives continue to be the employment numbers and the Federal Reserve’s verbal commitment to raising rates while keeping the market guessing on the schedule. The manufacturing sector has been benefitted from low energy prices, but hit by lower demand as the strong USD is discouraging overseas purchases. The internal demand from consumers continue to drive the recovery of the U.S. but there are analysts pointing to a possible over reliance on the consumer which is what trigged the 2008 crisis. The ISM has slowed down since last year due to the outside factors and there is an expectation that the reading will be close to last month’s 53.5, still an expansionary reading, but off the highs of November when it was 59.0. A ISM Manufacturing PMI over the forecasts will be USD positive and will continue to boost the currency against the EUR, but a stumble could be taken as a sign of weakness of the U.S. economy that could be further validated by a soft NFP number on Friday.

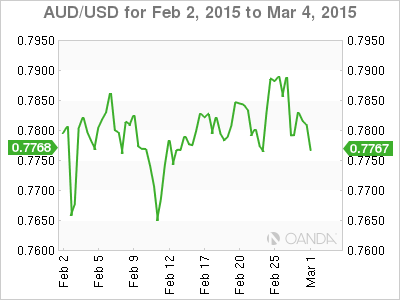

AUD Rate Statement

Softer data from Australia has increased the market expectations of a rate cut this week. Weak capital expenditures increased the probability from 38 percent up to 50%. The expected cut of 25 basis points will leave the benchmark rate at an all time low of 2 percent. The move from the RBA would depreciated the AUD in hopes to increase competitiveness while increasing a housing boom risk as low rates will continue to affect prices.

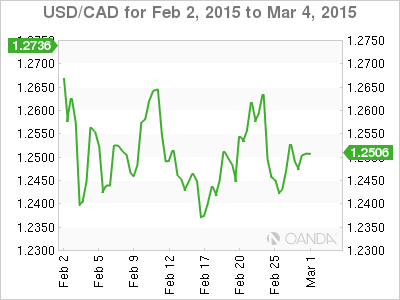

CAD Gross Domestic Product GDP

After the biggest factory drop in six years shrank Canadian GDP at the end of last month CAD traders will be watching this month’s GDP figures to get some insights ahead of the Bank of Canada Rate announcement. The fall in energy prices has hit the Canadian economy hard as the economy has not pivoted fast enough to benefit from a lower currency. The BoC could cut rates further in order to boost competitiveness and stimulate the Canadian economy.

AUD Gross Domestic Product GDP

The Reserve Bank of Australia cut its GDP forecast last month setting the market expectations for further slowdown of the economy and the actions from the central bank to intervene. The previous reading was well below expectations at 0.3 percent. The forecast is higher than the previous reading which can set the AUD for some disappointment if GDP comes again below the expected 0.7 percent.

USD ADP Non-Farm Employment Change

A preview of the non-farm payrolls release coming later in the week. The ADP and NFP reports do not have a perfect correlation as the size of their pool is different. The ADP data will give an early look at the growth of employment in the U.S. from the private sector. The estimate from the ADP is based on 400,000 private corporations for with the company provides payroll services. A strong ADP will appreciate the USD and raise NFP expectations despite the fact that their correlation is not high given the importance of employment as a leading indicator in understanding the Federal Reserve’s rate hike intentions.

CAD BOC Rate Statement

Bank of Canada Governor Stephen Poloz decreased the posibilities of follow up January’s surprise rate cut with another one on Wednesday. The move was explained as pre-emptive given the macro headwinds that the Canadian economy is facing. Lower energy prices have hit oil producing province Alberta, after it was the main engine of growth in the post credit crisis years. There are low expectations of a rate cut this week, but the market is pricing more cuts coming this year. The January rate cut has given the central bank time to sit back and watch the effects of the cut and measure their next intervention. A rate cut is coming, but it is not expected to happen in this meeting. The CAD is expected to gain if a no rate cut decision is published.

GBP Official Bank Rate

The Bank of England is not expected to raise rates until after the May general elections. The central bank was one of the tighter policy front runners last year even taking the lead from the Fed until the last quarter of the year had major policy makers change their tune to a more pessimistic one. The BOE continues to oversee an economy on the mend by making great strides on manufacturing and construction growth but with low inflation deemed a transitory effect. The MPC has voted 9–0 to keep rates on hold for the last couple of meetings and no change is expected this time.

EUR ECB Press Conference

The European Central Bank will issue a press release and face questions from the press. The European benchmark interest rate will remain unchanged, but the focus will be on further details on the much awaited quantitative easing program that was announced last meeting. The distractions of the Greek debt extension have been punted four months down the line and the market will once again by hanging on Draghi’s words on his plan to boost the European economy out of deflation. EUR pairs will be affected by the tone of Draghi and his estimates on how long this massive QE program will take to start turning European ship.

CAD Ivey PMI

Canadian manufacturing can continue to weaken the CAD versus the USD, specially if if combines with a strong U.S. manufacturing index. Last Ivey PMI reading was the first under 50, which put it in the realm of contraction. The index dropped to 45.4 last month. Economic conditions have not changed much for the benefit of Canadian manufacturing, but it is expected that the Bank of Canada actions can give exporters a pricing edge with a lower currency. The PMI is expected to enjoy a small recovery to 46 but still below the reading needed for expansion.

USD Non-Farm Employment Change

The fortunes of the USD this week will be set after the release of the non-farm payrolls report. The NFP has been the positive outlier on an otherwise softer U.S. economic data releases. Even when the headline number has beat expectations and the unemployment rate has hit pre crisis lows, the market has been well trained by the U.S. Fed to look deep into the details. Wage growth in particular will be in focus as analyst will be scouring the report for signs that corporations have hired more but also are paying more. The importance of the employment component of the Fed decision to start raising rates can end the week on a different note for the USD that all of the previous indicators combined. Interest rate divergence will continue to drive the EUR/USD and the more the ECB keeps driving an easing monetary policy and the US economic indicators align with the Fed starting a tightening cycle the pair will continue to trade lower.